The Daily Breakdown previews Nvidia’s earnings ahead of tonight’s big event. The company makes up a notable portion of US stock indicies.

Wednesday’s TLDR

- All eyes are on Nvidia’s earnings report after the close.

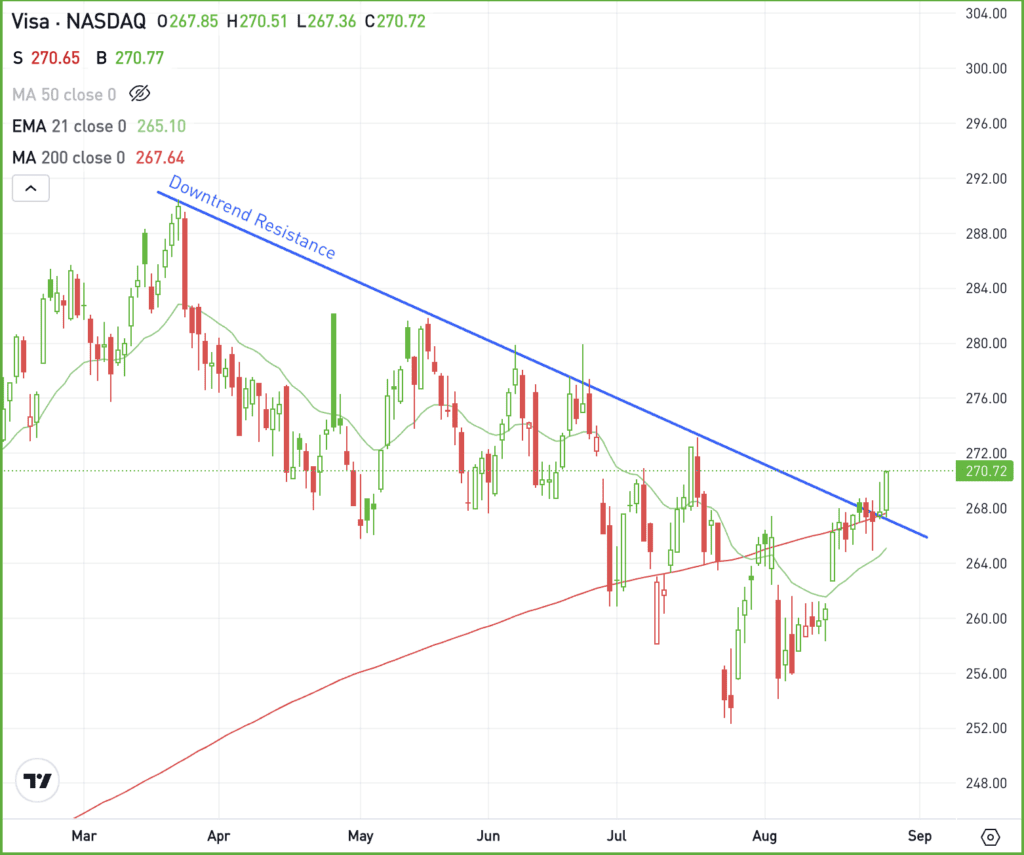

- Visa stock is in focus amid a breakout attempt.

- Bitcoin slips lower but bounces from today’s low.

What’s happening?

Weighing in with a $3.2 trillion market cap, Nvidia is the second largest company just behind Apple and just ahead of Microsoft. And now, it’s set to report earnings tonight.

It has a 7.6% weighting in the Nasdaq 100, a 6.7% weighting in the S&P 500, and makes up almost 20% of the VanEck Semiconductor ETF SMH.

The stock’s post-earnings performance could have a notable impact on the market based on those weightings alone. However, it will have a much more pronounced impact on semiconductor stocks, as Nvidia “sets the tone” for AI names.

However, I want you to remember two things.

First, Nvidia stock doesn’t always make a big move on earnings. The options market is pricing in a ~9% move by the end of the week — but that doesn’t mean it will happen or tell us which direction the move will be in.

Consider this. Here is the one-day performance the day after earnings for the last four quarters: 9.3%, 16.4%, -2.5%, 0.1%.

It’s not always a rally for Nvidia, even though the stock is up 174% over the last year.

Second, it’s the guidance that will matter more than the results. The expectation is that Nvidia will deliver a strong quarter. The question is, will management deliver guidance that tops analysts’ expectations?

If it does, that could be a bullish catalyst. If not, it could trigger some profit-taking.

It’s worth noting that a few other big companies report earnings after today’s close. A few of them include Salesforce, Crowdstrike, Okta, HP Inc, and Affirm.

Want to receive these insights straight to your inbox?

The setup — V

In late July, Visa stock pulled back to key support on earnings, but quickly found its footing and bounced higher.

With the recent rally, shares are clearing downtrend resistance, while also regaining all of its key daily moving averages. If Visa can remain above these key measures, bulls will likely look for more upside.

If Visa stock can stay above the $264 level — thus staying above all of the measures previously mentioned — then bullish traders can make a case for staying long and looking for more upside.

However, if the stock breaks below that level — thus falling below many of the measures it worked so hard to regain — then more downside selling could ensue.

Options

For some investors, options could be one alternative to speculate on V. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and Visa rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

BTC — Bitcoin dipped below $60,000 in early Wednesday trading amid a broad crypto market pullback, including ETH’s sharp decline. Despite recent inflows into Bitcoin ETFs, concerns — like potential US government sales of seized tokens — weigh heavily, as Bitcoin slipped over 6% at one point.

SMCI — Super Micro Computer stock dropped nearly 3% yesterday — and fell as much as 8.7% at one point — after short-seller Hindenburg Research accused it of improper accounting, dubious relationships, and export violations. Allegations include revenue manipulation, undisclosed related-party transactions, and increased exports to Russia, violating sanctions.

AMBA — Shares of Ambarella soared 19% in after-hours trading following a top- and bottom-line beat for its Q2 results. Further, strong Q3 revenue guidance between $77 million and $81 million surpassed analysts’ forecast of $69 million.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.