The Nasdaq 100 is in the midst of a near-10% correction and it’s a big week of earnings, including Microsoft, Meta, Apple and Amazon.

Monday’s TLDR

- Mega-cap tech earnings are in focus this week…

- So is the Fed and the jobs report.

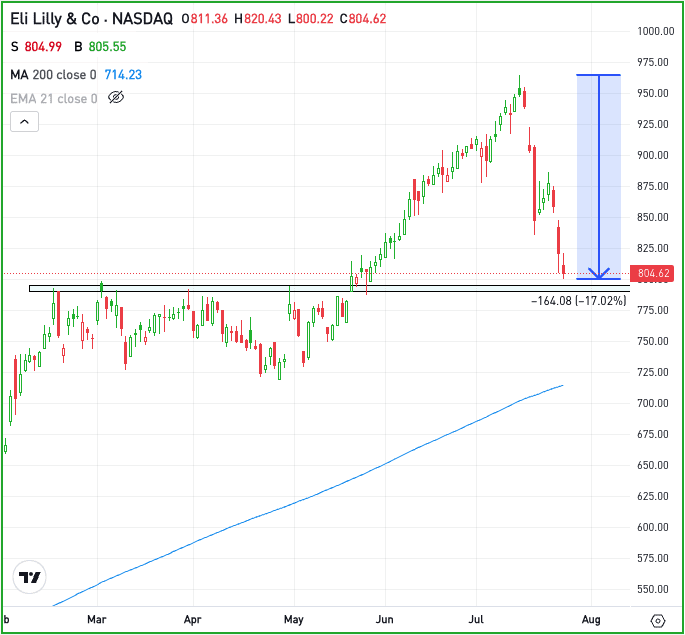

- Eli Lilly approaches a critical breakout area.

Weekly outlook

This week is set to be a doozy. The Nasdaq 100 is now riding a three-week losing streak and from its intraday high to intraday low, it’s fallen 9.5%. Is that enough of a decline to spur a bounce?

This week’s events will be a key factor to that answer.

Just in regards to tech, we’ll get earnings from PayPal, Advanced Micro Devices, and Microsoft on Tuesday. Meta, Arm, and Qualcomm will report on Wednesday, while Amazon, Apple, Intel, and Coinbase will report on Thursday.

In all, 171 companies in the S&P 500 — or roughly one-third of the index — are expected to report earnings this week, according to FactSet.

As if earnings didn’t make the calendar busy enough, the Federal Reserve’s two-day meeting concludes on Wednesday, where the committee will provide an update on interest rates and Chair Powell will give a Q&A press conference.

Then on Friday, we’ll get the monthly jobs report.

So is it a busy week? Oh yeah!

Want to receive these insights straight to your inbox?

The setup — LLY

Eli Lilly has become one of the largest companies in the US, sporting a market cap of roughly $760 billion. That makes it a top 10 weighting in the S&P 500.

However, the stock has been getting hammered, pulling back 17% from its recent rally to all-time highs. The dip has sent shares back to the prior breakout area near $790 to $800.

Bulls want to know if support will come into play in this zone.

Aggressive buyers might consider the pullback enough and begin accumulating near current levels, while more conservative buyers will want to see how LLY does on an actual test of this zone. Conversely, bears might speculate on support failing.

If $790 to $800 holds as support, a solid bounce could ensue. If it fails as support, more selling pressure could continue — potentially putting the 200-day moving average in play.

Options

One downside to LLY is its share price. Because the stock price is so high, the options prices are incredibly high, too. This can make it difficult for investors to approach these companies with options.

In that case, many traders may opt to just trade a few shares of the common stock — and that’s fine. However, one alternative is spreads.

Call spreads and put spreads allow traders to take options trades with a much lower premium than buying the calls outright. In these cases, the maximum risk is the premium paid.

Options aren’t for everyone — especially in these scenarios — but spreads make them more accessible. For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

NVDA — Nvidia shares fell roughly 7% in early Thursday trading, before investors stepped in to buy the dip. While shares still fell more than 4% last week, NVDA was buoyed by a decent bounce. Shares have declined in two consecutive weeks, but despite the recent losses, the stock remains one of the top-performing S&P 500 stocks this year, up over 130%.

NOW — ServiceNow hit an all-time high as AI demand boosted Q2 subscription revenue by 23%. Despite the COO’s resignation over a hiring probe, the company’s outlook remains strong, forecasting further growth in subscription revenue.

BTC — The launch of ETFs for Ethereum helped re-energize the crypto space, and now, Bitcoin is pushing higher too. Knocking on the door of $70,000, Bitcoin prices are at their highest level since June 10, as bulls hope the leader in crypto can continue higher.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.