Just because the Fed is cutting rates doesn’t mean a crisis is looming around the corner. The Daily Breakdown explores why.

Friday’s TLDR

- The Fed cut interest rates earlier this month

- But that doesn’t mean a crisis is coming

- Coca-Cola bulls look for more gains

The Bottom Line + Daily Breakdown

Earlier this month, the Federal Reserve lowered interest rates for the first time since March 2020. That was in response to the Covid-19 pandemic, and in fact, many times the Fed has lowered rates in response to a crisis.

Some skeptics take the Fed’s recent action as a warning sign for the future — but that isn’t always the case.

Crisis around the corner?

Here’s the tough-love reality: No one knows if there will be a disaster lurking around the corner. Look no further than the recent spike in volatility in early August due to the yen carry trade unwinding. Hardly anyone saw that one before it was too late.

But when we take stock of the current environment, we’re not in a fragile state.

Bloomberg estimates call for double-digit earnings growth for the S&P 500 in five of the next six quarters. This is an example of healthy fundamentals. 10 of the 11 S&P 500 sectors are up more than 10% so far on the year, as the rally broadens out to more stocks and sectors. This is an example of healthy price action.

When the Fed lowers interest rates, it’s generally to stimulate the economy and is often viewed as a positive, even when the economic backdrop isn’t quite so rosy.

In this case, the Fed lowered rates as inflation has cooled over the last two years and as we’ve had a recent uptick in labor market weakness.

A softening jobs market is a concern — and a big one at that. But we’re not to the point where we’re in a weakening economy.

Retail sales remain solid, while the most recent GDP report just clocked in with 3% annualized growth. As a reminder, we’re considered to be in a recession when we have consecutive quarters with negative GDP growth.

So what’s the deal?

The Fed often loosens its monetary policy — for instance, by lowering rates — to help spur economic demand in times of weakness. But that’s not the only time they do. In fact, the Fed has lowered rates plenty of times over the last few decades without the economy being in a recession.

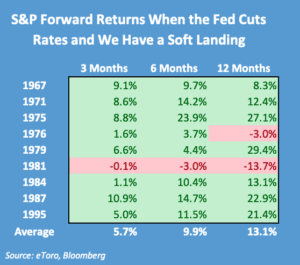

Going back to the 1960s, the Fed has entered a rate-cutting cycle nine other times while avoiding a recession. Here were the returns for the S&P 500 for each of those cycles over the next three, six and 12 months.

The bottom line

It’d be wrong to say there aren’t any concerns right now — mainly surrounding the jobs market. Roughly 70% of US GDP is driven by consumer spending, and consumers likely aren’t spending all that much if they lose their jobs. That’s a good reason to worry, but so far, those worries haven’t manifested into reality.

If that changes, then so will investors’ approach to risk assets like stocks and Bitcoin. But as long as market breadth remains strong and fundamentals (like earnings) remain solid, it’s important to remember that the Fed can cut rates without a crisis lurking around the corner.

Want to receive these insights straight to your inbox?

The setup — KO

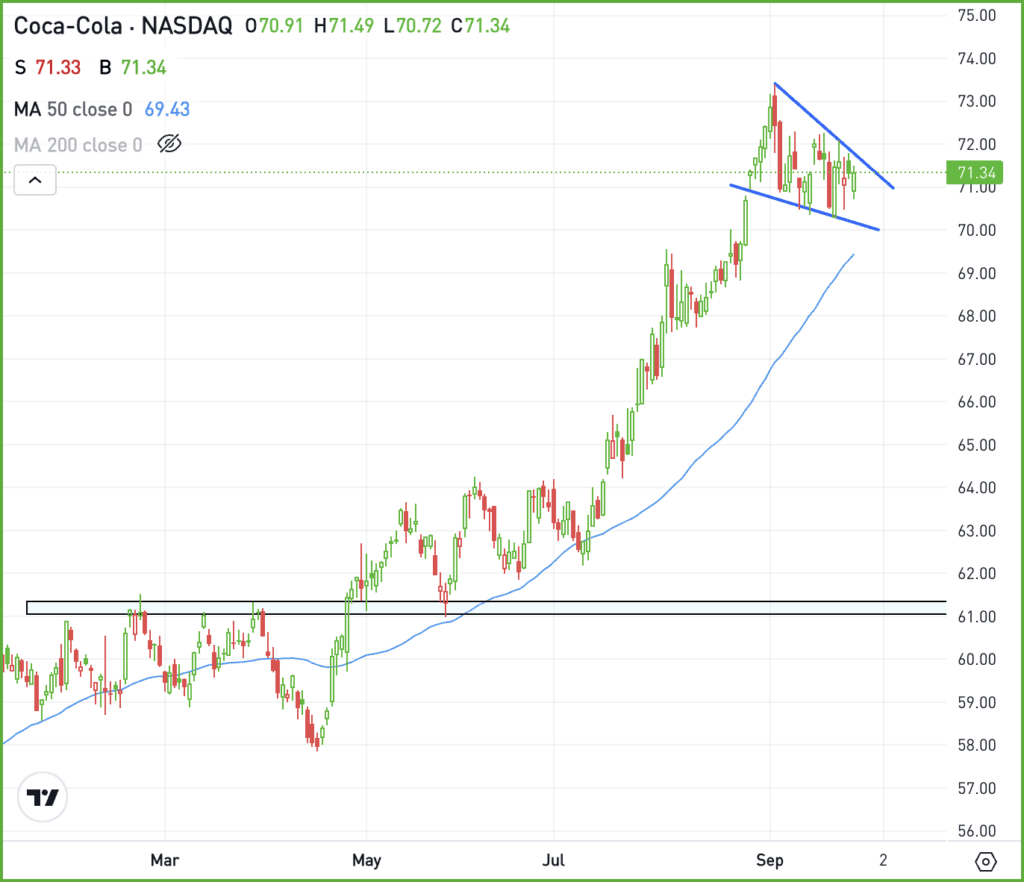

Shares of Coca-Cola have been exceptional this year, up 21%. In the rivalry vs. PepsiCo — which is flat in 2024 — KO has been the easy outperformer.

While Coca-Cola stock tends to be a slow mover, the charts remain fairly constructive. That’s as the stock continues to consolidate after its recent run to record highs.

KO might need more time consolidating, and may even need to test down toward the 50-day moving average. However, if the stock is able to clear upside resistance, investors could be looking at a move back to the highs — and potentially to new highs in the coming weeks and months.

On the flip side, a break below the 50-day moving average could usher in more selling pressure.

Options

Investors who believe shares will break out — or those who are waiting for the potential breakout to happen first — can participate with calls or call spreads. If speculating on the breakout rather than waiting for it to happen first, consider using enough time until expiration.

For investors who would rather speculate on resistance holding, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.