The Daily Breakdown looks at the shine we’re seeing in metals, as silver and gold roar to 52-week highs. What’s driving the gains?

Thursday’s TLDR

- Silver and gold are hitting fresh highs.

- UnitedHealth stock nears potential support.

- Apple to make in-home robots?

What’s happening?

Gold has been on fire, up about 12% so far this year and outpacing the S&P 500. Silver has done well too, up more than 14%.

The rally in gold is enough to send the yellow metal to all-time highs. While we haven’t seen silver reach the same heights, it’s trading at its highest level since June 2021.

One month ago, I highlighted the breakout potential in the gold ETF — GLD. Once gold did break out, silver didn’t seem interested in participating. In fact, coming into this week, silver prices were up just 3.5% on the year.

Now though, a blistering catch-up trade has taken place in silver, as it’s rallied almost 9% this week.

Gold has traded well lately, with the recent push to all-time highs coming after Fed Chair Powell said that it would likely be appropriate to lower rates “at some point this year.”

While the metals may need a pullback or some consolidation in the short term, the recent momentum has been quite bullish. We’ll see how the group handles the jobs report, which will be released tomorrow morning and could have an impact on how investors look at the rate-cut trade.

Want to receive these insights straight to your inbox?

The setup — UNH

Earlier this week, we highlighted the tumultuous decline in health insurance stocks like Humana, CVS, and UnitedHealth Group. While some companies are more impacted by the Medicare decision than others, the impact has not been bullish for this space.

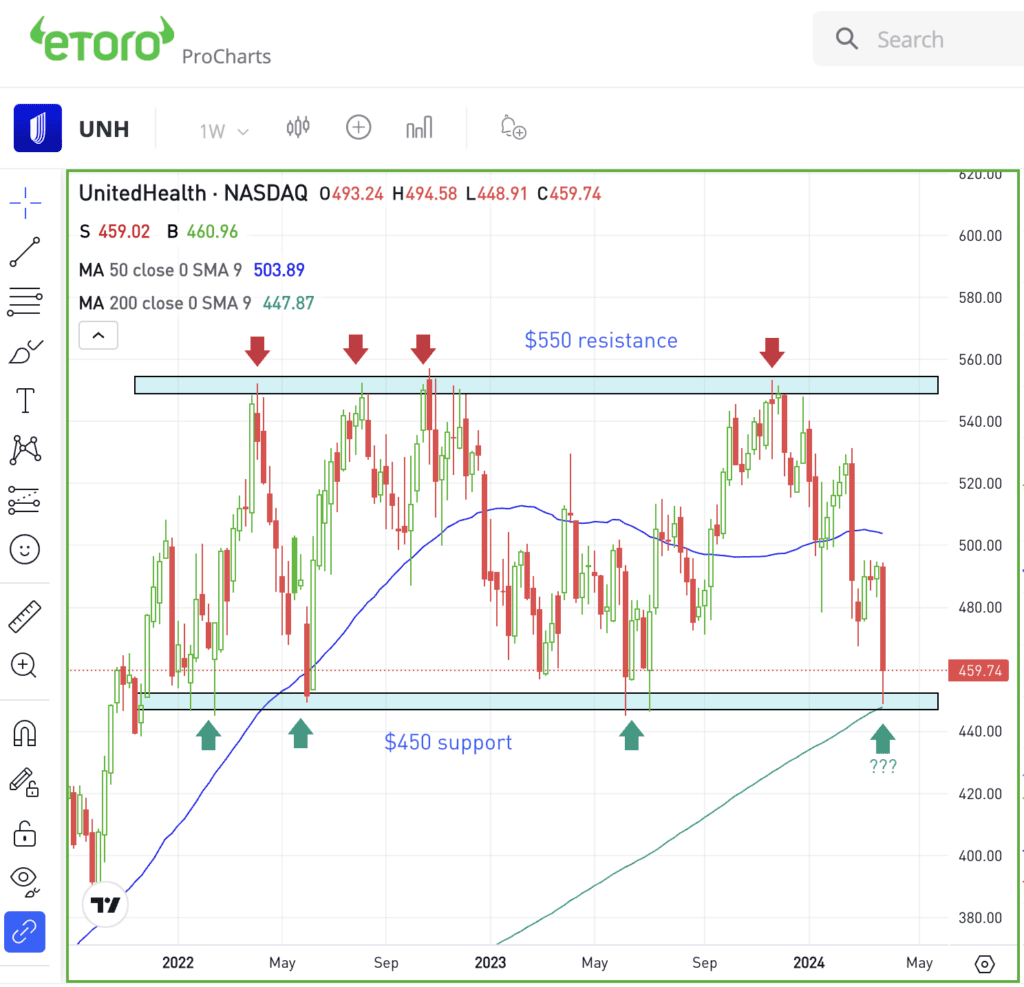

When we zoom out and look at UnitedHealth on a weekly basis, investors can see that the stock has been range-bound between $450 and $550 for more than two years.

For now, shares are bouncing from the $450 area — which has been support for the last two years — while UNH also neared its 200-week moving average.

Does that mean that support is guaranteed to hold this time? No!

The charts can illustrate areas where buyers and sellers have historically materialized. In this case, buyers have typically found value in UnitedHealth in the $450 area.

Maybe with the new Medicare decision, they don’t feel the same way this time and will let the stock drift below this level. For active investors though, they can consider buying a dip like this into historic support knowing that if it fails, they can exit the position with a manageable loss and move on.

However, if buyers do materialize and the stock bounces, these dip-buyers have a nice cost basis to work with as they manage their position moving forward.

What Wall Street is watching

AAPL — Apple looks to personal robotics for new revenue streams, exploring this space amid pressures from scrapping its electric vehicle project. This move could expand its consumer home presence, leveraging AI advancements.

F — Ford’s US sales rose 6.8% in Q1, hitting 508,023 vehicles. Hybrid sales soared 42%, led by trucks and SUVs. The Maverick hybrid became the top-selling hybrid truck with a 77% sales jump, reaching 19,660 units. Electric vehicle sales skyrocketed 86%, making Ford the second leading EV brand after Tesla, which recently delivered disappointing Q1 delivery results.

SPOT — Spotify soared over 8% following a Bloomberg report that the music-streaming giant is set to raise its premium subscription prices in several markets, including the US — its second increase within a year.

INTC — Not all semiconductor stocks are firing on all cylinders. Intel experienced an 8.2% drop after disclosing a $7 billion operating loss in its semiconductor manufacturing business for 2023, indicating significant challenges within its foundry operations. The stock is now down almost 20% for the year, although it’s still up more than 22% over the past 12 months.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.