The Daily Breakdown takes a closer look at PayPal, which has badly lagged the market’s rally, but recently hit 52-week highs.

Tuesday’s TLDR

- Dow hits record highs.

- PayPal stock clears key resistance.

- The Real estate sector is up 16% over the last three months.

What’s happening?

We’ve seen a fast and furious rally off the lows.

From peak to trough, the S&P 500 fell 9.7%. From the lows, it climbed more than 10% to get within 1% of its all-time highs — including a stretch where it rallied 8% in just eight sessions.

While impressive, it wouldn’t be surprising if the markets took a little breather.

It’s interesting to watch the rebound off the low as the S&P 500 has done well, the Dow hits new record highs, and as the Nasdaq 100 lags.

For its part, the Nasdaq fell harder from the highs — dipping about 16% — but it remains more than 5% from its all-time high. Nvidia’s earnings could play a big role in whether the Nasdaq 100 catches up and rallies to new highs or if it continues to underperform the other indices.

(We’ll get more into Nvidia tomorrow ahead of its report). For now though, the action remains quiet until this week’s larger events.

Want to receive these insights straight to your inbox?

The setup — PYPL

One stock that hasn’t come back to life since the 2022 bear market? PayPal.

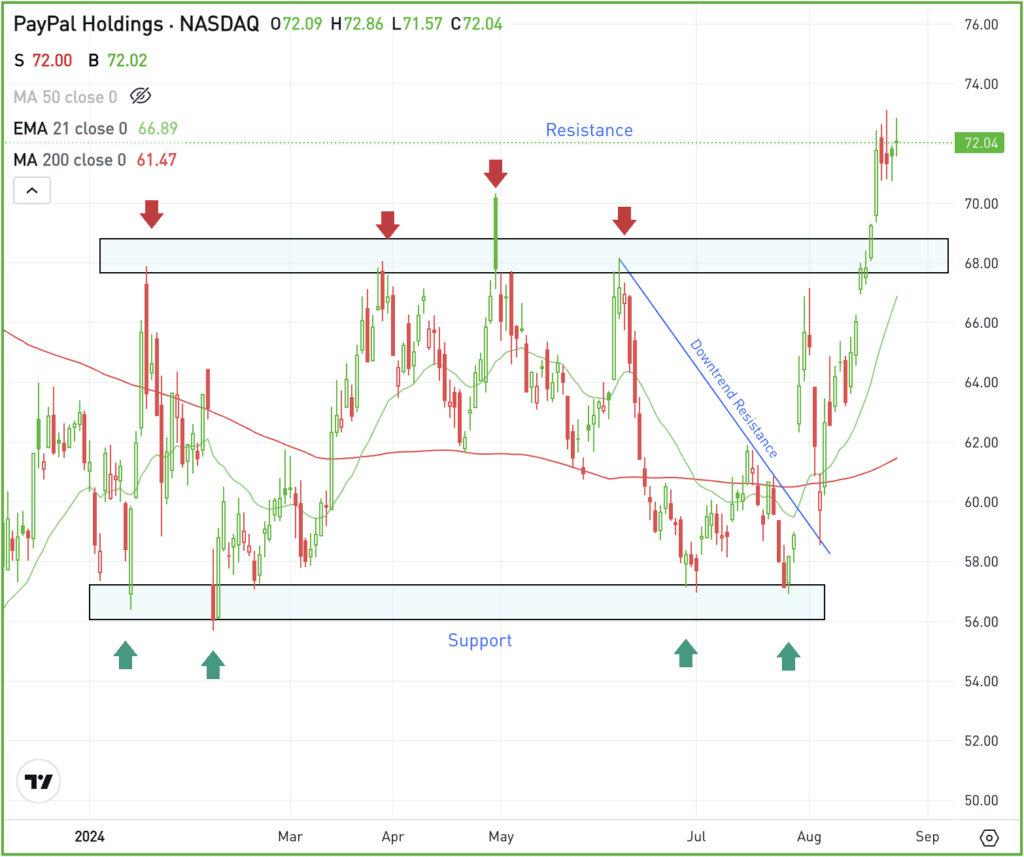

However, the stock recently hit new 52-week highs as it consolidates above the key $68 level, which had been resistance all year long.

Now, investors want to see prior resistance hold as support should PayPal pull back.

With PayPal above resistance, many bulls will look at this as a “buy the dips” candidate. As long as PayPal stays above prior resistance, that approach may work.

However, if shares break back below $68, then the stock may return to its prior range of $56 to $68.

Fundamentally, PayPal trades at roughly 16 times this year’s earnings estimates, which are forecast to only increase slightly from 2023. However, expectations accelerate meaningfully for next year. Analysts expect roughly 7% revenue growth this year and for the next several years.

What Wall Street is watching

AAPL — Apple is expected to unveil the iPhone 16 at its September 9 event. Further, analysts and Apple fans expect an updated Apple Watch, a new AirPods model, and an AI-powered Siri upgrade.

XPEV — XPeng shares jumped over 7% after CEO He Xiaopeng increased his stake, purchasing 1 million Class A shares and 1.42 million ADSs for roughly $13 million. His ownership rose to 18.8%, signaling confidence and plans for further investment.

XLRE — The Real Estate Select Sector ETF just hit new 52-week highs amid expectations that the Fed is on the brink of lowering interest rates. The XLRE ETF is up 8.2% so far on the year — the 10th best-performing S&P 500 sector out of 11 — however, it’s up 16% over the last three months, beating all other sectors.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.