There are a lot of ways to build wealth when it comes to investing and capital markets. The Daily Breakdown explores some of those methods.

Friday’s TLDR

- There’s a lot of ways to create wealth

- You just have to find what works for you

- Healthcare stocks are dipping

The Bottom Line + Daily Breakdown

BODY: We’re fresh off a trip from Stocktwits’ Stocktoberfest in Coronado, California, where we heard from seemingly every type of investor in the industry. From private equity, to technical analysis traders, fundamental investors — stock-pickers who use neither — gold bugs and commodity investors, crypto traders, meme coin speculators, unique item collectors, and even plain old index investors.

When you’re looking at a lineup like this, you inadvertently develop some preconceived notions. Stuff like, “Oh! I can’t wait to hear more from this person!” Or something like “eh, I don’t really want to hear about that.”

But if you go into the events with an open mind and are willing to listen, you realize that there are a ton of different ways to make money as an investor. That doesn’t mean you necessarily agree with each speaker or their investment approach, but I’ve always been a strong believer that investors should always do what works for them — and if it’s working, who’s to say it’s wrong?!

Niches get riches

During the panels, we would hear from investors who were committed to specific domains within the market. Obviously as the speakers, it’s no surprise that they had obtained some serious success thus far in their careers.

But what stood out to me is a saying that could apply to every investor: The riches are in the niches.

That doesn’t mean investors have to find undiscovered meme-coins or micro-cap stocks that have yet to go mainstream. It means developing a process or an approach that works for you; something that you can continually hone and improve on until you’ve become a master at it (a phrase I generally refrain from because I personally believe we are always learning and therefore capable of improving).

The bottom line

Investors shouldn’t feel pressured to stick with a process that isn’t working for them. Adaptability is a key to success for many businesses and it can be for investors too.

However, this event reiterated to me that anyone can become an expert in any field that they choose. That can mean by the asset or by the process (or both).

The asset could be broad — like the crypto industry — or it could be more specific, like honing in on a certain sector, industry, or theme. When it comes to process, investors may choose to study the fundamentals — like stock valuations, industry-specific trends, company financials, or asset structure — or they might rely on other techniques, like catalyst-driven events or technical analysis.

The beauty is that we have the freedom to proceed as we please. We can approach markets however we want; investors can focus on what interests them and they can blend processes to make it work best for them.

Want to receive these insights straight to your inbox?

The setup — Healthcare

If you recall, we wrote about healthcare earlier this month, noting the expected growth for the sector over the next six quarters.

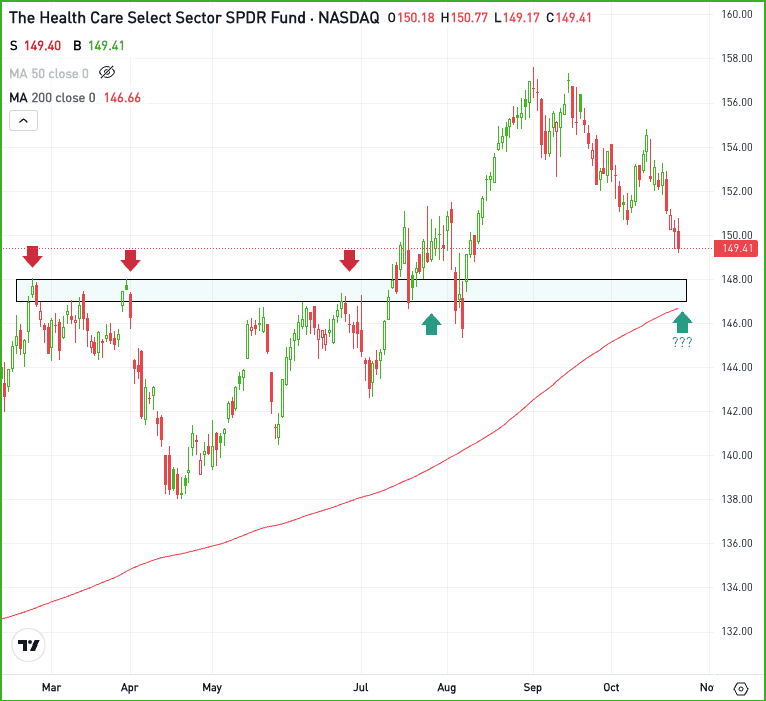

When looking at the Health Care Select Sector ETF — the XLV — it has fallen in four of the last five weeks, and short of a big rally on Friday, is set to make that five out of the last six weeks.

Despite solid fundamentals, this sector has been under selling pressure:

Notice how XLV is pulling back toward the $147 area. This was a major resistance area for the ETF earlier this year, but it was able to break out in July. More importantly, it held this area as support when it dipped in early August.

Now declining toward this zone, bulls will be keeping a close eye on this area — and the 200-day moving average, a key measure of the long-term trend — to see if it again acts as support.

If it does, active investors might view it as an attractive opportunity. If support fails to come to fruition, those buyers could cut their losses, as momentum may turn more bearish in the short term.

Options

On a dip, buying calls or call spreads may be one way to take advantage of a pullback. For call buyers, it may be advantageous to have adequate time until the option’s expiration.

For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.