The Daily Breakdown takes a look at where support may come into play for Microsoft, and why we could see a “sell the news” reaction to CPI.

Thursday’s TLDR

- The monthly inflation report is in focus this morning.

- Delta Air Lines descends after disappointing earnings.

- Costco raises membership prices.

What’s happening?

This morning, investors will get a look at one of two major inflation reports. Typically mid-month, we get the CPI report. At the end of the month, we get the PCE report.

Between the two, the Fed puts a little more stock in the latter (PCE) than the former, but that doesn’t render the CPI irrelevant. In fact, the monthly CPI report has become a major event for both the S&P 500 and Bitcoin.

According to Bloomberg economists, estimates for today’s CPI report call for 0.1% month-over-month growth and 3.1% year-over-year growth.

The recent price action in the stock market may have investors thinking one of two things: That the CPI report will be favorable or that the market isn’t worried about the CPI result.

That’s as the S&P 500 has rallied seven days in a row and has notched six straight record closing highs. Will today add another?

If the CPI print is favorable, bulls can maintain momentum — even if it leads to a short-term dip in the market driven by profit-taking. However, if the print comes in hot (or above estimates) then it’s likely that we’ll at least see a pause in the rally via a pullback.

Want to receive these insights straight to your inbox?

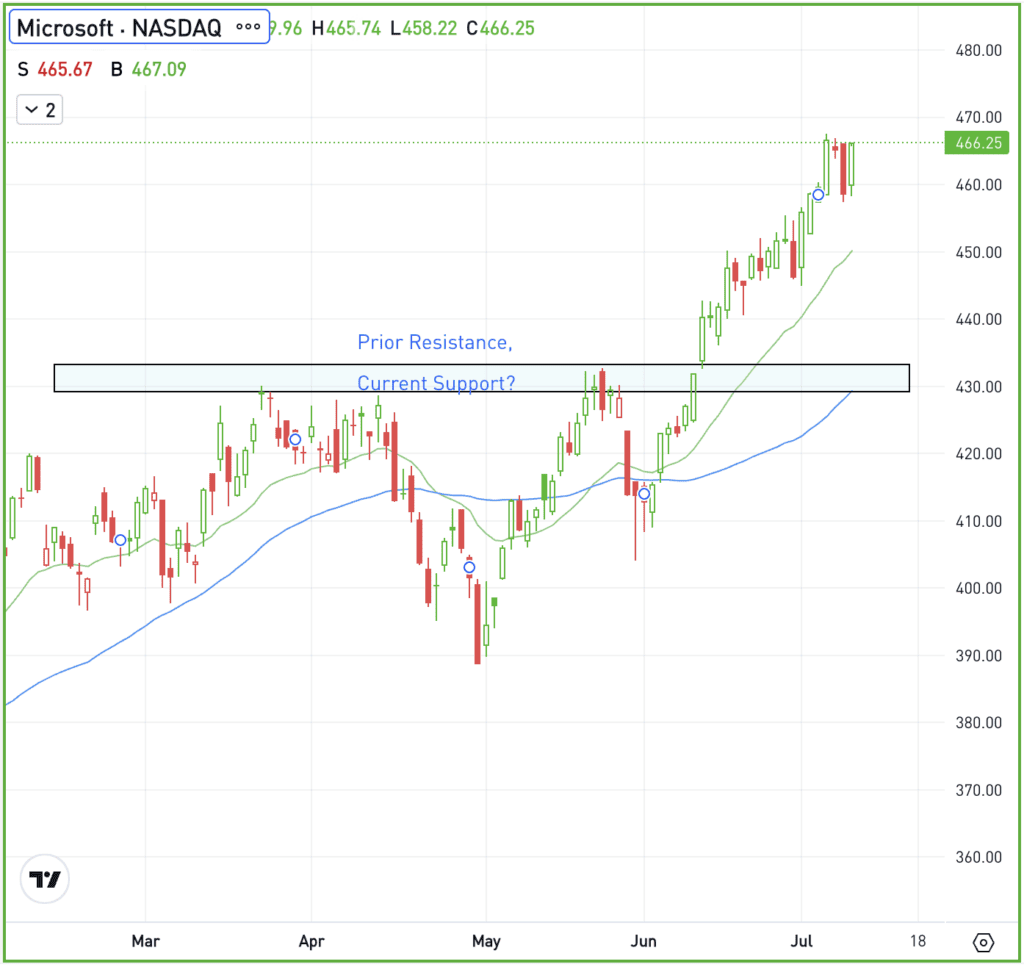

The setup — MSFT

Microsoft may be a stock to throw on your watchlist. Currently the second largest company by market cap (now behind Apple), Microsoft shares have been on fire this year.

The stock is up 24% so far in 2024 and has rallied more than 40% over the past 12 months. For its size, that’s a massive move.

Microsoft stock recently hit record highs and continues to hold up nicely. While it’s not Nvidia, Microsoft is also looked at as an AI play. Should it pull back, it could be a prime candidate for buying the dip — it’s just a question of when.

I’m not sure if MSFT would fall this far, but I have the $430 area outlined on the charts.

That’s around where the stock found prior resistance before breaking out in June. If the stock were to pull back to this area — a 7.5% dip from current levels — it would likely present investors with a reasonable risk/reward setup.

A dip of this magnitude would likely take some time to play out, but it’s an area to watch if we get a correction in Microsoft.

What Wall Street is watching

TSM — Taiwan Semiconductor saw 40% revenue growth in Q2 to NT$673.5 billion ($206.4 billion), driven by AI demand. TSMC supplies advanced chips to Apple and Nvidia, among others, boosting its market cap recently and sending shares to all-time highs.

AMD — Speaking of AI, Advanced Micro Devices has been riding a breakout of its own lately. Shares continue to climb, gaining on Wednesday after announcing that it will acquire European firm Silo AI in an all-cash transaction worth $665 million.

DAL — Shares of Delta Air Lines are tumbling lower in pre-market trading after the firm missed on Q2 revenue and earnings expectations. While management’s Q3 revenue outlook was above analysts’ expectations, their earnings outlook fell short.

COST — Costco Wholesale is in focus this morning as the retailer announced an increase in its membership prices for the first time since 2017. Basic memberships will go from $60 a year up to $65, while premium membership will go from $120 a year up to $130.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.