The Daily Breakdown looks at the week ahead, including earnings from Nvidia and the PCE inflation report on Friday.

Monday’s TLDR

- The S&P 500 is within 1% of its record highs.

- Earnings are still rolling, with Nvidia’s results in focus.

- Bitcoin is back above its 50-day and 200-day moving averages.

Weekly Outlook

On Friday, Fed Chair Powell uttered the words investors had been hoping for: “the time has come for policy to adjust.” Stocks finished the week on a high note after Powell’s comments, as the Fed is prepared to start cutting rates at its next meeting in mid-September.

Now, we enter the final trading week of August — and it’s going to be an exciting one.

Monday and Tuesday are relatively quiet with a few notable earnings from companies like Box and Nordstrom, but Wednesday is where the action picks up.

That’s as Nvidia gears up to report its quarterly results. This name leads the semiconductor space and with its $3.2 trillion market cap, it’s become an influential holding for the market as a whole.

We’ll also get earnings from Abercrombie & Fitch, Chewy, and Kohl’s in the morning. Nvidia reports after the close on Wednesday, along with Crowdstrike, Salesforce, Affirm, Okta, and others.

On Thursday, retail earnings pick up the pace, with Best Buy, Dollar General, American Eagle, Lululemon Athletica, Birkenstock, Gap, and Ulta. We’ll also get the second revision for Q2 GDP growth.

Lastly, on Friday we’ll get the PCE report. While rate cuts appear likely, the PCE report is always worth keeping on your radar as it’s the Fed’s preferred inflation gauge.

Want to receive these insights straight to your inbox?

The setup — BTC

Bitcoin caught a big boost on Friday on the back of Fed Chair Powell’s commentary, rising more than 6%.

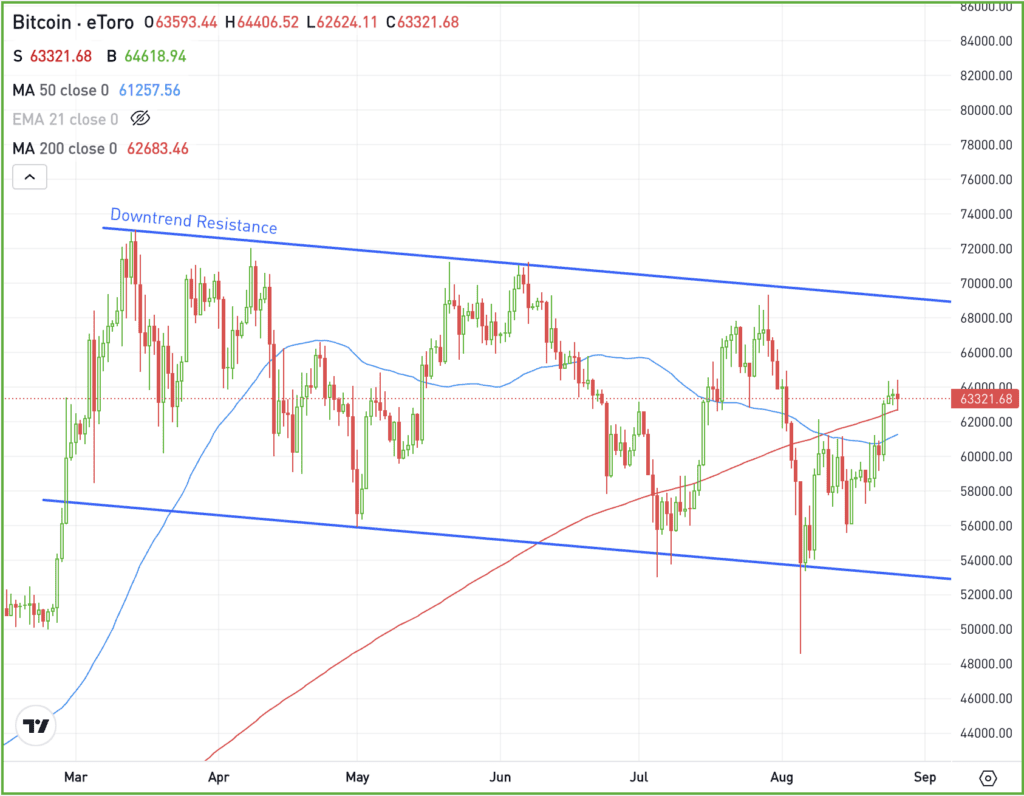

The rally sent Bitcoin above its 50-day and 200-day moving averages, as investors quietly regain some bullish momentum. Since regaining these measures on Friday, Bitcoin continues to trade above them.

While the recent momentum is a positive, BTC largely remains in a giant consolidation pattern marked by the blue lines below. Remember, this is healthy price action in the long term, even though it can be frustrating in the short term.

If BTC can stay above the 50-day and 200-day moving averages, bulls will likely look for a push toward downtrend resistance near $69,000. A move above this level could have investors speculating whether a fresh breakout is on the horizon.

However, if Bitcoin breaks back below these measures, it may continue chopping around below the $60,000 level. And if the selling pressure really picks up, a dip into the low- to mid-$50,000s range is possible.

What Wall Street is watching

CAVA — Cava hit all-time highs on Friday after the firm delivered solid Q2 results. Earnings of 17 cents a share easily topped estimates of 12 cents a share, while revenue grew 35% year over year to $233.5 million, beating estimates of $219.5 million.

PDD — Shares of PDD Holdings — otherwise known as Pinduoduo — are under pressure today, down over 15% after the firm delivered disappointing Q2 results. While earnings topped expectations, revenue of $13.36 billion missed estimates by more than $600 million, while management spoke of revenue pressure moving forward.

NSDQ100 — The S&P 500 is within 1% of its all-time high, while the Nasdaq 100 is still down almost 5% from its highs. Bulls are hoping strong earnings from Nvidia can help return the Nasdaq back toward record highs. However, if Nvidia fails to reignite momentum, the S&P 500 could continue to outperform.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.