Demand for new mortgage and home-loan refinancing is jumping now that the Fed has lowered rates. The Daily Breakdown digs deeper.

Wednesday’s TLDR

- Lower rates increase demand for mortgages, refinancing

- New home sales data will be released today

- Chinese stocks soar on new stimulus measures

What’s happening?

New home sales data will be released later this morning at 10 a.m. ET and while it’s probably a little too soon to see how the Fed’s latest 50 basis point rate cut is impacting housing demand, it’s having a noticeable impact on mortgage demand.

According to the Mortgage Bankers Association, in the week ended Sept. 20th, the group’s refinancing index jumped 20.3% to its highest level since April 2022. Further, applications to refinance or purchase a home rose 11% week over week, hitting its highest level since July 2022.

Lastly, the 30-year mortgage rate dropped slightly to 6.13% — its eighth straight weekly decline and the longest stretch of declines since 2018-2019.

The Fed last raised rates in July 2023 and didn’t lower rates until last week. As rates come down — and they are expected to keep coming down — the demand for refinancing and for fresh mortgage applications continues to grow.

Granted, there’s likely some pent-up demand in this regard, but it’s something investors are looking at optimistically. That’s as homebuilding ETFs — like the XHB and ITB — recently hit 52-week highs, while home improvement stores like Home Depot and Lowe’s recently hit new one-year highs as well.

Want to receive these insights straight to your inbox?

The setup — JPM

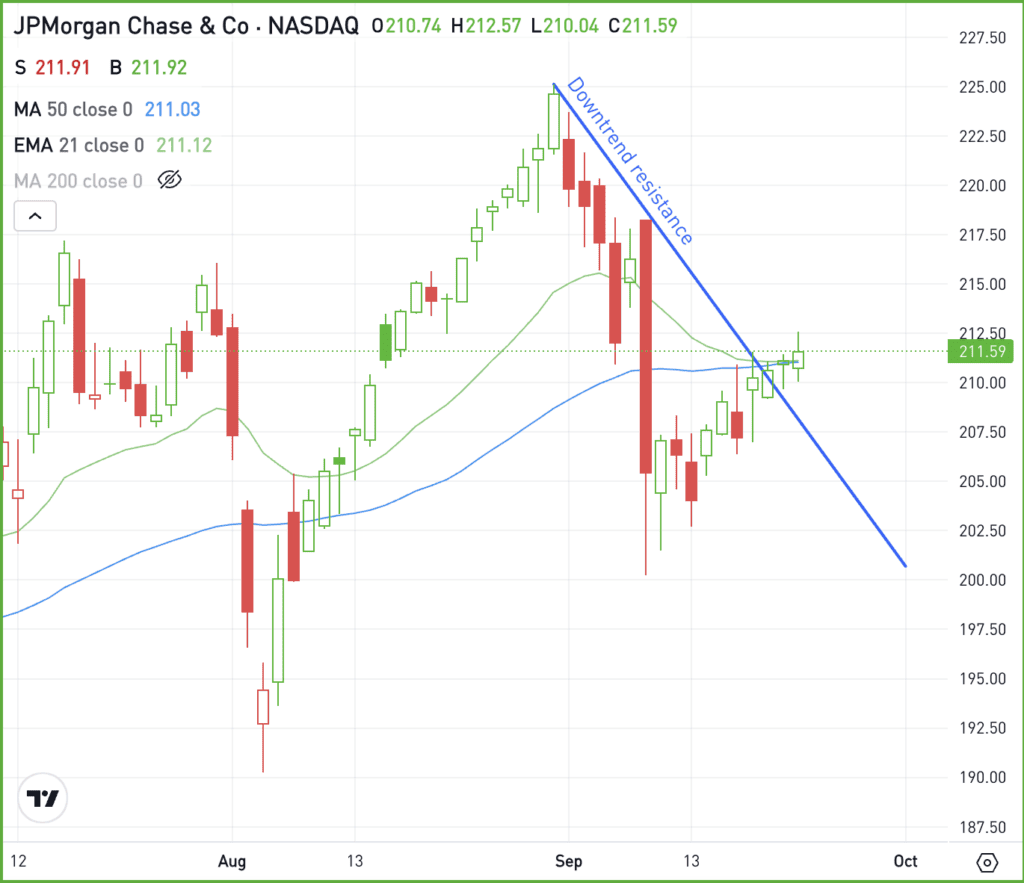

Financials have been one of the best-performing sectors in the S&P 500 so far this year, up more than 20%. Helping lead the charge has been JPMorgan.

Often considered a “best in breed” bank, JPM has been a stalwart in the financial space. That’s one reason its market cap has swelled to $600 billion.

Now, it could head even higher if shares can get above the $212 level.

JPM has been struggling with the $212 level in part because both the 21-day and 50-day moving averages come into play near this spot. If shares are able to clear this level, a larger rally might ensue. However, if shares come under pressure, sellers could gain momentum.

When it comes to fundamentals, both revenue and operating profit are forecast to climb more than 9% in 2024, while the stock trades are just under 12 times this year’s earnings estimates.

Options

Investors who believe shares will break out — or those who are waiting for the potential breakout to happen first — can participate with calls or call spreads. If speculating on the breakout rather than waiting for it to happen first, make sure to use enough time until expiration.

For investors who would rather speculate on resistance holding, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

MU – Micron will report earnings after the close today and is being closely followed by AI and chip investors. A strong outlook from management could bode well for the group, which has been struggling as the SMH ETF hasn’t hit a new high since July 11. Consensus expectations call for Micron to earn $1.11 a share on revenue of $7.64 billion (up 90.7% year over year). For next quarter, analysts expect earnings of $1.52 a share on revenue of $8.27 billion.

BABA – Alibaba stock surged higher on Tuesday, up almost 8% following new stimulus measures from the Chinese government. The Chinese central bank cut interest rates and lowered the reserve requirements for banks in hopes of driving more economic activity. Other stocks like JD.com and PDD Holdings also rallied on the day, while China-focused ETFs like KWEB and FXI also gained — with the latter hitting one-year highs.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.