The Daily Breakdown sizes up Nvidia ahead of earnings. Further, Amazon will be added to the Dow, replacing Walgreens.

Wednesday’s TLDR

- Nvidia, Rivian, and Lucid Motors will report earnings.

- Fed Minutes will be released this afternoon.

- Amazon will be added to the Dow.

What’s happening?

After Friday’s big monthly options expiration, volatility picked up on Tuesday.

US stocks moved lower, with tech and small caps feeling the brunt of the selloff. While the decline was not equal across the board, 10 out of the 11 S&P 500 sectors declined yesterday (with consumer staples being the lone gainer).

The dip even hit the red-hot semiconductor stocks, as AMD, Nvidia, and others all declined rather notably.

The pullback comes ahead of one of this quarter’s biggest earnings reports, as Nvidia is set to report its Q4 results after the close on Wednesday.

However, Nvidia won’t be alone. Rivian, Lucid Motors, Etsy, and others are also set to report tonight.

On the economic front, the Fed’s FOMC Minutes will be released at 2 pm ET. While investors won’t be looking for a change in interest rates, they will be looking for clues about future rate cuts from the Fed.

Want to receive these insights straight to your inbox?

The setup — NVDA

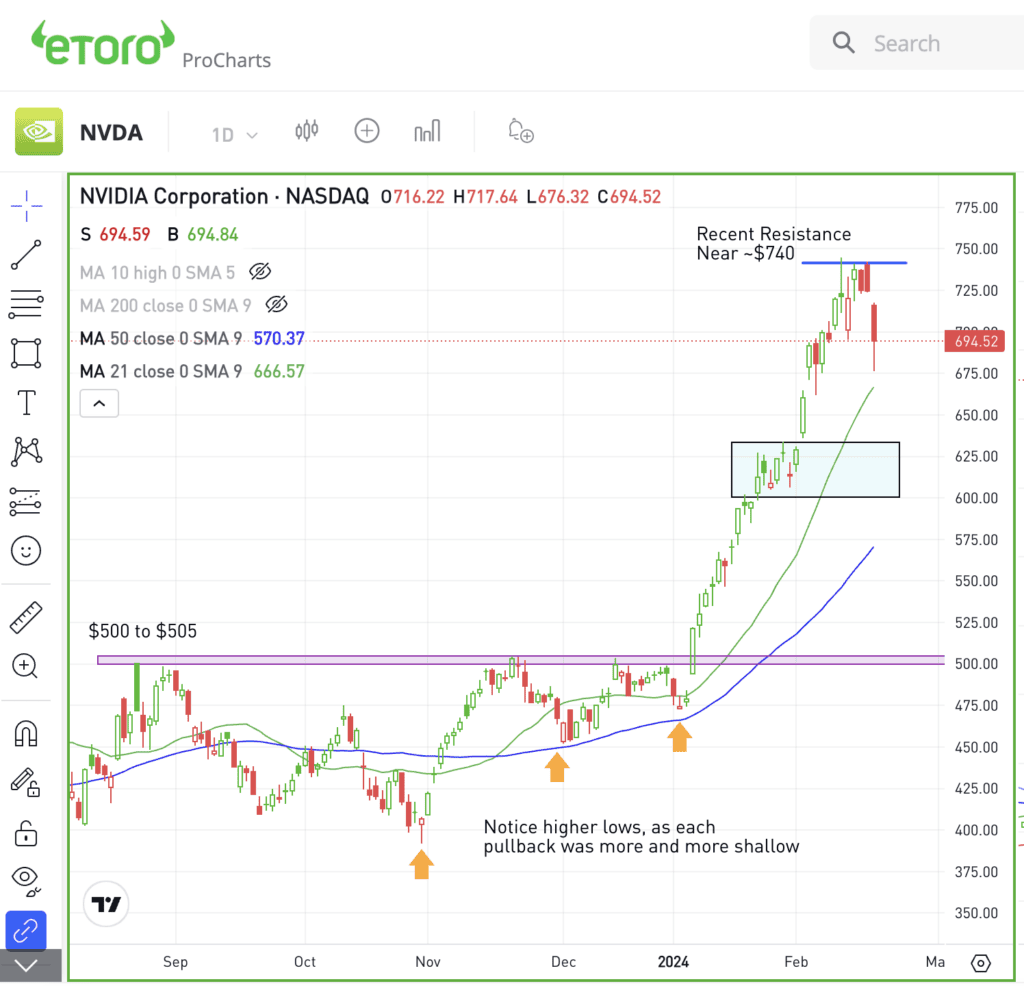

At its high on February 12, Nvidia stock was up more than 50% year to date. This was a massive move, which added about $600 billion to Nvidia’s market cap.

While the stock may have had a powerful surge to start the year, remember that it had been range-bound between $400 and $500 since summer. Even as markets went on to new 52-week highs, Nvidia was biding its time before breaking out.

As of Tuesday’s close, the options market is pricing in about a 9% move by the end of the week. It’s worth noting that just because that’s what’s being priced in, doesn’t mean that’s what will happen. If it does though, it could land Nvidia into some notable areas on the chart.

On the upside, recent resistance has come into play near $740. Bulls looking for a continuation in the rally will want to see Nvidia clear this level and start to build above it.

On the downside, the $610 to $630 range was a consolidation zone in late January, which allowed the stock to rest after a big breakout and helped to power it even higher.

If Nvidia pulls back that far — roughly 10% to 12% from Tuesday’s close and 16% to 18% off the high — it will be interesting to see if buyers step in and support the share price.

What Wall Street is watching

AMZN: Amazon is set to enter the Dow Jones Industrial Average next week, replacing Walgreens Boots Alliance. This change will broaden investors’ exposure to consumer retail, advertising, and cloud computing sectors.

WMT: Walmart stock hit new all-time highs after beating earnings and revenue estimates on Tuesday morning. The company also announced its acquisition of Vizio for $2.3 billion and raised its dividend by 9%.

PANW: Palo Alto Networks shares are plunging on Wednesday morning, down more than 20% after a disappointing quarterly update. While the firm beat on earnings and revenue expectations, management’s full-year guidance calls for revenue growth of 15% to 16% vs. a prior outlook of 18% to 19%.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.