After a bumpy start to 2024, US stocks enjoyed a big rally to start the week. The Daily Breakdown takes a look at Nvidia’s breakout and Bitcoin’s rally to 52-week highs.

Tuesday’s TLDR

- Stocks start the week with a bang.

- Nvidia’s breakout sends shares to new heights.

- Twilio rallies on CEO change and guidance update.

What’s happening?

Stocks may have broken their losing streak on Friday with a meager gain, but that wasn’t the case on Monday. Small caps and tech helped lead a strong rebound yesterday, with the Russell 2000 and Nasdaq 100 gaining 1.9% and 2.1%, respectively.

Nvidia hit all-time highs — more on that in a minute — while AMD and other chip stocks helped propel semiconductors higher as investors remain focused on AI.

Bitcoin rallied almost 7% on its way to new 52-week highs ahead of a likely ETF decision from the SEC later this week.

All of this is to say that investors were, at least for one day, piling back into growth stocks and so-called “risk-on” faves. The question is, how long will the bounce last?

A rebound after last week’s slump feels good, but we still have to remember that the S&P 500 rallied more than 16%, then pulled back 2%. Some more consolidation or a further dip would still be healthy (even if it’s frustrating).

Remember, we have the CPI report on Thursday — which could have an impact on rate-cut bets this year — while earnings season kicks off on Friday with the banks.

The setup

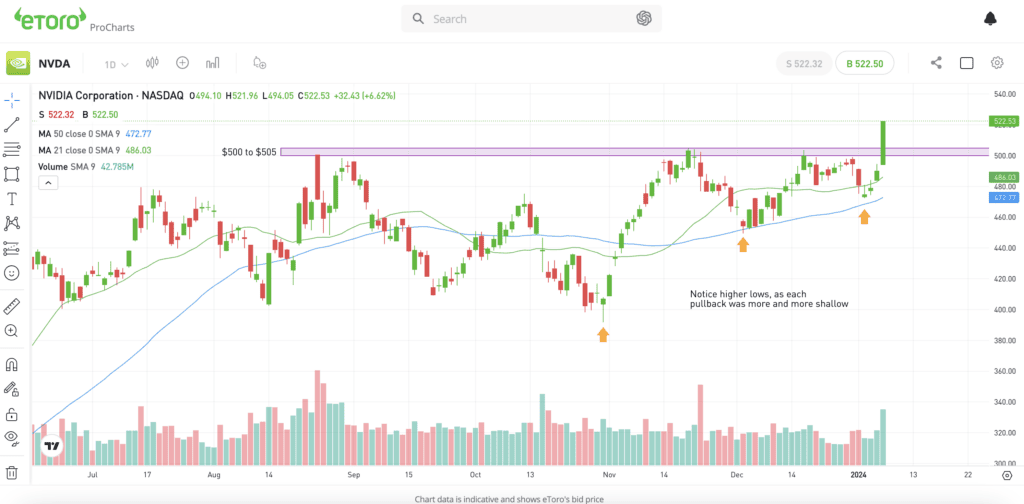

It’s hard not to talk about Nvidia this morning, given the size of yesterday’s rally. Shares climbed 6.4%, propelling Nvidia to all-time highs and finally triggering a breakout over the key $500 level.

I say “finally” because this potential breakout has been in the making for months now.

While Nvidia remains the face of AI, the stock has struggled to take out the highs from August. That’s when shares gapped up on another strong earnings report, then faded lower after hitting a high of $502.66.

The $500 to $505 zone has been resistance since then, while support was found near $400.

However, Nvidia stock has been putting in a series of higher lows since October, with each pullback becoming more shallow. Then yesterday, shares opened near $495, powered through $500, and climbed as high as $522.75.

The rally came on strong volume too, with more than 64 million shares changing hands — almost 70% above its 20-day average of roughly 38 million shares.

Aggressive buyers might pile into Nvidia now that the stock is trying to break out and trade into a new range. However, more conservative investors will likely wait for a potential pullback back toward the $500 breakout level for a possible entry.

Unless it closes back below $500, this move bodes well for Nvidia stock.

Want to receive these insights straight to your inbox?

What Wall Street is watching

NVDA: Nvidia released three new AI-focused graphics chips for PCs, enhancing personal gaming and design capabilities. The announcement was enough to fuel shares to all-time highs, propelling a notable breakout over the $500 level.

QQQ: Nvidia helped lead the tech-heavy Nasdaq to a 2.1% gain on the day, marking its best single-day gain since November 14. The rally came as big tech significantly boosted the markets and as many other stocks bounced back.

TWLO: Shares of Twilio boasted solid gains on Monday, too, rallying on news that Khozema Shipchandler will replace Jeff Lawson as Twilio’s new CEO. The company also said it expects its fourth-quarter guidance to come in above expectations.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.