The Daily Breakdown looks at gold and Bitcoin as they make new highs, while Microsoft dips into potential support.

Wednesday’s TLDR

- Stocks get socked on not-so-super Tuesday.

- Microsoft pulls back to potential support.

- Gold and Bitcoin hit new highs as demand heats up.

What’s happening?

It was Super Tuesday at the polls, but not a super Tuesday for US stocks.

That’s as the S&P 500 fell 1%, the Nasdaq 100 fell 1.8%, and US equities finally felt a little heat.

The S&P 500 is now down two days in a row, a dip that has become somewhat normal this year. In fact, it’s the fifth two-day dip since mid-January, with the four other pullbacks averaging a 1% to 2% decline.

Right now, we’re right in the middle of that range, with the index down 1.2% on a closing basis (and down 1.8% on a peak-to-trough basis).

We haven’t had a pullback of three or more days in a row since the first few trading sessions of the year. Will that happen today?

For the selling to ease a bit, investors will likely need to see big tech find its footing.

Tesla shares are down more than 10% so far this week, while Apple and Alphabet are down 5.3% and 3.3%, respectively. In fact, with the exception of Nvidia, all of the Magnificent 7 components are lower so far this week.

Want to receive these insights straight to your inbox?

The setup — MSFT

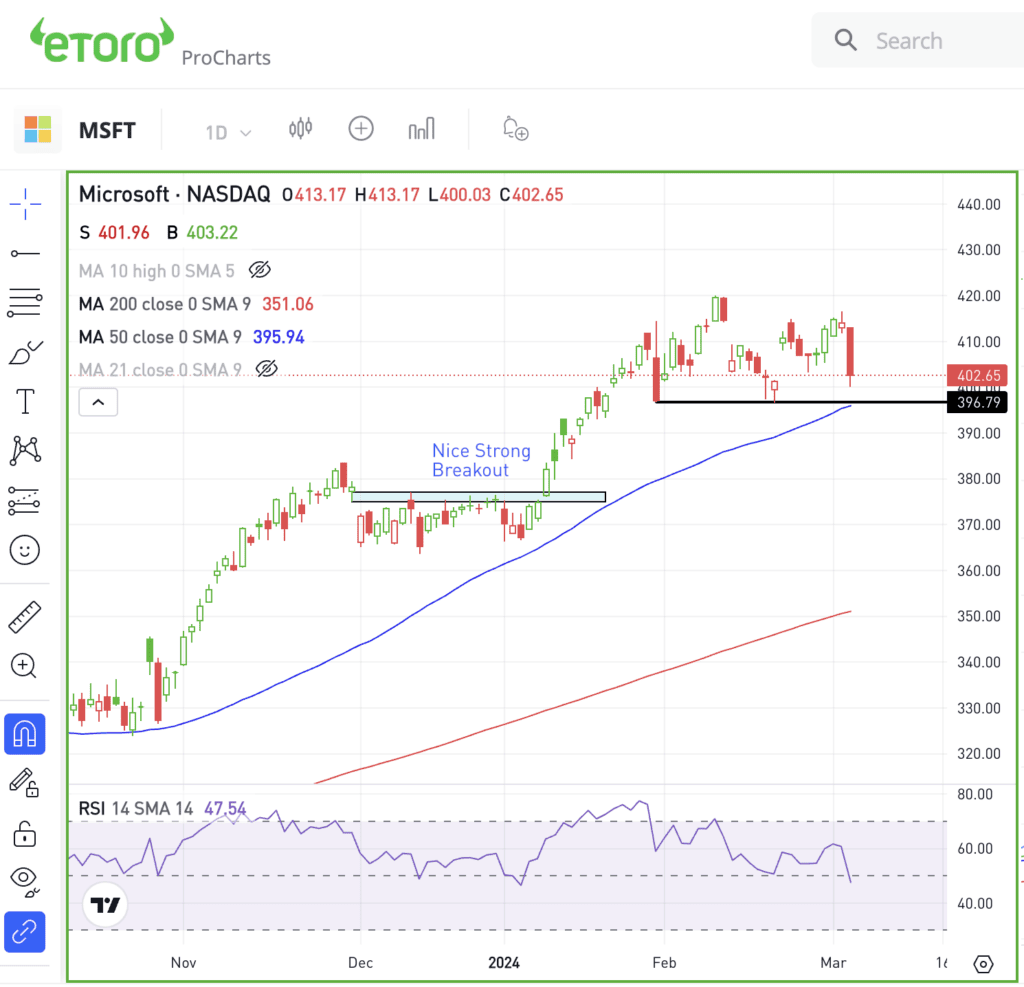

Late last week, I noted how Apple stock was leaning on key support — which failed this week as shares have spiraled lower. Now, investors are wondering if bulls will step in to buy the dip in Microsoft, which is now the largest US company by market cap.

The key difference here is that Microsoft stock has been in demand — up 8% over the last three months vs. a 12% decline in Apple — and was making new all-time highs just a few weeks ago.

The action lately has largely been consolidation, which is healthy after a big rally and leaves momentum leaning on the bullish side.

As you can see on the chart above, support has come into play in the $395 to $400 zone since late January. With the 50-day moving average also near this area, bulls hope it’s enough to buoy Microsoft again and trigger a bounce.

If Microsoft breaks below this support area and cannot bounce back, more selling pressure could ensue. Technically, a decline into the $380s is possible, with the stock’s prior all-time high from November sitting at $384.30.

For options traders, calls or bull call spreads could be one way to speculate on a potential bounce. In this scenario, buyers of calls or call spreads limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

What Wall Street is watching

TGT — Target shares soared 12% after the firm beat Q4 earnings expectations. That’s despite a drop in same-store sales and a conservative sales outlook. However, investors cheered the retailer’s higher profits and improved margins over the past year.

CRWD — CrowdStrike surged 23% in after-hours trading following an impressive Q4 report. Earnings of 95 cents a share beat estimates of 82 cents a share, driven by revenue of $845 million, which topped estimates of $839 million and grew 33% year over year.

BTC — Bitcoin briefly surged to new all-time highs and hit $69,210. The rally has been propelled by excitement surrounding Bitcoin ETFs and the impending halving event in April. However, after hitting its high, Bitcoin pulled back notably — briefly dropping below $60,000 — before finding its footing. The previous record was $68,982.20 from Nov. 2021.

GLD — Wall Street analysts anticipate further gains for gold as it reaches record highs, as the April futures contracts closed above $2,100 per ounce for the first time. Citi analysts view gold as a developed market “recession hedge,” while the GLD hit a new all-time high at $198.14.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.