Semiconductors have been crushed and now, The Daily Breakdown looks at what’s going on as the stock market continues to waver.

Thursday’s TLDR

- Tech and semiconductors continue to struggle

- JPMorgan looks for support after run to record highs

- Nio tries to rally on earnings

What’s happening?

Stocks tried to put on a brave face and rally on Wednesday, only to lose momentum and close slightly lower on the day. So far, it’s been a tricky month depending on where you look.

Semiconductors have become a favorite among investors, with stocks like Nvidia, Taiwan Semi, Advanced Micro Devices, and Broadcom leading the charge in tech — (by the way, Broadcom reports earnings tonight).

However, this group has struggled lately. Not only has this weighed on investor sentiment, but it’s also on the market-weighted indices. Nvidia, Broadcom, and Taiwan Semi are three of the top 11 stocks by market cap, combining for more than $4 trillion in market value.

While the AI trend is alive and well, the chip stocks are going through a bit of a tough stretch. Not everything is doing as badly, though.

The S&P 500 is about 3% away from its all-time high, while seven of the 11 S&P 500 sectors made new 52-week highs in the last three trading sessions — including four that did so yesterday.

That doesn’t mean stocks can’t struggle in the short term as uncertainty, seasonality, and selling pressure in big tech take a toll. But there are positives under the hood.

Want to receive these insights straight to your inbox?

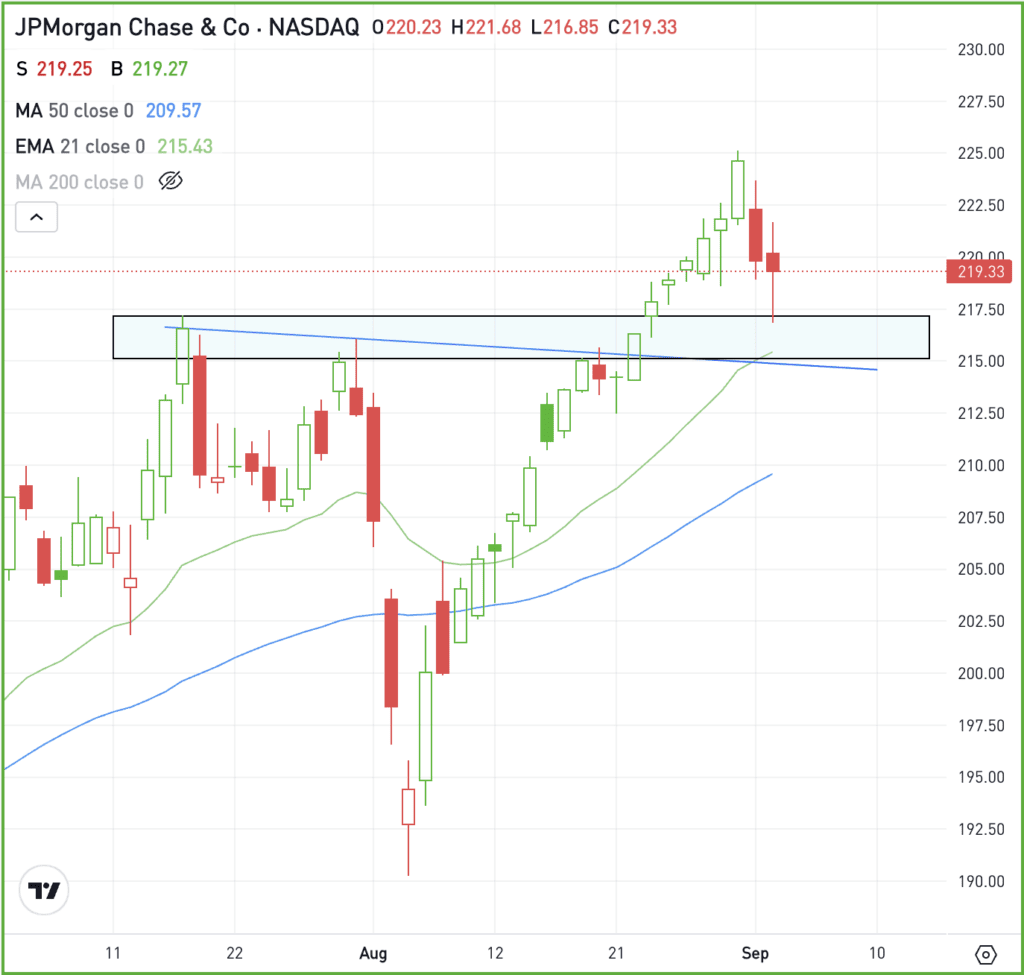

The setup — JPM

BODY: Recently, we looked at Bank of America and now I want to look at JPMorgan as financial stocks continue to trade well. Shares of JPM have been on a tear this year, up about 29% so far in 2024 and recently hit all-time highs.

Now pulling back a bit, will support come into play?

JPM has been on a tear from the August 5th low, rallying more than 18%. At one point, shares closed higher in 18 out of 19 sessions. So a pullback here makes sense.

If the dip continues, I want to see how the stock handles the $215 area. This area was resistance until shares were able to break out in late August. Further, the 21-day moving average comes into play near this zone.

JPMorgan is considered a best-in-breed company. If the stock can hold the $215 area, a bounce back toward the highs could ensue. However, if more selling pressure picks up, a larger correction could be underway.

Options

On a dip, buying calls or call spreads may be one way to take advantage of a pullback. For call buyers, it may be advantageous to make sure they have adequate time until the option’s expiration.

For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

AI – Shares of C3.ai are diving lower in pre-market trading, down almost 20% after the firm delivered disappointing quarterly results. While the firm was able to beat earnings and revenue expectations for Q1, revenue guidance for Q2 and the full year disappointed investors.

NIO – Shares of Nio are inching higher in pre-market trading thanks to upbeat Q3 guidance. Despite reporting a revenue miss for Q2, sales still nearly doubled year over year, while deliveries grew considerably as well.

VZ – Verizon is in focus as the company plans to acquire Frontier Communications in a $20 billion all-cash deal. Subject to shareholder approval, Verizon will acquire the company for $38.50 a share, a near-44% premium to Frontier’s 90-day volume-weighted average share price on September 3, 2024.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.