The Daily Breakdown looks at the different earnings reactions between Snap and Meta. We’re also watching the XLY ETF after its breakout.

Wednesday’s TLDR

- Snap plummets 30% after earnings.

- Are consumer discretionary stocks poised to rally?

- Ford delivers an earnings and revenue beat.

What’s happening?

Social media stocks have highlighted the high-risk, high-reward potential that investors face during earnings season.

Last week, Meta delivered strong quarterly results and the stock responded with a 20.3% rally to all-time highs. Last night, Snap plunged 30% after it reported disappointing results.

While the reactions were quite different, both stocks had one thing in common: The shares moved far more than the market had expected.

Earnings season highlights the elevated volatility we can see. It’s one reason I look at options as a potential approach in these situations.

For instance, investors who were long 100 shares of Snap are seeing an overnight loss of more than $5 a share (or about $500). Investors who opted for upside call purchases will likely see their position wiped out with today’s decline, but the position was likely worth a lot less.

For example, Snap closed at $17.45 yesterday and the February $17.50 calls traded at about $2.00 toward yesterday’s close (for a total position size of $200). It’s a bummer to see a 100% loss on a position, but in this case, that total loss is limited to $2.00 (or $200), a much better outcome than being long 100 shares.

And if investors opted for the $17.50 puts instead of the calls, they’re seeing big gains with today’s plunge.

The risk with buying options — either calls or puts — is that they become worthless. However, there’s an underappreciated benefit in there. Traders know exactly what their maximum risk is, especially going into potentially volatile events.

If you want to try your hand at trading options but without the risk, consider trying eToro’s free options trading contest* — which has $4,000 in prizes up for grabs.

*Terms and conditions apply. You must be approved for an options account in order to participate.

The setup

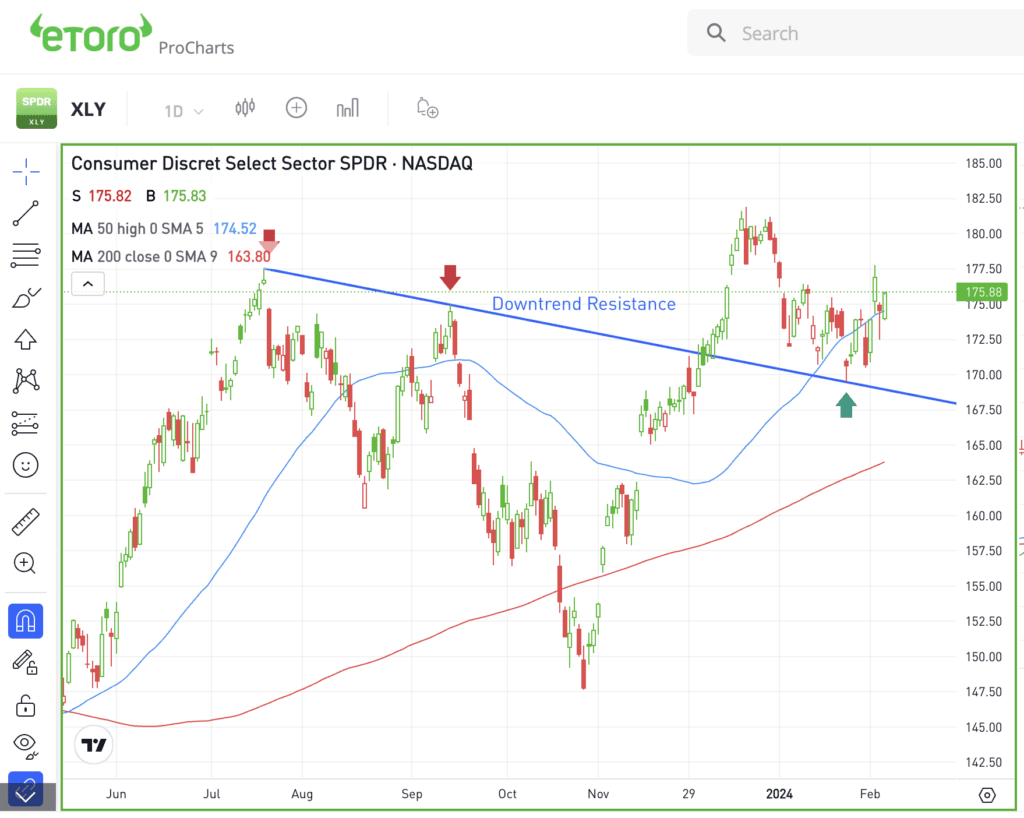

Nike and Starbucks caught my eye yesterday, which had me zooming out to XLY — the consumer discretionary ETF.

Amid an eight-week rally, XLY was able to break out over resistance. It has since pulled back, but found support just above its prior downtrend resistance level.

Now, it’s consolidating between $170 to $175 and above prior resistance, looking for a potential move higher.

Want to receive these insights straight to your inbox?

Bulls are looking for XLY to gain traction over $175, and preferably, over last month’s high at $178.33. On the downside, investors want the ETF to hold above last month’s low near $169.75.

As long as consumer spending remains strong, this group could continue to do well. If that’s the case, keep an eye on XLY.

For what it’s worth, the ETF’s top three holdings are Amazon, Tesla, and Home Depot, while stocks like Starbucks, Booking Holdings, and Chipotle are in the top 10.

What Wall Street is watching

SNAP: Despite solid user growth and a slight earnings beat, Snap shares dropped over 30% last night as Q4 revenue of $1.36 billion missed consensus expectations of $1.38 billion. Further, management’s revenue outlook slightly missed analysts’ expectations.

F: Shares of Ford are racing higher this morning, up almost 6% after a strong fourth quarter report. Earnings of 29 cents a share more than doubled consensus estimates of 12 cents a share, while revenue of $46 billion easily beat estimates of $43.1 billion.

TM: Toyota cruised to all-time highs after announcing a $1.3 billion investment in a Kentucky facility to manufacture its new all-electric, three-row SUV targeting the US market. The production is slated to begin between late 2025 and early 2026, and is part of Toyota’s $35 billion commitment to electric vehicles by 2030.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.