The Daily Breakdown takes a look at the stock market ahead of the monthly inflation report and as Microsoft stock breaks out.

Thursday’s TLDR

- The CPI report is due up today.

- Microsoft is breaking out, with all-time highs in sight.

- SEC approves 11 spot Bitcoin ETFs.

What’s happening?

Everyone seems focused on Bitcoin’s big news, now that the SEC has approved 11 spot Bitcoin ETFs for trading. However, the broader market’s focus will likely shift from cryptocurrency to the bigger picture.

That starts with the monthly inflation report due on Thursday morning.

The CPI report has become one of the biggest economic reports of the month, given the Fed’s focus on inflation and the impact it has on interest rates.

Investors are hoping we don’t see an unexpected jump in inflation — one that causes the Fed to rethink a situation where rates need to stay higher for longer. The bond market is currently pricing in the first rate cut in March, and investors want to see those probabilities increase.

Beyond inflation, earnings season kicks off on Friday morning. That’s as JPMorgan, Bank of America, Citigroup, Wells Fargo, and others report their quarterly results.

The setup

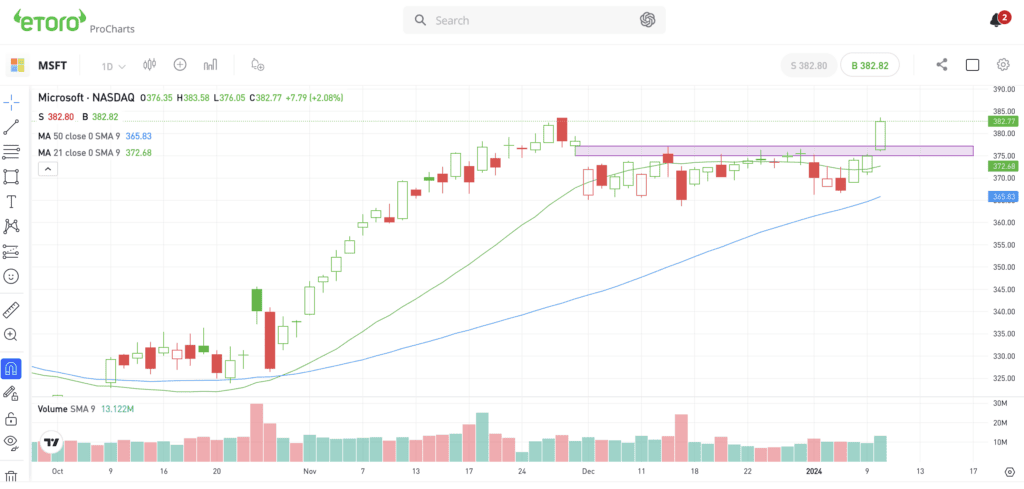

We talked about Microsoft in late December, specifically pointing out the key $377.50 level.

That level had been acting as resistance for multiple weeks, and we were looking for an eventual move over this mark. On Wednesday, that’s exactly what we got.

With the breakout, that put the all-time high in play at $384.30 — a level Microsoft stock came within pennies of yesterday.

Let’s see if Microsoft can hit new highs amid this breakout — a move that could be influenced by the market’s reaction to today’s CPI report.

If Microsoft can rally to new all-time highs and continue higher, it could set the stage for a rally up to the $397 to $400 zone. $400 is a nice round number, while a key Fibonacci extension (the 161.8%) also comes into play near $397.50.

However, if Microsoft struggles to close above its prior all-time high near $384, then it could lose some steam. If that’s the case, bulls will want to see prior resistance near $377.50 — the breakout level — turn into current support.

Want to receive these insights straight to your inbox?

What Wall Street is watching

BTC: The SEC approved the first spot Bitcoin ETFs on Wednesday, granting permission to 11 ETFs. The SEC has permitted a range of industry giants, such as BlackRock, Invesco, and Fidelity, as well as smaller contenders like Valkyrie, to start trading their ETFs.

IRBT: iRobot’s shares plunged on reports that Amazon won’t make concessions to the EU antitrust regulator for its $1.7 billion acquisition of the company. Due to competition concerns, the European Commission is probing the deal, which is expected to conclude by February 14. Meanwhile, Amazon’s shares rose 1.5%.

LEN: Lennar stock climbed following the company’s decision to raise its annual dividend from $1.50 to $2 per share. Additionally, Lennar revealed plans to buy back another $5 billion of its shares. With the rally, the stock is now within a stone’s throw of its all-time high.

OXY: Warren Buffett’s Berkshire Hathaway remains a big buyer of Occidental Petroleum. According to a recent SEC filing, Berkshire has upped its stake in the oil and gas giant to 34%. Berkshire accumulated more than 15 million shares of the company last month.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.