The Daily Breakdown looks at US stocks with earnings, the Fed and the jobs report all on tap this week. Plus, SoFi’s big earnings move.

Monday’s TLDR

- SoFi stock surges on earnings.

- Big earnings reports are on tap this week.

- Investors also face the Fed and monthly jobs report.

What’s happening?

Some weeks are chill. Some weeks not so much. This week, it’s the latter.

First, earnings remain at the forefront.

We’ll hear from Magnificent Seven stocks like Microsoft, Alphabet, Amazon, Apple, and Meta. We’ll also hear from chip stocks like AMD, Qualcomm, and Super Micro Computer.

Boeing, GM, UPS, Royal Caribbean and plenty of others will also report.

It’s a big week for earnings, but it’s also a big week for economic events.

Most notably, we have the Fed’s policy meeting on Wednesday afternoon and the monthly jobs report on Friday.

With some potential fireworks ready to go this week, it could make for a good time to jump into eToro’s free options trading contest* — especially with $4,000 in prizes up for grabs. Just sayin’.

*Terms and conditions apply. You must be approved for an options account in order to participate.

The setup

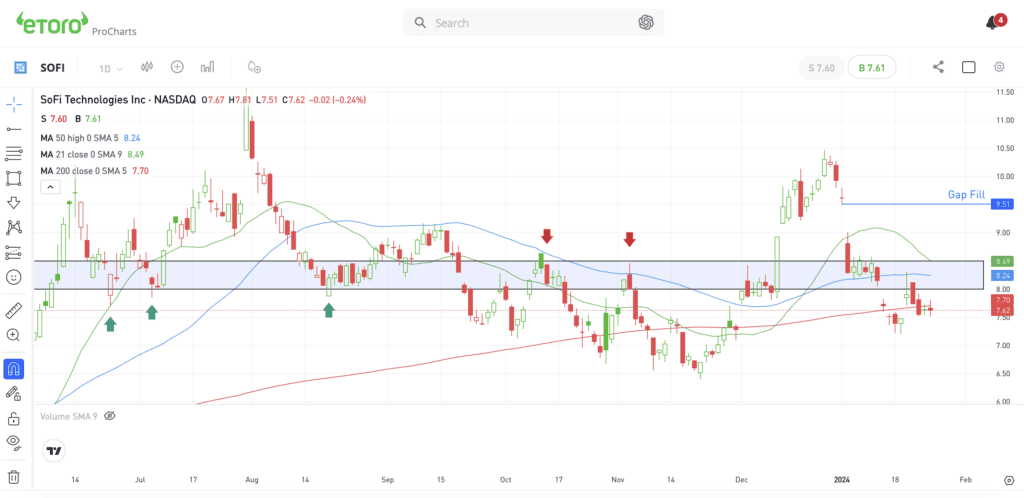

SoFi reported earnings this morning and we’re seeing a bullish response so far. Shares are up about 10% in pre-market trading.

If the stock can carry those gains into Monday’s open, the stock will open near a critical spot on the charts.

That’s as SoFi tries to regain all of its major daily moving averages — including its 21-day, 50-day and 200-day. It’s also as the stock tries to get above the vital $8 to $8.50 area.

The company delivered an earnings and revenue beat, then provided a solid full-year outlook. Will that be enough to launch SoFi stock back over this key area on the charts?

If SoFi can’t regain this area, investors have to be on guard for this zone to act as potential resistance. However, if SoFi stock can regain it, we could see the stock garner some bullish momentum in 2024.

Want to receive these insights straight to your inbox?

What Wall Street is watching

INTC: Intel shares plunged on Friday after the firm’s fourth-quarter report. The company delivered a top- and bottom-line beat, with revenue growing 10% year over year. However, guidance for the first quarter was well below analysts’ expectations.

USO: Oil prices surged following attacks by Iran-aligned militants. The attacks killed US troops in Jordan and targeted a Red Sea fuel tanker. The move escalates Middle East tensions and puts pressure on President Biden, with traders re-evaluating regional shipping risks.

USDOLLAR: The dollar is holding steady ahead of the upcoming Fed meeting on Wednesday, the US jobs report on Friday, and amid heightened Middle East tensions. The dollar index is hovering near a six-week high and is up about 2.3% so far this month.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.