The Daily Breakdown looks at earnings from the Magnificent Seven stocks, as well as the breakout in Pinterest stock.

Tuesday’s TLDR

- Five of the Magnificent Seven stocks report earnings this week.

- Pinterest hits a one-year high.

- SoFi erupts higher by 20.2%.

What’s happening?

The S&P 500 rallied to another all-time high on Monday, bursting higher with a 0.8% gain. It’s now just 1.5% away from the heavily watched 5,000 level.

Tech and small caps led the way yesterday, with the Nasdaq 100 gaining 1% and the Russell 2000 jumping 1.7%.

It’s encouraging to see small caps trading well, as it keeps the “risk on” mentality alive. However, we’ll likely need continued strength in tech for the market to continue higher.

We’re seeing some positive signs this morning, with the big pre-market rally in Super Micro Computer after it delivered a top- and bottom-line beat. Investors are hoping it means good things for other AI-related stocks — like AMD, which reports tonight.

More broadly speaking though, five of the Magnificent Seven stocks report this week — Microsoft, Amazon, Apple, Alphabet, and Meta — while one other component, Tesla, has already reported. Nvidia will report later in February.

Those seven stocks make up almost 29% of the S&P 500. So how they perform really does hold weight.

Want to receive these insights straight to your inbox?

The setup

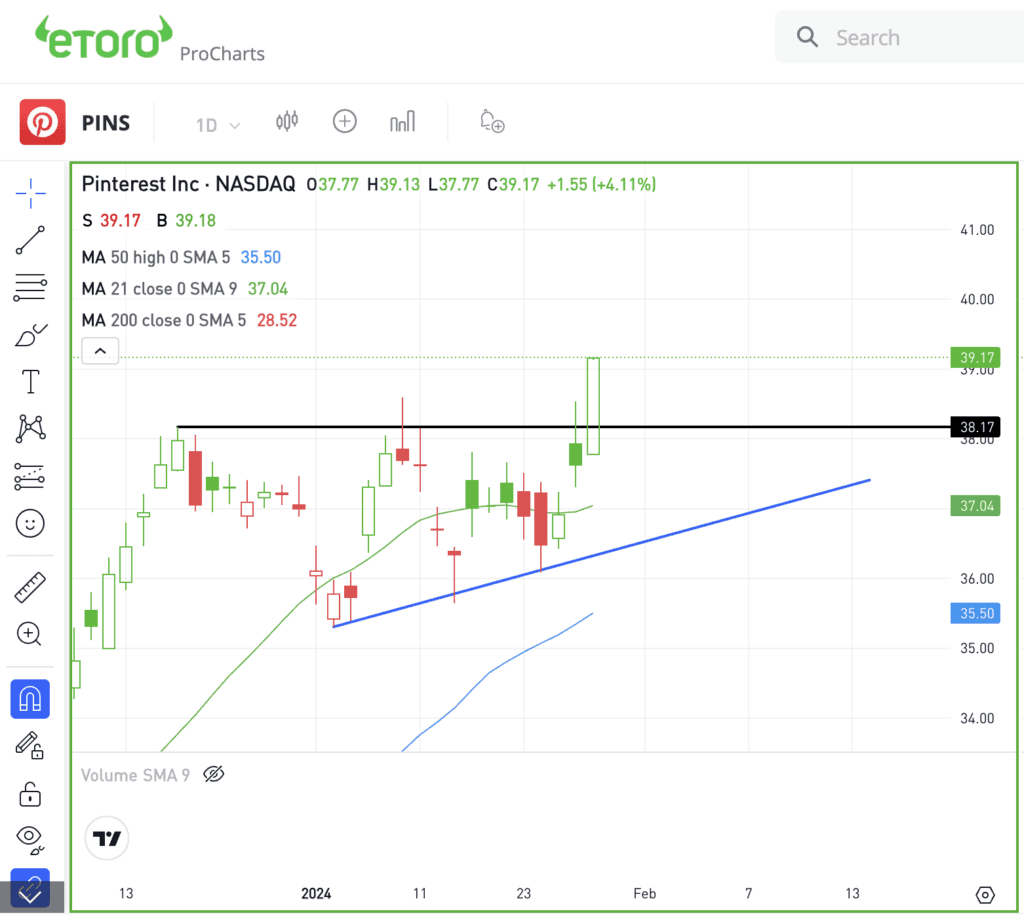

While Pinterest suffered a peak-to-trough decline of 82% during the bear market, shares are up almost 6% so far this month and are up more than 56% over the last three months.

Pinterest traded up to $38 in mid-December, then ran out of steam. Until yesterday, this level had been acting as resistance.

On Monday, shares climbed 3.9% on volume of 15.8 million shares — the stock’s largest one-day trading volume in about two months. The rally was enough to send the stock above $38, triggering a breakout on the daily chart.

With earnings on February 8, it wouldn’t be too surprising if Pinterest enjoyed a pre-earnings rally into that event.

If Pinterest can stay above $38, bulls remain in control with a hope of driving shares into the $40s. On the flip side, a break back below $38 and the stock may need some more time to consolidate its big gains over the last few months.

What Wall Street is watching

SOFI: SoFi shares surged on Monday after the firm reported its Q4 results. While investors cheered the company’s earnings and revenue beat, it was management’s better-than-expected full-year outlook that really powered the rally and led to the stock’s best one-day performance in more than a year.

IRBT: Shares of iRobot, the Roomba maker, dropped after Amazon officially scrapped its acquisition due to regulatory hurdles. In response, iRobot plans to reduce its workforce by 31%, or around 350 employees. iRobot also announced its CEO’s resignation. Amazon’s shares saw a slight increase, climbing 1.3% on Monday.

BTC: Bitcoin is slowly making its way higher, as the cryptocurrency tries to shake off the “sell the news” reaction since the SEC approved a number of Bitcoin ETFs earlier this month. Bitcoin has rallied in five of the last seven sessions, and is up about 13% in that stretch. It’s now at its highest level in several weeks as bulls try to regain momentum.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.