The Daily Breakdown looks at Nvidia’s powerful earnings rally and sizes up the S&P 500 after a strong rally over the last few months.

Thursday’s TLDR

- Nvidia surges on earnings.

- Tech stocks look to rebound.

- Rivian and Lucid dip on earnings.

What’s happening?

It was one of the most highly anticipated earnings reports of the last few years…and Nvidia delivered.

It’s been a top name over the past 12 months, and more recently, it had been vying with Amazon and Alphabet for the third-largest market cap in the S&P 500.

With shares spiking higher on earnings — up almost 10% in after-hours trading last night and up even more this morning — Nvidia looks set to vault comfortably into that No. 3 spot.

The firm delivered an earnings and revenue beat last night, then provided Q1 guidance that topped consensus expectations as management spoke positively about the demand for AI.

Coming into Thursday’s session, Nvidia’s earnings are helping give the markets a nice boost.

The SMH — a popular semiconductor ETF — is up more than 5%, the QQQ ETF is up about 2%, and a handful of chip stocks are ripping higher.

Remember the key upside area to watch on Nvidia today. If it can hold its gains and power higher, it could unlock more upside.

Want to receive these insights straight to your inbox?

The setup — SPY

It’s been a great run over the last four months and this morning’s Nvidia-fueled exuberance feels good. But it’s hard not to preach a little bit of caution after such a powerful rally.

The S&P 500 had rallied in 14 of the past 15 weeks before last week’s 0.5% dip. The current rally has carried the index from 4,100 in late October to more than 5,000 earlier this month — a gain of roughly 23%.

While the indices churn higher, plenty of individual stock and ETF setups can continue to work. However, these types of rallies give active investors an opportunity to lock in profits, raise their stop-loss levels, and wait to redeploy their capital in better opportunities.

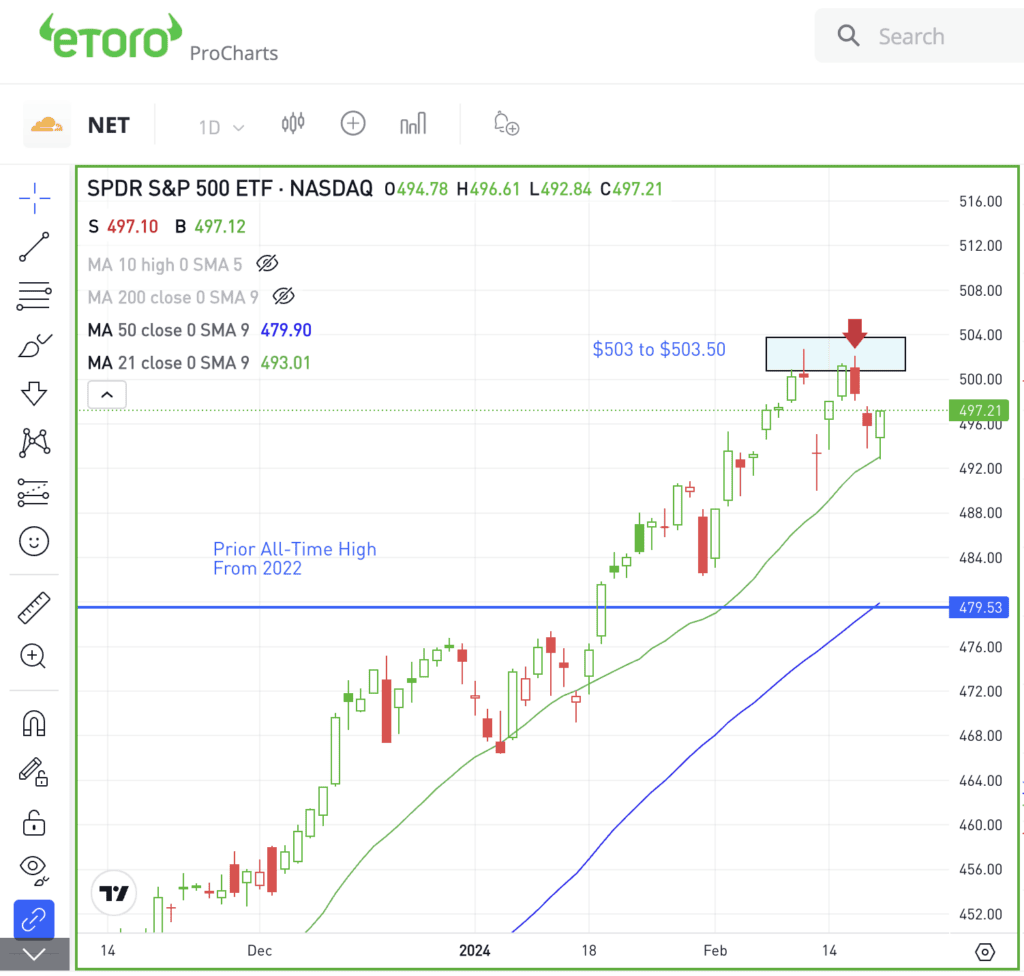

Above is a chart of SPY, the most popular S&P 500 ETF. Notice how last week’s rally in SPY resulted in a lower high, a sign that momentum could be waning.

With this morning’s premarket rally, SPY is trading back toward its highs from earlier this month, up near $503 to $504.

I’m curious to see how the market will trade near these levels. If SPY is able to power above this zone, then more gains could be on the table in the short term.

However, if SPY gets near or above this zone but can’t stay above it, more downside potential exists.

And remember, it doesn’t have to be an all-or-nothing situation. It’s okay to be a little cautious after a huge run and expect a modest dip without looking for the market to crash.

What Wall Street is watching

NVDA: We talked a lot about Nvidia today, but didn’t dive into the results too much. Fourth-quarter earnings of $5.16 a share beat estimates of $4.59 per share, while revenue grew 265% year over year — and no, that’s not a typo! — to $22.1 billion, beating estimates of $20.4 billion. For Q1, the midpoint of management’s revenue outlook was $24 billion, ahead of consensus estimates of $22.2 billion.

DOCN: Shares of DigitalOcean are trading higher this morning after beating earnings and revenue expectations on Wednesday evening. The firm also delivered solid Q1 and full-year guidance.

SMCI: Super Micro Computer has enjoyed a huge rally so far in 2024, up 158% year to date. Shares are rallying again on Thursday morning, riding the momentum from Nvidia’s earnings report. The firm also proposed a convertible note offering of up to $1.5 billion, which will mature in March 2029.

RIVN: Despite beating on Q4 revenue estimates, Rivian shares are getting hammered this morning. Unfortunately, the firm missed on earnings estimates and announced that it’s laying off about 10% of its salaried workforce. Lastly, Rivian called for flat production growth in 2024 vs. 2023 and provided a disappointing full-year EBITDA outlook. It didn’t help that Lucid Motors also delivered disappointing results.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.