The Daily Breakdown takes a look at the new highs in the S&P 500, Nasdaq, and Dow, while small caps and the IWM ETF play catch up.

Tuesday’s TLDR

- S&P 500, Nasdaq, and Dow notch new highs.

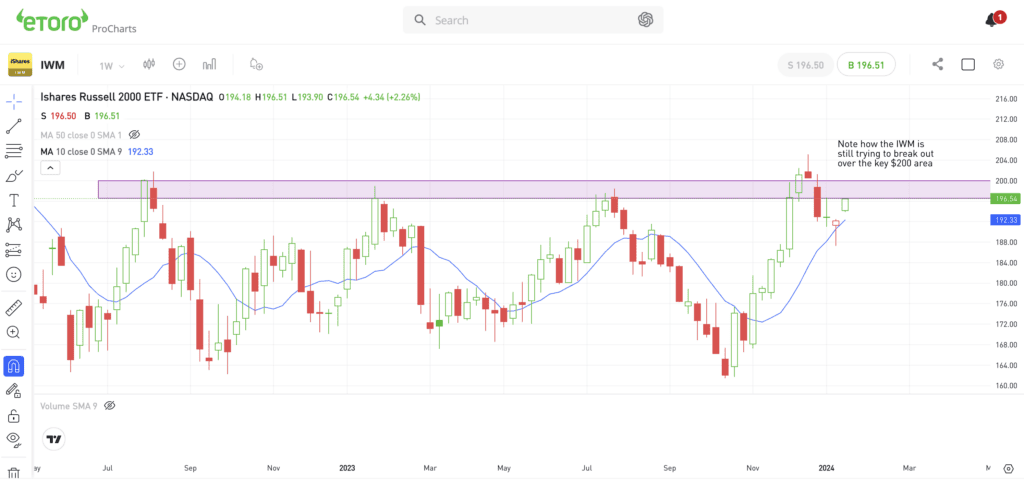

- IWM tries for another key breakout.

- Gilead Sciences tumbles more than 10%.

What’s happening?

We continue to see upside momentum as US stocks hit more all-time highs.

The S&P 500, Nasdaq 100, and Dow all traded to new highs on Monday. All we’re missing is the Russell 2000, which remains almost 20% below its all-time high.

While we’re at new heights in the stock market, not all stocks — or investors — are necessarily on the bandwagon.

However, sometimes doubt only acts as a catalyst when it comes to driving markets even higher. That’s particularly true when there’s a record amount of money on the sidelines, like there is right now.

If stocks continue to perform well and interest rates fall, we could see a big shift from cash back into stocks as investors chase returns.

In the short term, earnings will be the main catalyst. In the longer term though, keep the major trends in focus. At least for now, those trends remain bullish.

The setup

Three of the four major US stock indices are hitting new highs, while small caps remain notably below their previous cycle high.

While the Russell 2000 lags the S&P 500, Nasdaq, and Dow in its year-to-date performance, it sports the best three-month return in the group — up 19.1%.

The IWM ETF is a common trading vehicle for the Russell 2000, and it’s still trying for a major breakout.

Near the end of 2023, the IWM briefly pushed above the key $200 level before retreating back to the 10-week moving average (as shown above).

So far, bulls have seen a nice reaction from this area, with the IWM consistently rebounding higher.

I don’t know whether the IWM will be able to break out over the $200 zone in the short term, but if it eventually does, it could kickstart a much larger move to the upside.

Active bulls want to see the IWM stay above its recent low near $187.50. On the upside, they want to see a push above $200, then a retest of the recent high near $205.50, followed by the $210 level.

Remember, the all-time high is up near $244.50, so there could be some room to run if small caps perform well this year. And if you think the US economy is fine and we’re in a bull market, you may have a case for small caps outperforming large caps this year.

Want to receive these insights straight to your inbox?

What Wall Street is watching

ADM: Archer-Daniels-Midland stock cratered on Monday following weak Q4 earnings guidance and after CFO Vikram Luthar was placed on leave amid an accounting probe.

GILD: Shares of Gilead Sciences tumbled after its cancer drug Trodelvy failed in a Phase 3 lung cancer trial. Trodelvy failed to outperform Docetaxel in treating non-small cell lung cancer, impacting Gilead’s oncology prospects despite its success in breast and bladder cancer.

AMD: Advanced Micro Devices finally pulled back, dipping about 3.5% following a downgrade from Northland Capital Markets. Analyst Gus Richard warned of potential slowdowns in pricing and demand, possibly impacting revenue growth. However, shares are still up more than 14% so far this year.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.