The Daily Breakdown looks at the action after the February CPI report, as well as the technical setup in Microsoft.

Wednesday’s TLDR

- Stocks march higher despite hot inflation.

- Microsoft stock bounces from support.

- Ethereum “Dencun” upgrade is today.

What’s happening?

Yesterday’s CPI print came in a tad hot, with headline inflation topping economists’ expectations. And yet, the S&P 500 popped 1.1%, the Nasdaq 100 ripped 1.5%, and US stocks continued to chug higher.

Remember, the market craves certainty. It likes to know what’s going to happen. Knowing the path forward allows for a calmness in the market. However, when uncertainty increases and markets don’t know what’s around the corner, that’s when we see volatility pick up and larger swings take place.

We see this sort of thing in the crypto market, too.

When regulators were weighing the Bitcoin ETFs, we saw Bitcoin rally into that event on the idea that these ETFs would be approved. Now Bitcoin is rallying again ahead of its halving event in April.

So what helped drive stocks higher yesterday?

While it’s not actually a certainty that the Fed will cut rates in June, yesterday’s slightly-higher-than-expected inflation report wasn’t enough to significantly alter the outlook on rate cuts happening in a few months.

We’ll find out more next Wednesday at the Fed’s FOMC meeting. But for now, investors are growing more and more confident with a June rate cut, which helped give stocks a lift yesterday — even as bond yields and the US dollar index both rallied too, something that’s often considered a headwind for equities.

This week remains busy, with the retail sales report due out tomorrow morning at 8:30 a.m. ET, and a big options expiration on Friday. So stay on your toes.

Want to receive these insights straight to your inbox?

The setup — MSFT

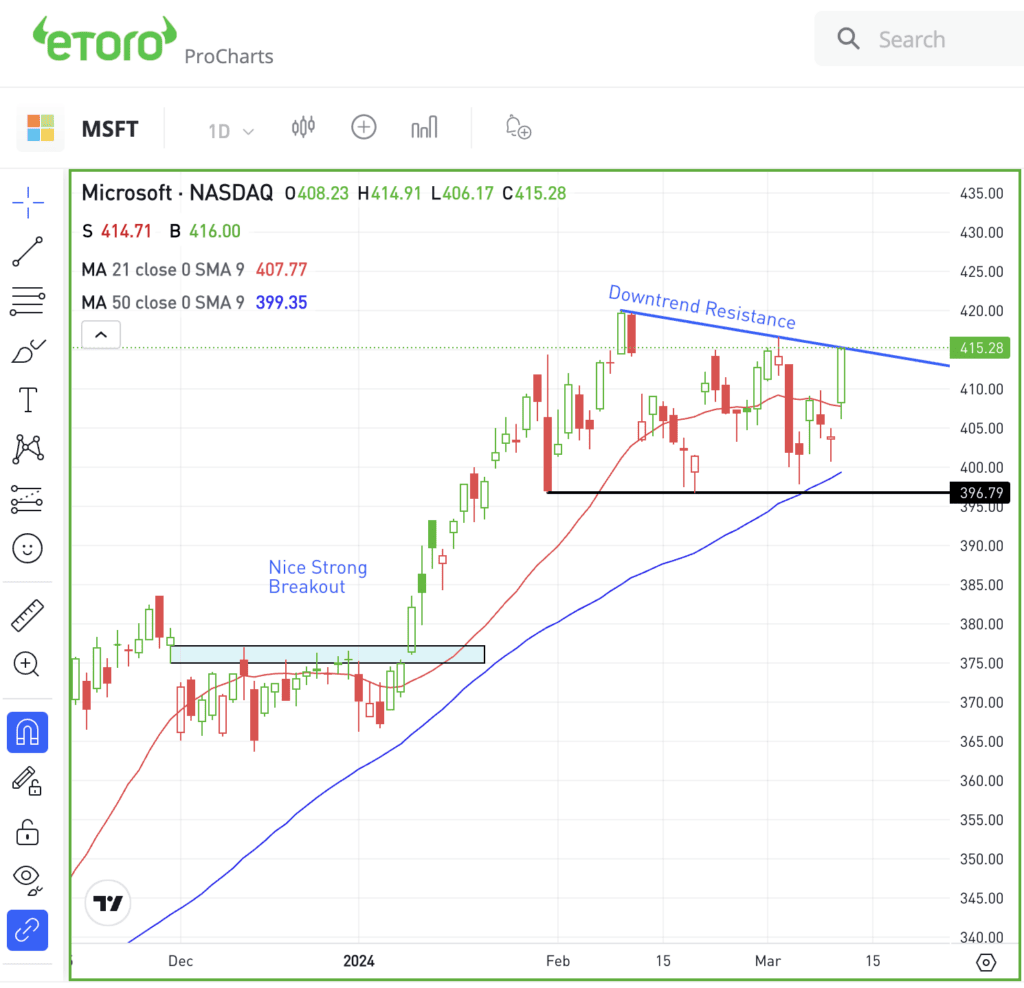

In early March, I looked at Microsoft as the stock pulled back into potential support. That support area held and the stock enjoyed a nice bounce.

Now, Microsoft is trying to break out over downtrend resistance.

Ideally, bulls want to see the stock clear downtrend resistance (the blue line on the chart), then take out the current March high at $417.35. If that happens, the all-time high near $421 could be in play next.

However, if resistance holds, Microsoft could continue to consolidate.

For options traders, calls or bull call spreads could be one way to speculate on a potential breakout. In this scenario, buyers of calls or call spreads limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect downside could speculate with puts or put spreads.

If you want to try your hand at trading options but without the risk, consider eToro’s options trading contest* — which has $4,000 in prizes up for grabs.

*Terms and conditions apply. You must be approved for an options account in order to participate.

What Wall Street is watching

LUV — Southwest Airlines tumbled nearly 15% as the company re-evaluates its 2024 forecasts due to Boeing delivery delays. Q1 leisure bookings underperformed expectations, with unit revenue projections cut from a 4.5% increase to a new forecast calling for growth of 0% to 2%.

BA — Boeing shares declined 4% following a report that the company failed 33 of 89 audits on the 737 Max, with 97 instances of alleged noncompliance discovered after a door panel incident on an Alaska Airlines flight.

ETH — The Ethereum network’s “Dencun” upgrade is set for ~9:55AM EST. Trading and access to Ethereum should remain unaffected, barring network instability. If instability occurs, Ethereum trading will pause until stability is resumed. Normal service resumes post-upgrade stability.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.