The Daily Breakdown looks at the week ahead as earnings season begins and takes a closer look at small caps amid their recent rally.

Monday’s TLDR

- J&J, Netflix, Citi, and others report this week.

- Small caps break out on Friday.

- Tesla tumbles, Uber soars.

Weekly Outlook

Earnings are picking up pace as we approach the halfway point of October. There’s also a lot of Fed speakers this week, so active traders should be aware of the headlines that could come from these events and potentially move markets during the day.

Today’s relatively quiet on the earnings and economic front, but Tuesday has loads of earnings reports, including Walgreens, Citigroup, Bank of America, Johnson & Johnson and United Airlines.

On Wednesday, we’ll get earnings from firms like ASML, Morgan Stanley, Abbott Laboratories, Discover, and others.

Thursday will have investors’ attention.

That’s when we’ll get US retail sales at 8:30 a.m. ET, which will give us the latest update on the US consumer. Earlier in the morning, Eurozone CPI will be released for investors who are curious about inflation across the pond.

On the earnings front, we’ll hear from semiconductor giant Taiwan Semiconductor — which carries a market cap of nearly $850 billion — as well as Netflix and a handful of regional banks.

On Friday, American Express, Procter & Gamble, Comerica, and others will report earnings.

Want to receive these insights straight to your inbox?

The setup — Small Caps

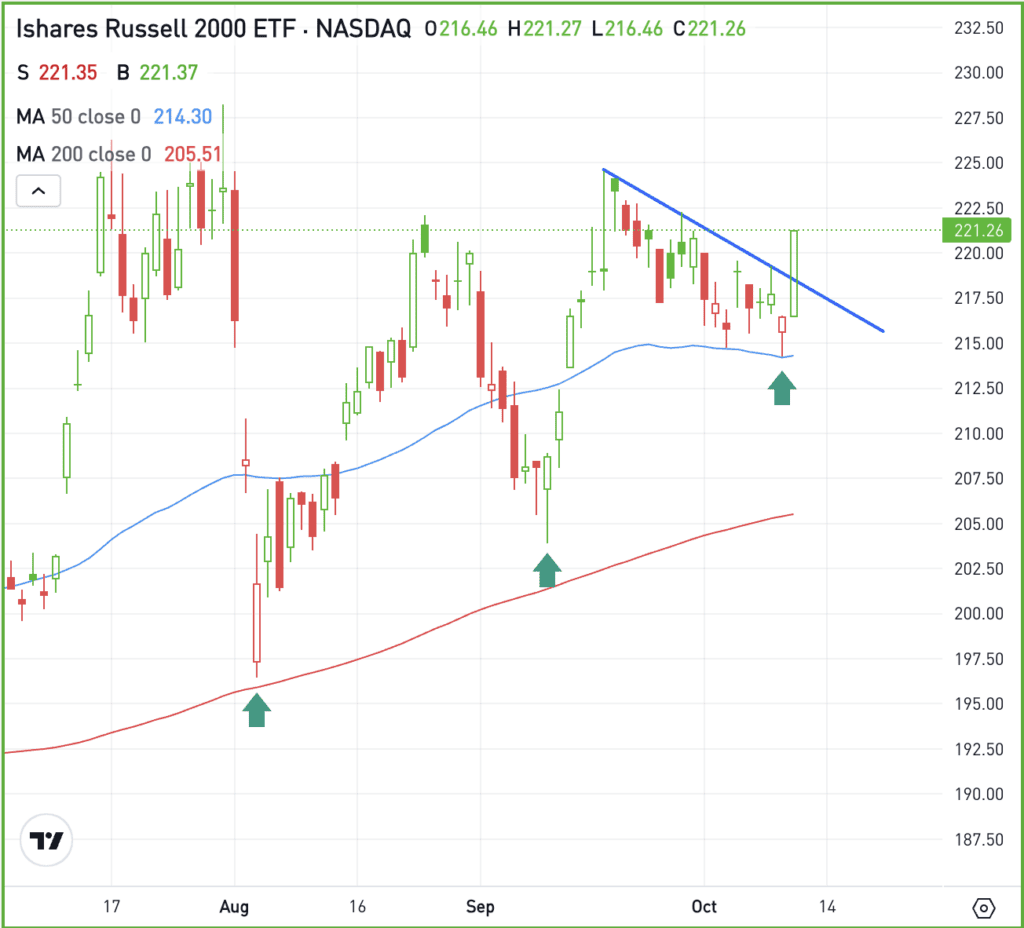

Small caps made a powerful move on Friday, with the iShares Russell 2000 ETF — IWM — rallying 2%.

This group has lagged the S&P 500 so far in 2024 and has been volatile over the last few months. However, it’s hard not to notice that each pullback becomes more shallow than the previous one, as bulls step in to buy the dip (highlighted with the green arrows below).

Now, shares are clearing downtrend resistance after Friday’s rally.

IWM held its 50-day moving average as the $215 area acted as support. So long as it can continue to do so moving forward, bulls can look for a potential move higher. However, if the recent low gives out and IWM drops below $215, more selling pressure could ensue.

Fundamentally, investors are starting to take a closer look at small caps. That’s as the Fed begins to lower rates and as small caps have a low valuation relative to large caps.

Options

For some investors, options could be one alternative to speculate on IWM. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and IWM rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

WFC – Shares of Wells Fargo jumped more than 5% on Friday after the firm delivered a solid Q3 earnings report. While revenue of $20.36 billion missed estimates by $100 million, earnings of $1.42 a share beat expectations of $1.29 a share.

TSLA – Shares of Tesla tumbled lower on Friday, and at one point in the session, the stock was down more than 10%. The decline came after the automaker’s “We, Robot” event on Thursday evening. Conversely, Uber stock rallied more than 10% on Friday as investors felt confident that Tesla wouldn’t be disrupting Uber’s business any time soon.

GS – After several investment banks reported earnings on Friday, all eyes will be on Goldman Sachs’ quarterly results on Tuesday. Investors will be looking for key updates, especially regarding the bank’s performance and any strategic shifts in the current economic environment. On Friday, GS stock hit a new 52-week high. Check out the chart.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.