The Daily Breakdown looks at the post-earnings rally in Boeing as it approaches resistance, while keeping the Fed meeting front and center.

Wednesday’s TLDR

- The Fed isn’t expected to cut rates today…

- But investors will look for confidence in a September cut.

- Microsoft stock falls on cloud results.

What’s happening?

It’s the last day of July and it’s been a bumpy month.

Small caps continue to dominate, with the Russell 2000 up 9.5% so far this month. (Teaser: I have some fun data on robust small-cap performance that I can share with you later this week, once July is in the books).

Mega-cap tech continues to be a victim of profit-taking though, with the Nasdaq 100 down 4.5% and the S&P 500 down 0.5%.

Tech is trying to bounce today, despite the mild earnings selloff in Microsoft. That’s as Advanced Micro Devices is fueling a big bounce in chip stocks. Let’s see if money rotates back into this group.

A big influence on how we’ll end the month may boil down to the Fed.

The Fed’s interest rate decision is due up at 2 pm ET today, followed by a Q&A press conference with Chair Powell at 2:30 pm.

The market doesn’t expect a rate-cut from the Fed today, but the market is fully pricing in a rate cut in September. So the hope and expectation is that Powell will instill confidence in a rate cut later this quarter (although it’s unlikely he’ll make a firm commitment to it).

Want to receive these insights straight to your inbox?

The setup — BA

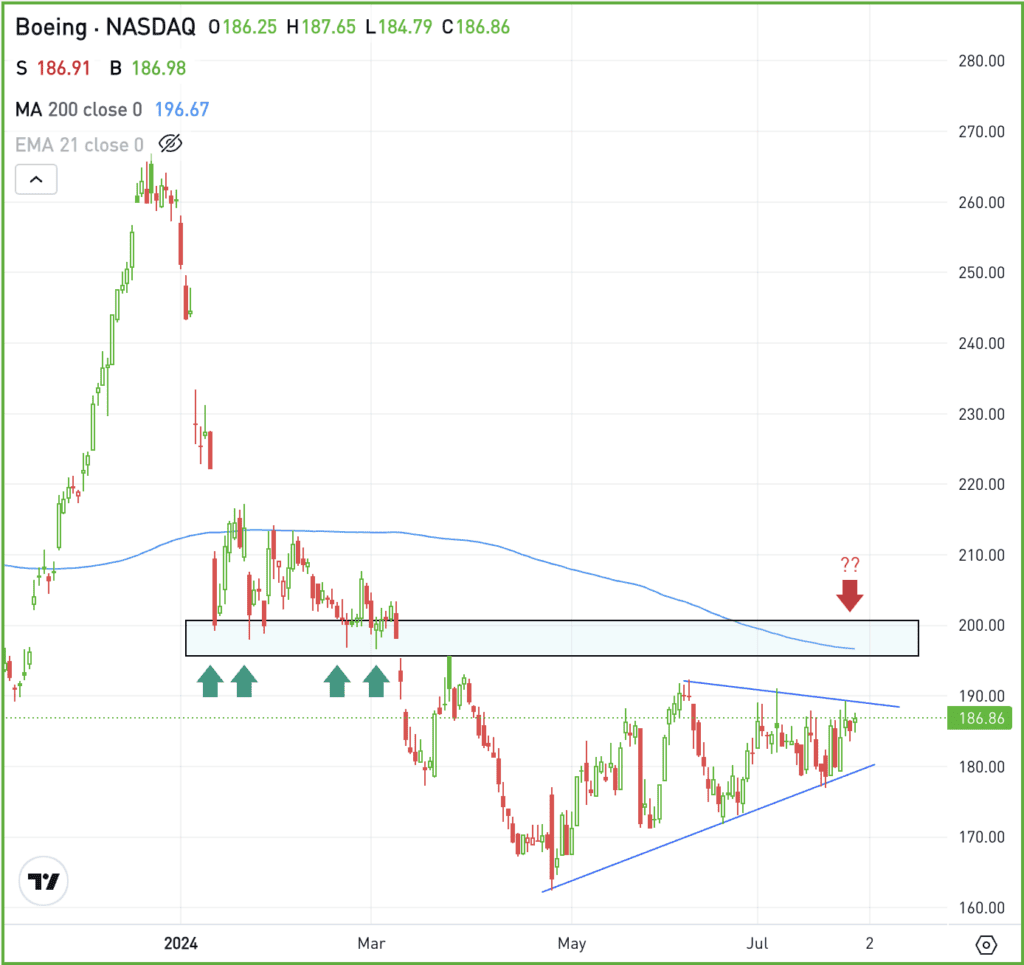

Boeing shares have struggled this year, down almost 30% coming into today’s session. Despite reporting a top- and bottom-line miss this morning, the stock is trading slightly higher.

But investors may want to check the charts before jumping into this name.

Boeing had a meteoric rise in Q4, only to come crashing back down in January. At first, the $195 to $200 area was support. Once it broke though, it became resistance in March.

If BA can rally back to this zone this week, will it act as resistance?

That’s what traders want to know, while also noting that the 200-day moving average could act as resistance as well. If the stock can regain this key moving and climb above $200, perhaps a larger rebound could ensue. But until that’s proven to be the case, it may be key to remember this area for BA stock.

Options

For options traders, puts or bear put spreads could be one way to speculate on further downside. It could also be a way for BA bulls to hedge their long positions. Those who think more upside is likely, calls or call spreads is one way to speculate.

In both scenarios — with calls or puts — options buyers limit their risk to the price paid for the options or spreads.

Find out more about options trading with our free Academy courses, and practice draft trading risk-free until you’re ready to try options trading for real.

What Wall Street is watching

MSFT — Microsoft shares dropped in after-hours trading after reporting disappointing results from its cloud business, overshadowing its strong performance in the quarter. Microsoft’s Azure cloud service posted slower quarterly growth, with revenue rising 29%, down from 31% prior. Despite beating expectations on both revenue and earnings, the underwhelming cloud results concerned investors.

CRWD — Shares of CrowdStrike fell over 9% after Delta Air Lines announced plans to seek compensation for a global IT outage caused by CrowdStrike’s software. The outage led to thousands of flight cancellations and significant disruption. Investors worry more companies could do the same.

SBUX — Shares rose in extended trading despite reporting in-line earnings and quarterly revenue below expectations, while comp-store sales disappointed too. However, investors are hopeful the firm can turn around its woes and that activist investor Elliott Investment Management can help shake things up.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.