The Daily Breakdown looks at shares of Nike, which are trying to rally as institutional investors get involved in the stock.

Tuesday’s TLDR

- S&P 500 dips 2.1%, Nasdaq 100 falls 3.2%

- Nvidia, semiconductors lead the decline

- Nike bulls are hoping that support holds

What’s happening?

On Friday we talked about the spooky seasonality that can accompany September, with the S&P 500 down in 7 of the last 10 Septembers. With yesterday being the first trading session of the month, some of that action was clearly on display.

It didn’t help that semiconductor stocks — like Nvidia, Advanced Micro Devices, and Intel, among others — were nosediving, while tech stocks were hit hard.

While uncertainties persist in the short term, investors can take comfort in some other observations.

As rough as yesterday was, five of the 11 S&P 500 sectors hit new 52-week highs. 88 stocks within the index hit new one-year highs, while just six stocks hit new one-year lows. Despite yesterday’s tumble, the S&P 500 is down just 2.3% from its all-time high and still remains higher by 8% from its August 5th low.

These realities won’t stop stocks from falling further this week or this month. However, it underscores the underlying strength of the market and can serve as a reminder for investors to keep looking for opportunities outside of the Magnificent 7.

Want to receive these insights straight to your inbox?

The setup — NKE

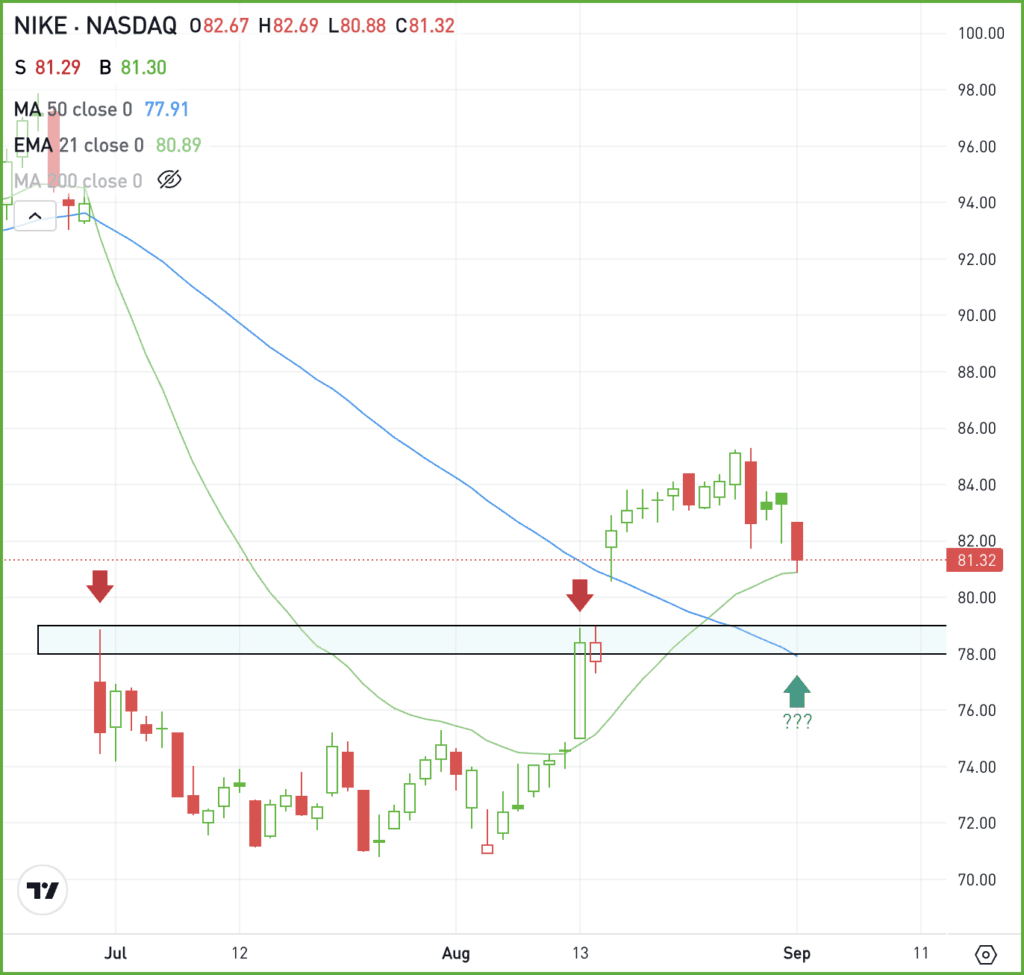

Nike has been a disappointment this year, down 25% so far in 2024 and down more than 50% from its all-time high. Yet the stock has had some momentum lately as recent SEC filings have shown some interest among institutional investors.

Some long-term investors may say Nike has declined enough and they might justify a long position near current levels. However, more active investors may wait for a potential retest of the $78 to $79 area, which was resistance before the recent rally.

Above this zone now, will it act as support?

For now, Nike stock is finding support at the 21-day moving average. However, a move lower could put this zone back in play. If it’s support, bulls might consider buying the recent dip, looking for a bounce back to the upside.

If NKE breaks back below this zone though, more selling pressure could ensue.

Options

For options traders, calls or bull call spreads could be one way to speculate on support holding. In this scenario, options buyers limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

SMH – The VanEck Semiconductor ETF tumbled yesterday, as weakness in the group continues to cause semiconductors to lag the overall market. While Nvidia’s dip was the main focus, weakness in Taiwan Semiconductor, Broadcom, Texas Instruments, and Qualcomm didn’t help matters.

Oil – Oil prices fell almost 5% and hit its lowest level since December amid fears of OPEC+ output hikes and slowing Chinese demand. Additionally, gasoline for October delivery dropped to its lowest level in nearly three years.

BA – Boeing was one of six S&P 500 components to make new 52-week lows yesterday. The selloff comes amid continued weakness in the stock price, with shares now down 38% so far in 2024.

GTLB – Shares of Gitlab are ripping higher this morning after the firm delivered better-than-expected quarterly results. The company beat on Q2 earnings and revenue expectations, and delivered better-than-expected full-year guidance.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.