The Daily Breakdown looks at Nvidia, which became the most valuable company in the world after surpassing Apple and Microsoft’s market cap.

Thursday’s TLDR

- Nvidia is now the world’s most valuable company.

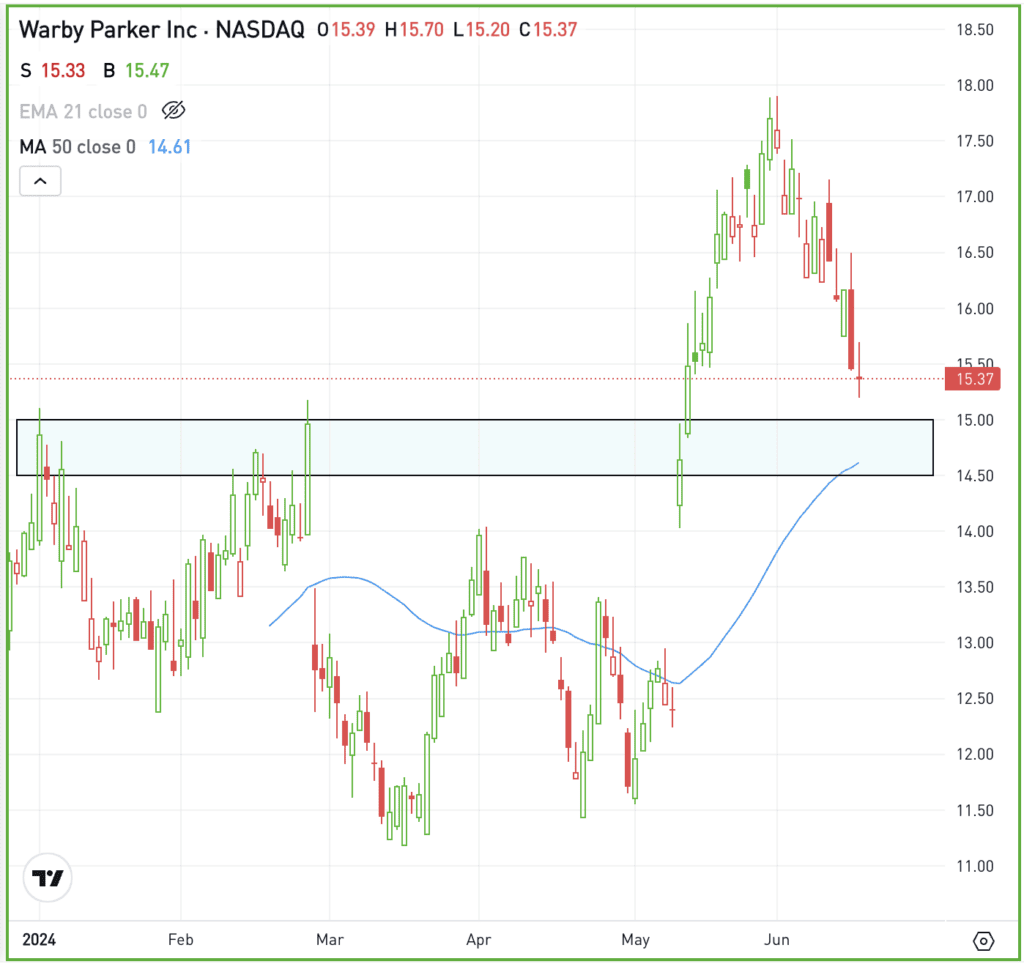

- Warby Parker stock pulls back to potential support.

- McDonald’s looks to offer a new value meal.

What’s happening?

There are just two trading days left in the week and the calendar looks pretty chill.

We have earnings from Kroger, Accenture, Dardin and a few others this morning, while a few minor economic reports are due up.

This week’s big event comes tomorrow, as the markets digest a triple-witch expiration. We’ll dig into that a bit more tomorrow, but for now, investors are simply wondering if stocks can continue higher.

The saying “never short a dull market” exists for a reason. While there certainly can be periods of volatility and pullbacks within a larger uptrend, falling volumes and quiet trading can often allow markets to drift higher.

We’re seeing that price action now, as the S&P 500 and Nasdaq 100 continue to climb even as volumes remain subdued. It also comes amid narrowing leadership.

A big part of the recent rally has been Nvidia, which is now the most valuable company in the world with a $3.34 trillion market cap. Nvidia is working on its ninth straight weekly gain, up about 78% in that stretch. For the year, shares are up 174%.

Want to receive these insights straight to your inbox?

The setup — WRBY

With a market cap just below $2 billion, Warby Parker is not as large of a company as we often look at. However, the stock’s pullback after a big earnings-inspired rally has our attention.

Investors cheered the firm’s earnings report in mid-May, with shares jumping 18% in a single day. A few weeks later WRBY was up 44% from its pre-earnings levels.

Now though, shares are pulling back and bulls are looking at the $14.50 to $15 area.

Technical traders are looking for this prior resistance zone to act as current support. This area also contains the 50-day moving average.

It’s possible that Warby Parker could find its footing before testing down into this area — and it’s possible that the stock drops below this zone and continues lower.

However, for investors keeping an eye on this name, the $14.50 to $15 zone represents a solid risk/reward setup. That’s because a break below this area allows traders to stop-out of their position while keeping their losses contained, and if support holds, the stock could see a healthy rebound.

Options

Buying calls or call spreads may be one way to take advantage of a pullback. For call buyers, it may be advantageous to make sure they have adequate time until the option’s expiration.

For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

NVDA — Nvidia soared 3%, overtaking Microsoft as the most valuable public company, continuing its remarkable ascent after recently surpassing a $3 trillion market cap and Apple in value.

EWQ — French stocks are bracing for more volatility due to political risks, according to Goldman Sachs strategists. Recent declines were marked by the CAC 40’s worst performance since March 2022, prompted by fears of a far-right victory in the upcoming legislative elections.

MCD — McDonald’s is reportedly readying a new $5 value meal for customers, which would include a McDouble cheeseburger, small fries, a four-piece chicken nugget, and a small soft drink. The offer comes amid intensifying value competition from fast-food companies trying to lure customers back.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.