The Daily Breakdown looks at the strength in Nvidia, AMD, and even Intel as the trade in semiconductor stocks continues to heat up.

Tuesday’s TLDR

- AI continues to drive semiconductor stocks higher.

- Taiwan Semi, Intel, AMD and others are rallying too.

- Broadcom’s 10-for-1 stock split is in focus.

What’s happening?

The semiconductor trade won’t stay hot forever, but it hasn’t cooled down very much yet. In mid-June, it looked like that could have been the case, though.

That’s as Nvidia had pulled back about 16% — shedding over $400 billion in market cap — in a three-day stretch. Other names in the space struggled at the same time, leading some investors to think that more downside was on its way.

Instead, investors stepped in to buy the dip in this year’s hottest theme and the space continues to cook higher. And it’s not just Nvidia.

Advanced Micro Devices is up more than 9% in the last two days and is up 13.5% over the past week. Taiwan Semiconductor hit new all-time highs yesterday as its market cap creeps toward the coveted $1 trillion market. Even Intel is finding its groove, up more than 10% over the past week (and is currently higher again in pre-market trading).

For now, the dips are being bought in the AI trade. That trend may continue into earnings season — and it’s the reaction to earnings that will hint at whether that trend continues or cools off a bit in the second half of 2024.

Want to receive these insights straight to your inbox?

The setup — HPE

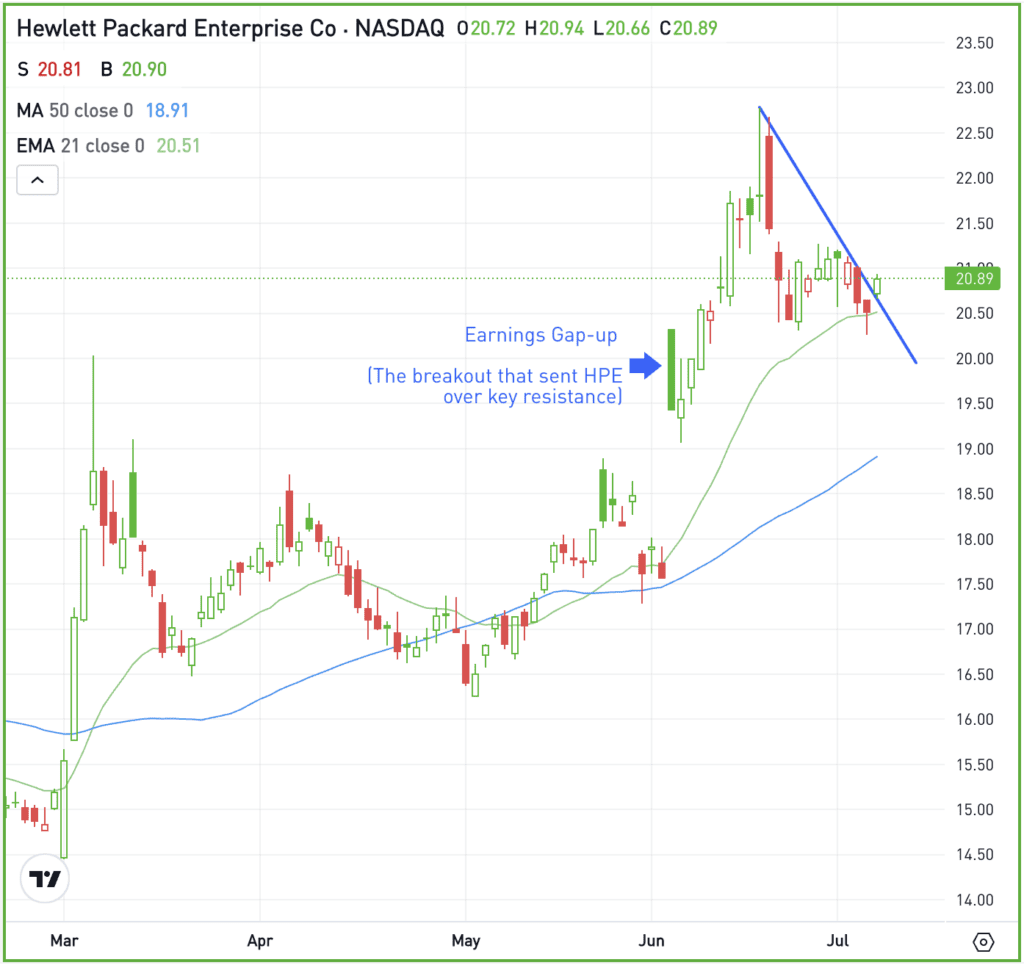

In early June, we looked at Hewlett Packard Enterprise as the stock was breaking out over a very key range after better-than-expected earnings.

That breakout has led to solid price action over the past month, and now, bulls are looking for renewed momentum once again.

Notice how HPE is finding support around $20.50 and the rising 21-day moving average. Now it’s trying to clear short-term downtrend resistance too.

If it’s able to do so and gain momentum over $21, the recent highs near $22.50 could be in play, followed by new potential highs above that. On the downside, a break below the $20 to $20.50 area could put a test of the 50-day moving average in the cards.

Options

For some investors, options could be one alternative to speculate on HPE. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and HPE rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

ASML — ASML shares surged to over $1,000 amid optimism around its key customer, Taiwan Semiconductor. ASML’s CEO highlighted growing demand for older-generation chips, driving bullish sentiment and lifting the stock.

GLW — Corning shares surged as AI demand boosts equipment sales. The company raised its Q2 sales guidance to $3.6 billion alongside expected earnings growth. Increased demand for fiber optics is driving Corning’s strong performance and market optimism.

AVGO — Broadcom shares rallied as its 10-for-1 stock split nears. Effective July 12, the split follows a mixed securities offering. Broadcom’s stock has climbed over 20% since the announcement, mirroring Nvidia’s similar recent stock split.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.