Micron’s strong earnings response is triggering a rally in tech and semiconductor stocks – particularly AMD, which is trying to break out.

Thursday’s TLDR

- Micron earnings power shares higher

- Chip and tech stocks catch a boost too

- AMD stock looks for a key breakout

What’s happening?

Micron is igniting a rally on Wall Street this morning. Shares are rising more than 16% in pre-market trading after the firm beat on revenue and earnings expectations and after management provided guidance for next quarter that was above analysts’ expectations.

According to Bloomberg: “The rosy outlook is the latest sign that Micron is benefiting from a boom in AI spending. Orders for a type of product called high-bandwidth memory have added a lucrative new revenue stream for the company and other chipmakers. The technology helps develop AI systems by providing more rapid access to massive pools of information.”

It’s no wonder then that the Semiconductor ETF — the SMH — is rising more than 3% this morning, or that leading chip stocks like Nvidia and Advanced Micro Devices are moving higher today.

While stocks are on the move higher today, tech is the clear leader, and as we’ve discussed recently, it could be in a position to play catch-up to the overall market.

Keep an eye on how the final GDP revision could impact stocks today, and remember, the Fed’s preferred inflation gauge (the PCE report) will be released tomorrow morning.

Want to receive these insights straight to your inbox?

The setup — AMD

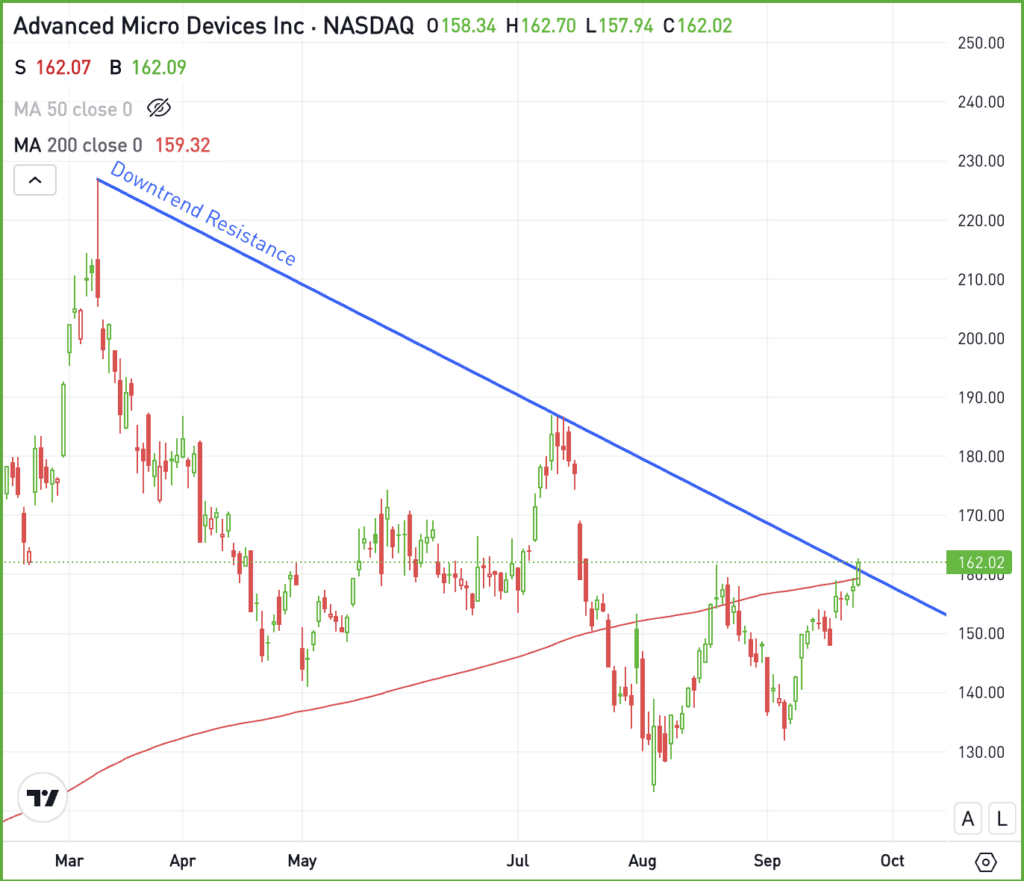

Advanced Micro Devices is trying to break out over key resistance, potentially opening the door to more upside.

The stock has been volatile lately, but in July the company reported strong quarterly results and provided solid guidance. As we look at forward estimates for earnings and revenue, we can see a growth acceleration is expected.

Combined with the company’s AI event on October 10th, the stock could have some positive catalysts on the horizon.

None of these catalysts guarantee a rally for AMD. But with shares moving higher this morning on the back of Micron’s earnings, it could give the stock a much-needed breakout. That’s as it attempts to regain the 200-day moving average and clear downtrend resistance.

Options

For options traders, calls or bull call spreads could be one way to speculate on more upside. In this scenario, options buyers limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect the rally to fizzle out or for shares to fall could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

COST – With shares up more than 37% so far in 2024, Costco is set to report earnings tonight. Analysts expect the retailer to report earnings of $5.08 a share on revenue of $79.91 billion.

SPX500 – The S&P 500 hit another record high on Wednesday, even though the index closed slightly lower on the day. So far, it’s up 1.3% for the month of September and is working on its fifth straight monthly gain. Today’s GDP report and tomorrow’s PCE report are on watch, with the month and quarter coming to an end on Monday.

LUV – Shares of Southwest Airlines are in focus this morning after management unveiled a new $2.5 billion buyback program and raised its Q3 outlook for revenue per available seat miles, which is considered a proxy for pricing power in the industry.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.