The Daily Breakdown takes a closer look at the Federal Reserve and examines when the committee should consider lowering interesting rates.

Friday’s TLDR

- Fed Chair Powell is due to speak at 10 a.m. ET.

- The Fed finally has the ammo to cut rates.

- Meta stock hits new all-time highs on Thursday.

The Bottom Line + Daily Breakdown

The Fed has been under a microscope this year, as investors continuously speculate on when they will commit to an interest rate cut. Now more than ever, it looks like the Fed is gearing up for its first rate cut in more than four years.

Every year, the Fed holds its Jackson Hole symposium, which includes Fed members, business leaders, economists, and academics who gather to discuss monetary policy, the global economy, and financial markets.

The event started on Thursday and goes until Saturday. In between, Chairman Jerome Powell will provide a speech at 10 a.m. ET. In that speech, investors are looking for more clarity around the Fed’s expected rate cut in September and perhaps a clue on how big of a rate cut to expect.

The roadmap

In late July, the Fed held off on lowering interest rates, but laid out the path for cutting rates at its next meeting in September. Just two days later, many market pundits were arguing that the Fed was behind the ball and had waited too long to cut rates.

That’s as we got a weak monthly jobs report on August 2nd, which showed that the unemployment rate had jumped to 4.3%.

Remember, the Fed will cut rates for one of two reasons: Either inflation has moved low enough to justify lower rates or the economy has weakened to a point where it needs lower rates. For obvious reasons, investors should prefer the former rather than the latter when it comes to the Fed’s reasoning.

Given that the Fed has been very transparent in recent years — often spelling out their intentions ahead of time — investors will be looking for clarity from Chair Powell on Friday morning regarding what the Fed will do from here.

The Bottom Line

The bond market is certain the Fed will cut rates in September, pricing in 100% odds of at least a 25 basis point reduction. There is some speculation that the Fed may possibly cut rates by 50 basis points, although that’s not the consensus expectation at this point.

Even if we exclude the July jobs report, there’s no denying that the labor market has softened in recent months. Combined with the very slow but clearly steady descent in inflation, it’s time for the Fed to cut rates.

Upon doing so, there’s always the risk that we see a reflationary reaction (where inflation goes back up). But we already know the economy can wait out inflation, as it has chugged along for the last several years.

What it can’t wait out is a breakdown in the labor market — which is what the Fed risks by keeping its monetary policy too tight for too long.

Want to receive these insights straight to your inbox?

The setup — META

Up 50% so far in 2024 and Meta is the second-best performing Magnificent 7 stock of 2024 — trailing only Nvidia and its near-150% return. Outside of this duo, the next-best performer is Alphabet, up 17.3%.

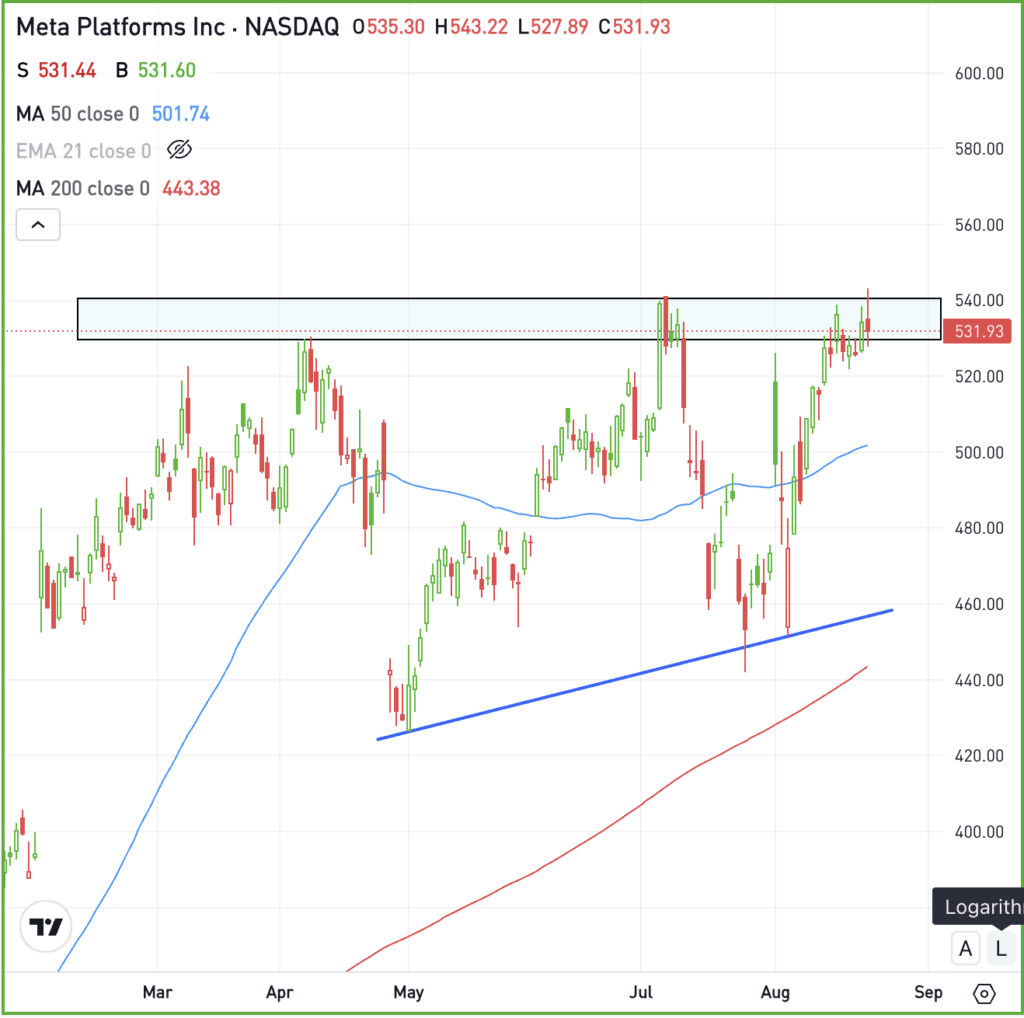

However, the stock has been struggling with the key $530 to $540 area. This is setting up as a potential breakout area to keep an eye on.

For many investors, they might opt to stick META stock on their watchlist, set a price alert just above this zone, and wait for the potential breakout to happen.

If shares do eventually break out, look for the $530 to $540 area to turn into potential support, which could help set up the next move higher.

However, if shares pull back, I want to see if Meta dips down toward $500. That’s a key price and it’s also where the stock finds its 50-day moving average.

Options

Investors who believe shares will break out — or those who are waiting for the potential breakout to happen first — can participate with calls or call spreads.

If speculating on the breakout rather than waiting for it to happen first, make sure to use enough time until expiration. Of course, they could always wait for a pullback instead.

For investors who would rather speculate on resistance holding, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.