After Apple and the Nasdaq suffered their worst trading in months, The Daily Breakdown takes a look at where markets stand.

Wednesday’s TLDR

- Nasdaq has its worst day in months.

- Bitcoin stumbles after strong start to 2024.

- Cloudflare nears potential support.

What’s happening?

Yesterday, we talked about a strong trend colliding with a market that could clearly use a rest. But I wasn’t expecting the Nasdaq to suffer its worst day since October.

The index fell 1.7%, by far the worst of the major averages. The S&P 500 and Russell 2000 lost about 0.6% on the first trading day of 2024, while the Dow snuck past the carnage with a 25-point gain.

Yesterday was a wake-up call for active investors who were being lulled to sleep by the market’s nine-week win streak. Many beaten-down names came to life yesterday, while last year’s high-flyers suffered from some profit taking.

The futures market is indicating another lower open on Wednesday.

This dip may last a day or two, or it might last a week or two — we don’t really know.

This is where it pays to have some cash on the sideline. Investors can be patient and wait for stocks to find support, then accumulate a position in some of their favorite names at more favorable levels.

The setup — Cloudflare

Despite boasting a market cap of more than $26 billion, we don’t talk about Cloudflare all that often. However, NET stock is worth a closer look.

Shares limped into 2023. However, it found its stride last year, climbing more than 84%.

While it ended on a strong note — rallying more than 50% from its October low — Cloudflare stock has declined in four straight sessions. On a weekly basis, it’s trying to avoid its third straight weekly loss.

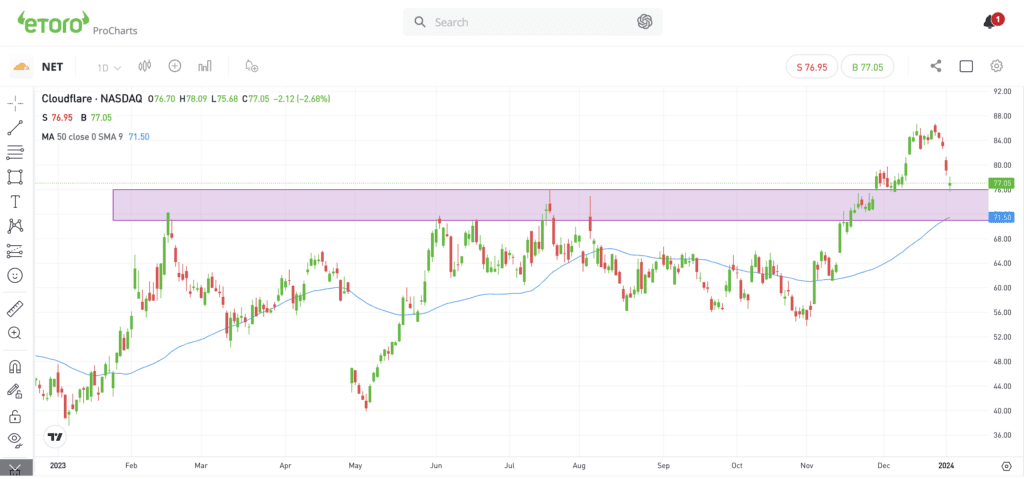

As it falls, keep an eye on the low $70s.

Until a breakout last quarter, the $71 to $76 zone was stiff resistance for most of 2023. In this area, we also find the rising 50-day moving average, as well as the 10-week and 200-week moving averages.

Admittedly, it’s a wide range to keep an eye on.

But if prior resistance can act as current support, it’s possible Cloudflare could enjoy a strong rebound. If support doesn’t materialize, more downside is possible.

What Wall Street is watching

Bitcoin: At one point, Bitcoin was up 8.7% to start 2024. Now it’s flat, as the leading cryptocurrency takes a tough hit today. Coinbase, Marathon Digital, MicroStrategy, and other crypto-related stocks are feeling the pressure in pre-market trading.

Tesla: Tesla reports 485,000 deliveries for Q4, reaching a total of 1.8 million for 2023. This marks a 38% increase in deliveries and a 35% rise in production compared to 2022. However, BYD outpaced Tesla last quarter, selling over 526,000 EVs.

Li Auto: Li Auto’s shares fell despite delivering 50,353 vehicles in December, representing month-over-month growth of 22.7% and a year-over-year increase of 137.1%. The decline occurs amidst overall positive performance indicators.

Apple: Apple shares dropped after Barclays downgraded the stock, citing concerns over the iPhone 15 business. Apple’s 3.6% decline matched its worst decline since early September. Clearly, this was not the start to 2024 that investors were looking for, and it was a big reason why the Nasdaq stumbled yesterday.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.

Content, research, tools, and stock symbols displayed are for educational purposes only and do not imply a recommendation or solicitation to engage in any specific investment strategy. All investments involve risk, losses may exceed the amount of principal invested, and past performance does not guarantee future results.