The Daily Breakdown looks at yet another earnings beat by Nvidia, as the AI juggernaut continues to delivery above-consensus results.

Thursday’s TLDR

- Nvidia delivers with another earnings beat.

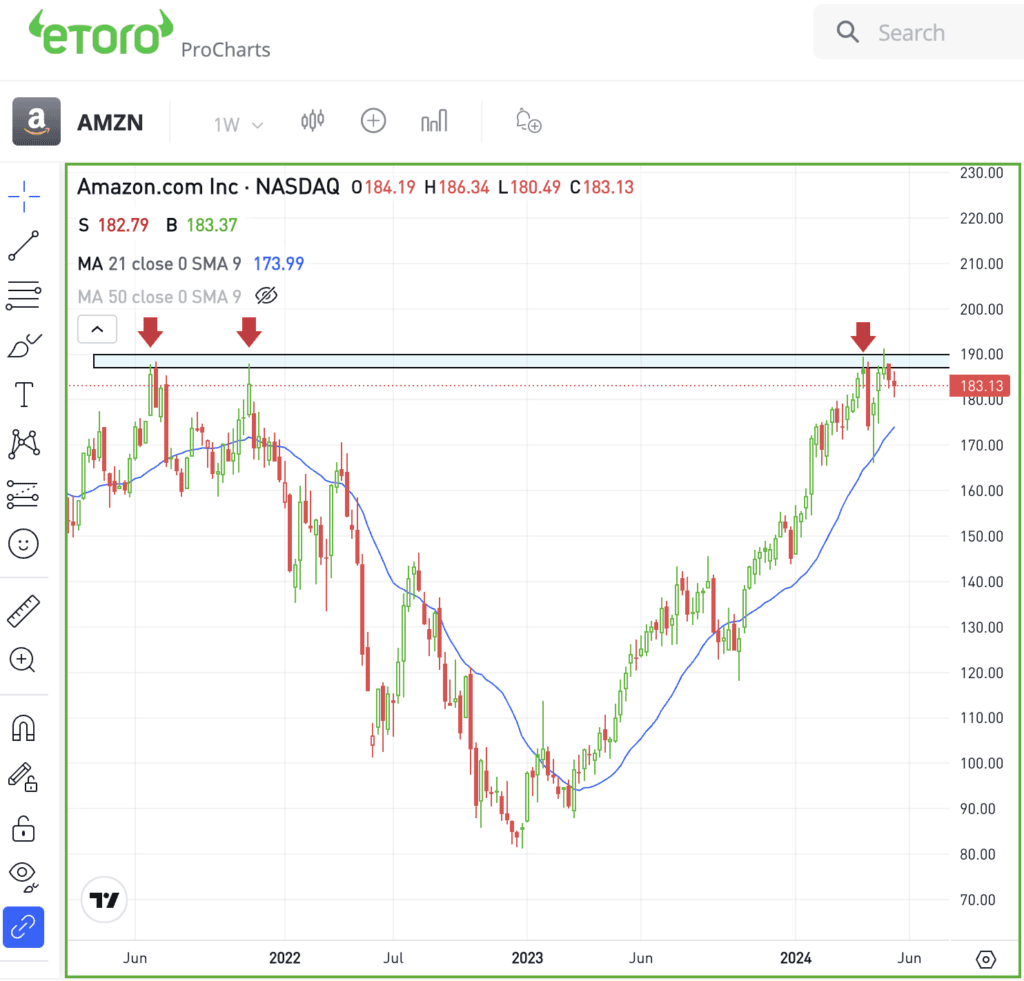

- Amazon has a clear breakout level to watch.

- Target dives on earnings disappointment.

What’s happening?

The Nasdaq 100 ended slightly lower on the day, but not until after it hit another record high. But that wasn’t the story of the day — that belonged to Nvidia.

That’s as the firm reported earnings after the close, delivering a top- and bottom-line beat. Guidance came in ahead of expectations, while the firm announced a 10-for-1 stock split.

There were a couple of other interesting tidbits, but overall, Nvidia did everything right. The quarter was robust, guidance was strong, and management proposed a stock split.

So the question is, will the stock hold its gains?

Shares are rallying in after-hours trading, gaining about 7% to just over $1,000. The news was great, but it’s how the stock reacts to the news that matters. If the stock gaps up and holds above $1,000, that’s good for bulls. However, if it fades and gives up a bulk of its gains, Nvidia may need more time to consolidate — even after a great quarter.

Want to receive these insights straight to your inbox?

The setup — AMZN

I can’t help but notice this giant resistance level in Amazon. That’s as the stock has been butting up against the $190 level now for several years, dating back to 2021.

Shares traded up to this level in mid-April and faded lower, before rebounding on earnings — the stock actually hit a new all-time high — and was again rejected from this level.

Amazon may be a name for investors to put on their watchlist. While a breakout may not be imminent, it’s one I want to keep an eye on.

If it can clear and hold this resistance level, a breakout could be in the cards. However, if the stock pulls back significantly from here, let’s see if it can hold the key $165 level, which has been support since February.

Options

Investors who believe shares will break out — or wait for the potential breakout to happen first — can participate with calls or call spreads. If speculating on the breakout rather than waiting for it, make sure to use enough time until expiration.

For investors who would rather speculate on resistance holding firm, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

TGT — Target shares fell 8% after missing earnings estimates for the first time since November 2022, with earnings of $2.03 a share missing estimates of $2.06 a share. Revenue slipped 3.1% year over year and was in-line with expectations. For the full year, management expects adjusted earnings of $8.60 to $9.60 a share vs. expectations of $9.42 a share.

SCHW — Shares of Charles Schwab dipped on Wednesday amid comments from its Investor Day. That’s as CFO Peter Crawford said the company’s Q2 adjusted earnings are unlikely to be higher than Q1.

SPX500 — The S&P 500 was trading about flat on Wednesday when the Fed Minutes were released at 2:00 pm ET. The release triggered a dip in the index, which was down 0.65% at one point on the day before bouncing into the close. The rebound helped to erase some of the losses, but the index still closed lower on the day.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.