The Daily Breakdown explores the post-earnings tumble in Meta, despite the firm beating on earnings and revenue expectations.

Thursday’s TLDR

- Meta beat on earnings, but takes a beating.

- Q1 GDP report is in focus today.

- Mega-cap tech earnings are on watch this evening.

What’s happening?

The next few days will be notable — and not just because the market is digesting the post-earnings bounce in Tesla and the earnings-fueled slump in Meta.

Nor is it because Microsoft, Alphabet, and Intel report after today’s close. In fact, all of those factors are very important — particularly for the Nasdaq 100.

This is still a big earnings week, but there are some key economic reports to focus on.

That starts today with the Q1 GDP report, where economists at Bloomberg expect annualized growth of 2.5%. The GDP report is a key economic report that gives a quarterly look at how the US economy is doing.

Then on Friday we get the monthly PCE report. Remember, that’s the Fed’s preferred inflation gauge.

Investors will be keeping a close eye on both of these measures for clues on when the Fed might cut rates. With a string of higher-than-expected inflation and economic readings to start the year, expectations of rate cuts have fallen.

These reports will be the latest updates that investors take into consideration when it comes to interest rates and when the Fed may cut.

Want to receive these insights straight to your inbox?

The setup — META

Meta beat on earnings — more on that below in the “What Wall Street Is Watching” section below — but the stock took a beating, falling about 15% in after-hours trading.

Coming into earnings, Meta had been a powerful performer, with shares up 39.4% on the year.

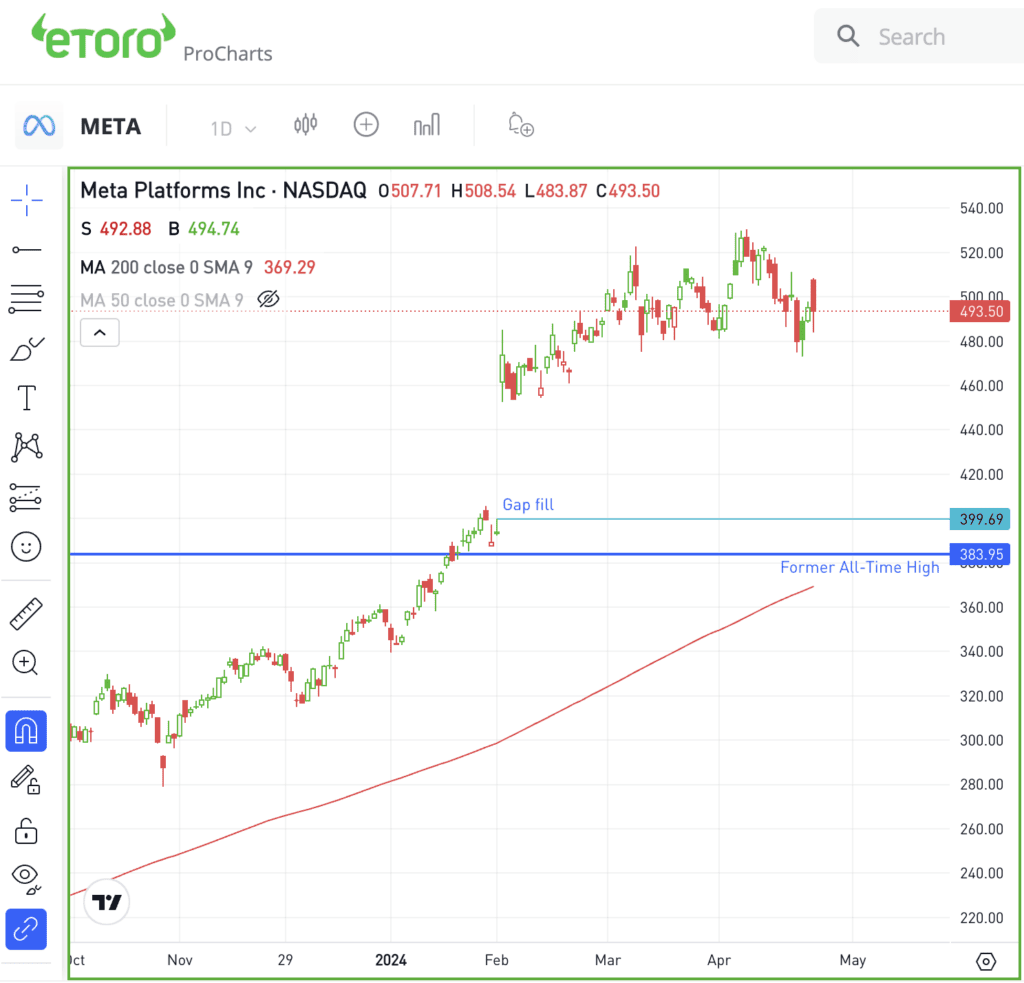

At the lows in after-hours trading, Meta declined down to $400. If that happened in regular-hours trading, that would fill the “gap” from the last earnings report in February, as noted on the chart below.

If the stock moves back down toward $400 and it doesn’t draw in buyers, more selling pressure could ensue in the days or weeks ahead. If that’s the case, it would be interesting to see if Meta were to dip into the $375 to $385 area.

In that zone we find the prior all-time high from September 2021, as well as the 200-day moving average.

If that were to happen, it would mark a decline of roughly 28% from the highs — which is a big decline. Remember, that may not happen. But if it does, it would be worth watching to see if Meta finds support.

What Wall Street is watching

META — Shares of Meta took a hit after reporting earnings on Wednesday. The firm beat on Q1 earnings and revenue expectations, but the midpoint of management’s Q2 guidance came up short of analysts’ expectations and higher-than-expected capital expenditure plans spooked investors.

BA — Boeing shares rallied as much as 5% on Wednesday, but ended the day lower by 2.9% after the firm delivered earnings before the open. A loss of $1.13 a share beat analysts’ estimates by 30 cents per share, while revenue of $16.6 billion slipped 7.5% year over year and missed expectations by $620 million.

F — After the close on Wednesday, Ford reported better-than-expected Q1 results. Earnings of 49 cents per share beat analysts’ expectations of 44 cents a share, while revenue of $42.8 billion grew 3.2% year over year and beat consensus estimates by $1.3 billion. Management’s full-year EBIT outlook remained unchanged, but said its tracking on the higher end of the $10 billion to $12 billion outlook.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.