The Daily Breakdown looks at the selloff in Nvidia, AMD and other leading chip stocks as this year’s biggest winners take a step back.

Thursday’s TLDR

- Chip stocks slide amid political worries.

- The SMH ETF had its worst day in years.

- UnitedHealth enjoys a breakout to all-time highs.

What’s happening?

Chip stocks were the story of the day, with this group getting crushed on Wednesday.

The VanEck Semiconductor ETF — SMH — fell 7.1% yesterday, its worst trading session since March 18, 2020 and its fifth worst one-day performance in the last five years. The other four sessions came in March 2020.

Nvidia fell 6.6%, while Advanced Micro Devices tumbled 10.2%. ASML — which reported earnings that morning — fell 12.7%, while Taiwan Semiconductor — which reported earnings this morning — sank 8%. Broadcom, Micron, and plenty of others were hit, too.

Simply put, there was nowhere to hide.

ASML reported strong orders, while Taiwan Semi beat estimates and its outlook topped expectations. So why so much pain? The selloff was fueled by political risk.

Reports that the Biden Administration may further tighten restrictions on exports of semiconductor equipment to China sent the group into a tailspin, while former President Trump said that Taiwan — which is the world’s largest producer of chips — should pay for its own defense.

Together, this one-two punch was enough to sink semiconductor stocks — and the Nasdaq 100, which fell nearly 3%.

We’ll see if this group can recover in the days and weeks ahead or if this helped kickstart a larger pullback. While chip stocks have a great fundamental backdrop, they have done really well this year and there is a strong rotation going on right now. That’s as investors move from what’s worked well (like mega cap tech) to what hasn’t worked (like small caps).

Want to receive these insights straight to your inbox?

The setup — UNH

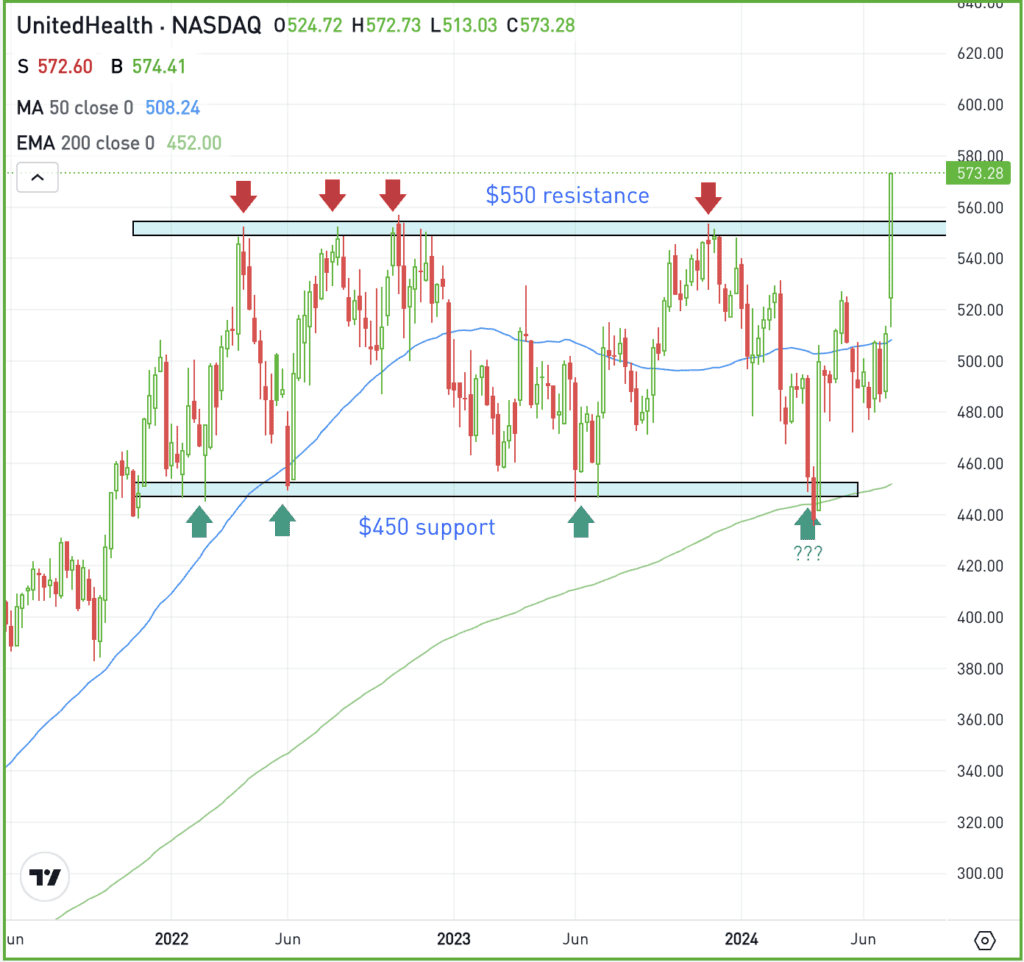

BODY: Look at this beauty of a breakout in UnitedHealth.

Shares are up over 12% this week and have rallied in eight straight sessions. After a favorable response to earnings this week, the stock was able to clear the vital $550 level, which had been resistance for more than two years.

If this chart looks familiar, it’s because we talked about UNH in early April as it pulled back to key support in the $450 area.

Now clearing resistance, bulls want to see if UNH can stay above $550 and establish a new trading range or trend above this mark. For that reason, buyers may feel comfortable stepping in on the pullbacks so long as UNH stays above $550.

Below $550 and UnitedHealth shares risk falling back into the previous $450 to $550 range it was stuck in for years.

Options

If UNH remains in an uptrend, bulls will want to see prior resistance turn to current support.

For options traders, calls or bull call spreads could be one way to speculate on support holding on a pullback. In this scenario, buyers of calls or call spreads limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

JNJ — Johnson & Johnson reported strong Q2 results, with earnings of $2.82 a share beating estimates of $2.70 a share, while revenue of $22.4 billion grew 4.3% year over year and narrowly beat expectations of $22.34 billion. The beats were driven by its pharmaceutical division, sending many pharma stocks higher. However, its MedTech division did not meet expectations.

FIVE — Five Below shares slumped after announcing a leadership transition and downbeat Q2 outlook. Kenneth Bull will succeed Joel Anderson and become interim CEO, while Thomas Vellios will serve as Executive Chairman. Management expects Q2 sales in the range of $820 million to $826 million, below consensus expectations of $839.8 million.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.