The Daily Breakdown looks at the US stock market as we start Q3 and is up nicely so far in 2024. Shares of GM are pulling back.

Monday’s TLDR

- There are only three full trading days this week.

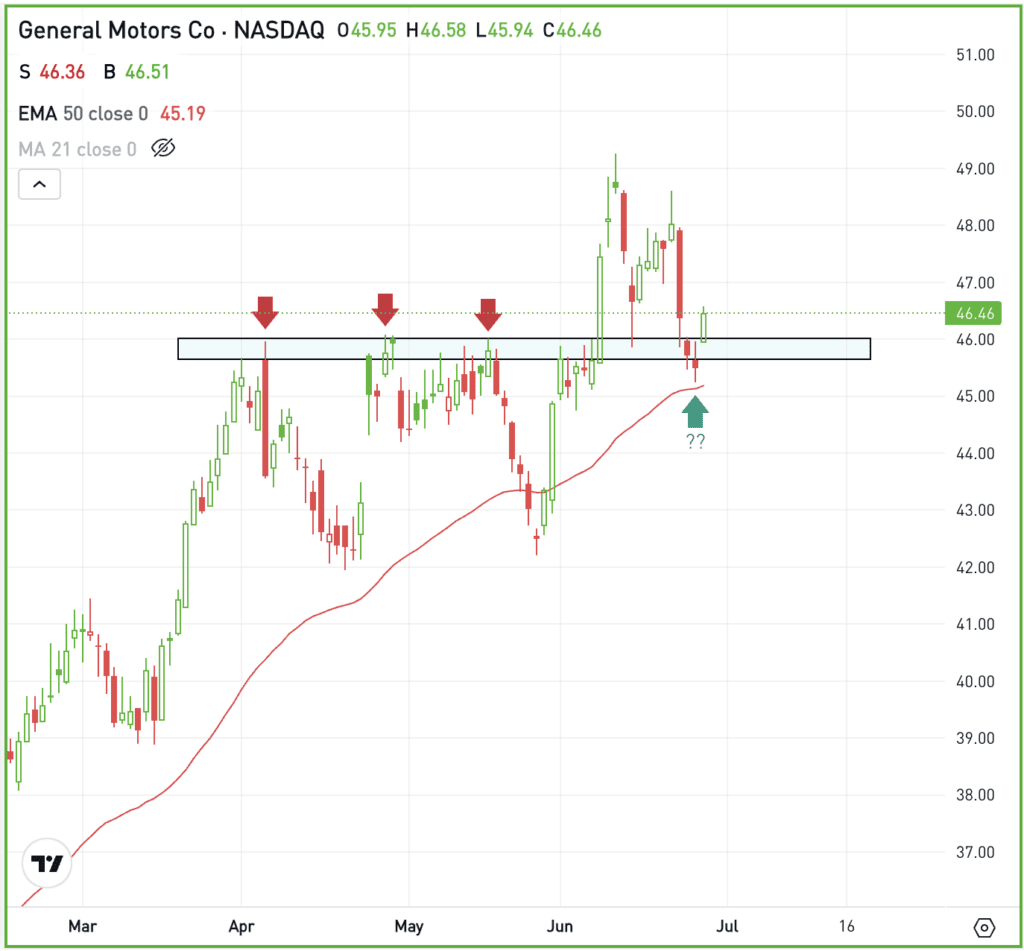

- GM stock retests key breakout area.

- Chewy in focus after Roaring Kitty’s new stake.

What’s happening?

Can somebody pinch me to prove that I’m not dreaming and it’s actually July 1st already?

We’re kicking off Q3 today and investors are right to wonder if it will be a quiet week. Because of the July 4th holiday, the US stock market is closed on Thursday and will close early at 1 p.m. ET on Wednesday.

I think you can imagine the number of investors and firms that will also be taking the day off on Friday as well — even though that’s when we’ll get the monthly jobs report for June.

However, the jobs report isn’t the only thing investors are watching this week.

We’ll get manufacturing and PMI data this morning, which will help paint a clearer picture of the economy. On Tuesday, we’ll get more labor data with the JOLTs report, and on Wednesday, we’ll get more PMI data and the Fed Minutes — the latter of which is a summary of talking points from the Fed’s most recent meeting.

While earnings are quiet this week, look for that to change late next week.

The setup — GM

Remember when we talked about the breakout in General Motors in mid-June? That’s when shares were hitting new 52-week highs after the company announced a big share buyback.

Now though, the stock is pulling back to the breakout area and the 50-day moving average. If the stock can hold support in the mid-$40s, bulls have a reasonable argument to stay long based on the technicals.

Before the breakout in June, this area had been resistance in April and May. Along with the 50-day moving average, holding this zone should bode well for the stock, which may attempt to rally back to the recent high.

However, if GM shares break below support, active traders can stop-out of the position with a modest loss.

GM stock pays a modest dividend yield of ~1% and only trades at about 5 times this year’s earnings expectations, which calls for more than 20% year over year growth.

Options

Buying calls or call spreads may be one way to take advantage of the retest. For call buyers, it may be advantageous to make sure they have adequate time until the option’s expiration.

For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

CHWY – Shares of Chewy are in focus this morning after Keith Gill — AKA Roaring Kitty and most notoriously linked with GameStop — disclosed a 6.6% stake in the firm. According to a 13G filing with the SEC, Gill has accumulated a position of more than 9 million shares.

NKE – Nike shares were pummeled on Friday, falling 20% after the firm reported disappointing quarterly results. While earnings of $1.01 a share easily beat analysts’ expectations of 84 cents a share, revenue of $12.6 billion slipped 1.7% year over year and missed estimates by $250 million. Worse, management was not optimistic with its outlook.

BA – Over the weekend, Boeing announced that it will acquire Spirit AeroSystems Holdings for $37.25 a share in an all-stock deal. Currently, the deal is valued at about $8.3 billion. Note: This is not a deal for Spirit Airlines.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.