The Daily Breakdown analyzes what happened at the latest Fed meeting, and takes a closer look at the Reddit IPO on Thursday.

Thursday’s TLDR

- The Fed still expects three rate cuts this year.

- Reddit will begin publicly trading today.

- Micron breaks out on earnings.

- Nike, Lululemon, and FedEx report earnings tonight.

What’s happening?

You all know that yesterday was Fed day — so what do we need to know?

As expected, the Fed did not alter interest rates on Wednesday. In fact, not a whole lot changed from the Fed’s prior stance in January. Essentially, Fed members still need to see more data to feel confident in cutting rates.

However, the Fed still expects three rate cuts this year (just as they did in December), which was a positive for investors who thought the Fed may pull back on the idea of three rate cuts in 2024.

While Chair Powell wouldn’t commit to when the Fed will cut rates, the bond market still expects the June meeting as the most likely time frame.

Overall, the results from the Fed meeting were enough to drive the S&P 500 to a new all-time high above 5,200. Let’s see how we finish out the week, which is still loaded with big events.

Perhaps most notably is the Reddit IPO, which will begin trading today under the symbol “RDDT.” Last night, the company priced its IPO at $34 a share, raising almost $750 million and valuing the firm at about $6.4 billion.

On the earnings front, it’ll be a busy evening with Nike, Lululemon, and FedEx all reporting quarterly results tonight.

Want to receive these insights straight to your inbox?

The setup — IWM

With more clarity around interest rates, certain asset classes are expected to perform better. Small caps are one of those groups, as they tend to be more sensitive to interest rates than larger companies.

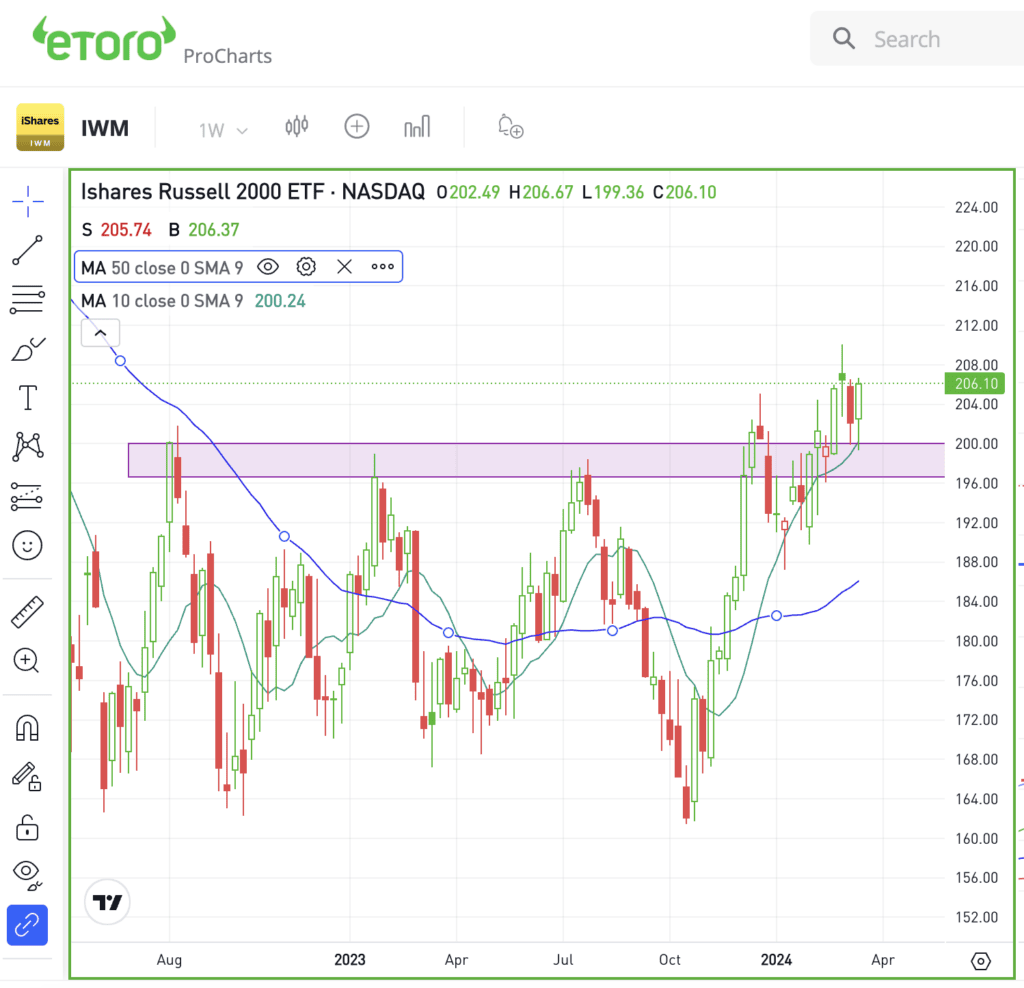

In this case, we’re looking at the IWM ETF, which is an ETF modeled after the Russell 2000 — a small-cap index.

Take note of how the Russell 2000 hasn’t hit new all-time highs like the S&P 500, Nasdaq 100, or the Dow — it’s been a laggard. But on the bright side, the IWM has gotten above the key $200 level, as shown below.

The $195 to $200 zone has been stiff resistance for IWM for about two years now. So if the ETF can stay above this level and continue higher, it could be a big momentum shift for this long-lagging index.

For options traders, calls or bull call spreads could be one way to speculate on continued move higher. In this scenario, buyers of calls or call spreads limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect downside could speculate with puts or put spreads.

And remember, you don’t have to trade small caps. You can find value in this group by simply observing them. For instance, is prior resistance turning into key support? Is the IWM making higher highs and/or hitting 52-week highs?

Those would be positive developments, telling you that investors are rotating back into small caps and see potential in this group.

What Wall Street is watching

MU — Micron Technology shares are surging this morning, up about 17% after the firm reported better-than-expected quarterly results. Micron beat on Q2 earnings and revenue expectations and delivered better-than-expected guidance for both metrics. The rally is triggering a multi-year (and technically, a multi-decade) breakout.

GES — Shares of Guess are ripping higher this morning too. That’s after the retailer delivered earnings of $2.01 a share on revenue of $891 million, far outpacing analysts’ expectations for earnings of $1.56 a share on revenue of $856 million. A special dividend of $2.25 per share also helped.

ACN — Shares of Accenture are dipping in pre-market trading after the firm cut its revenue outlook. Management previously expected annual revenue growth of 2% to 5%, but now expects revenue growth in the range of 1% to 3%. Consensus expectations had called for about 3.3% growth before the company’s update.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.