The Daily Breakdown looks at Netflix hitting 52-week highs, the S&P 500 at all-time highs and Tesla ahead of its earnings report.

Wednesday’s TLDR

- VIX is back below 13.

- Netflix set for 52-week highs after earnings.

- Tesla’s Q4 results are due up tonight.

What’s happening?

The S&P 500 is riding a four-day win streak, and if Netflix has enough sway, it could help the index notch its fifth straight daily gain.

While the S&P 500 advanced yesterday, it wasn’t able to notch a new record high. That’s not a problem though, as the VIX continues to sink. It’s now down in four straight sessions, and is back below 13.

While a sub-13 VIX has marked the lower end of the range over the last few months, a continued lack of volatility may help to grease the wheels for a further stock market rally.

Earnings are a major focus at this point, but at least they’re off to a good start.

Bank stocks have traded well after reporting earlier this month, while Netflix shares are jumping after strong results last night. The stock is up almost 10% this morning and should notch a fresh 52-week high today.

Will that bode well for other FAANG stocks? The hope is that it will.

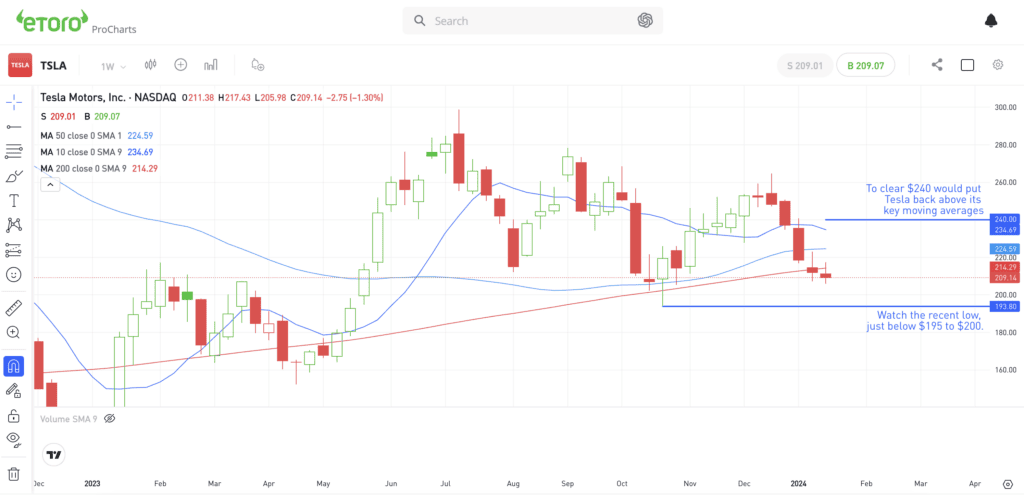

The setup — TSLA

Netflix and Tesla are the main focus this week when it comes to earnings. With Netflix’s stock rallying after earnings, bulls are hoping Tesla can replicate the reaction.

Unfortunately, the price action in Tesla hasn’t been all that good lately.

Of the Magnificent Seven stocks, Tesla is the only one that’s down over the last three months and year to date. In fact, shares are down more than 15% so far in 2024.

Further, while four of the components — Meta, Nvidia, Microsoft and Apple — have taken out their prior bull market highs, Tesla remains almost 50% below its former record high.

It’s performed well at times — for instance, up 45% over the last 12 months — but many investors are disappointed with the stock’s inability to rebound further.

So what should bulls be looking for?

I want to see Tesla regain the $225 to $230 area as a starting point, and eventually, clear the $240 level. If it can regain $240, Tesla will have reclaimed all of its daily and weekly moving averages and help spark some much-needed bullish momentum.

On the flip side, bulls have to use some caution, too.

Shares are already making new year-to-date lows. If more weakness follows the company’s earnings report, keep a close eye on the $195 to $200 zone. This area was support ahead of the stock’s big fourth-quarter rally.

To lose this level would not bode well for momentum.

Want to receive these insights straight to your inbox?

What Wall Street is watching

NFLX: Netflix added 13.1 million subscribers last quarter, its largest quarterly growth result since the early phase of the pandemic. This figure easily surpassed Wall Street’s 8.91 million estimate, and also helped power a revenue beat. Additionally, Netflix ventured into live events, securing exclusive rights to WWE’s “Raw” and other content.

MMM: 3M’s stock plunged after lower-than-expected guidance. The company forecasts full-year adjusted earnings per share between $9.35 and $9.75, which is below analysts’ expectations of $9.81 per share.

EBAY: Shares of eBay are rallying on Wednesday morning after the firm announced a round of job reductions. The company plans to reduce its workforce by 9%, or about 1,000 full-time jobs, as CEO Jamie Iannone argued that “headcount and expenses have outpaced the growth of our business.”

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.