The S&P 500 is on the precipice of a major streak, while the rotation into small cap stocks remains robust. The Daily Breakdown digs in.

Wednesday’s TLDR

- The S&P 500 has gone 351 sessions without a one-day 2% dip.

- 352 sessions would make it the best stretch since 2007.

- But the index is down about 1% in pre-market trading.

What’s happening?

The S&P 500 has now gone 351 trading sessions without a one-day decline of 2% or more. If it can make it to 352 sessions today, it will be the index’s longest streak since the financial crisis began in 2007.

The question is, will it get there?

The S&P 500 ETF — SPY — is down about 1% in pre-market trading, while the Nasdaq 100 is down roughly 1.5% as semiconductor stocks lead the move lower. Clearly we’re set for a little more volatility than we have gotten used to.

Last Thursday’s 0.9% decline in the S&P 500 was the biggest one-day dip in the index since April 30. We’ll see how today shapes up, as stocks could clearly use a breather but firmly remain in an uptrend.

It’s worth pointing out that the July monthly VIX options expire today, while seasonally speaking, the front half of July tends to be strong for equities and the back half tends to be weaker. When it comes to seasonality, it’s something that’s good to know, but not something to base a bulk of your investment decisions on.

Some profit-taking here wouldn’t be all that surprising — or unhealthy for that matter.

The setup — IWM

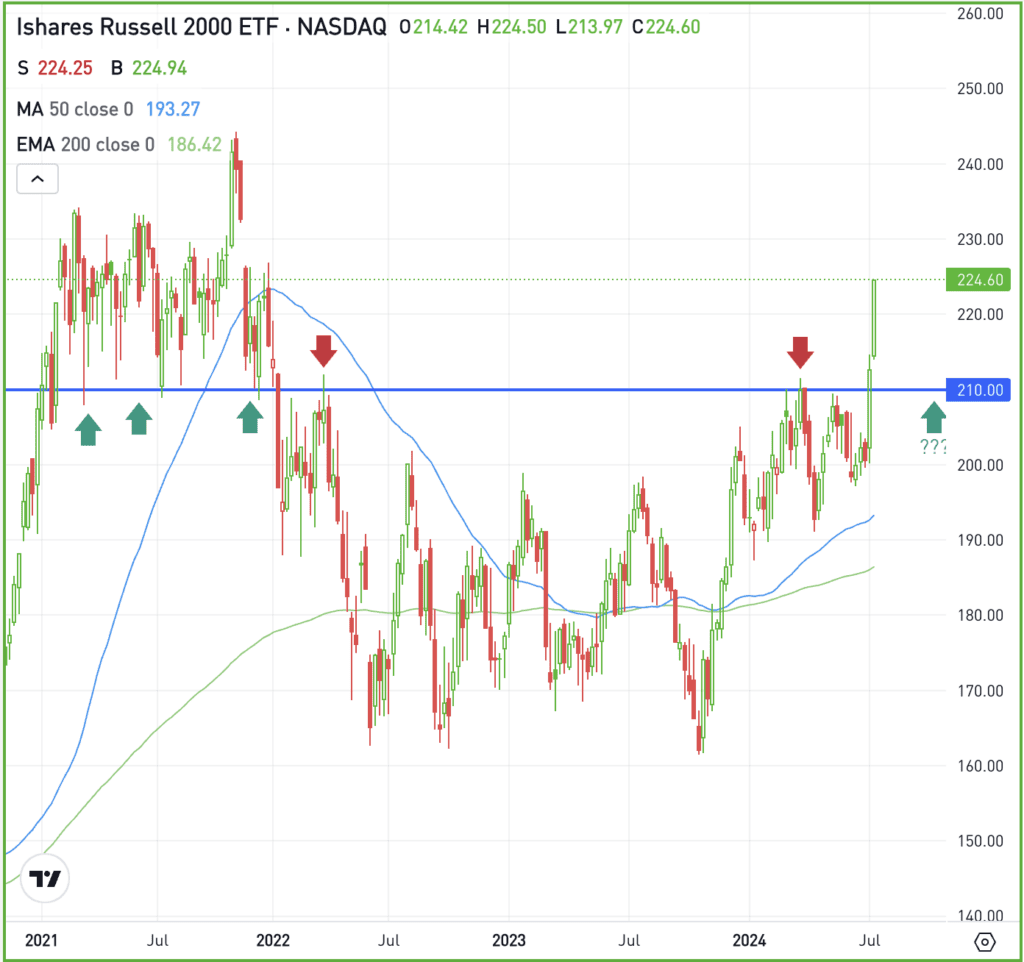

The Russell 2000 has been on fire, rallying 11.5% over the last five days. That vaulted the IWM ETF higher as well, given that it’s one of the most popular ways to trade the index.

The rally triggered a huge move over the key $210 level, which has served as a major support and resistance level over the last few years.

The IWM could certainly use a rest after such a dramatic rally over the last week. However, it’s clear that institutions are putting their money behind this rotation trade, speculating that the gains can continue.

If the IWM can stay over $210, it’s possible for it to continue higher, with many looking at resistance in the $230s (from 2021) and the all-time high near $245 as possible upside targets.

Below $210 and the IWM risks losing a bulk of its bullish momentum.

Options

For options traders, calls or call spreads could be one way to buy the dip in IWM if and when it does pull back. In these scenarios, options buyers limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect downside could speculate with puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

ASML — ASML exceeded quarterly earnings expectations as its bookings increased. The company reported second-quarter net sales of €6.24 billion and a net profit of €1.58 billion, surpassing forecasts amid recovering demand for its advanced chip-making machines. However, the stock is down as it has already benefited from the semiconductor rally and guidance came in light.

BAC — Bank of America shares surged after announcing a rebound in net interest income. The bank reported earnings of 83 cents per share on revenue of $25.54 billion, beating expectations of 80 cents a share and $25.22 billion, respectively.

SCHW — Charles Schwab tumbled after warning of necessary profit-protecting cutbacks. The firm reported adjusted earnings of 73 cents per share on revenue of $4.69 billion, barely beating estimates. However, it missed on net interest margin expectations.

AMZN — It’s day two of Amazon’s celebrated Prime Day. As noted yesterday, the event hasn’t helped the stock price as much as some investors would have hoped. However, bulls are hoping that the breakout level holds as support.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.