Nvidia is gearing up to report earnings, this time as the world’s largest public company. The Daily Breakdown previews the results.

Wednesday’s TLDR

- Nvidia reports after the close

- So does SNOW and PANW

- BTC notches new record high

What’s happening?

After today’s close, Nvidia will report earnings. With its $3.65 trillion market cap, Nvidia weighs in as the world’s largest public company.

The stock is up almost 200% in 2024 and bulls are hopeful that Nvidia will add to this year’s gains. With shares near all-time highs, Nvidia will need a strong quarter and guidance if bulls want to see more gains.

According to FactSet, analysts expect earnings of 75 cents a share on revenue of $33.15 billion, representing year-over-year growth of 86.1% and 83%, respectively.

As is often the case, guidance will be key.

While investors want to see a strong prior quarter, it’s common for them to put more emphasis on the coming quarter — or year if a company provides an annual outlook. Remember, it’s more about what a company is going to do, not about what it has done.

In that sense, analysts are currently looking for next quarter’s earnings to weigh in at 82 cents a share on revenue of about $37.1 billion. A guide above those numbers doesn’t guarantee a rally, but it does bode well for Nvidia bulls.

It’s worth mentioning that Palo Alto Networks and Snowflake will also be in focus tonight, as they too report earnings after the close.

Want to receive these insights straight to your inbox?

The setup — Nvidia

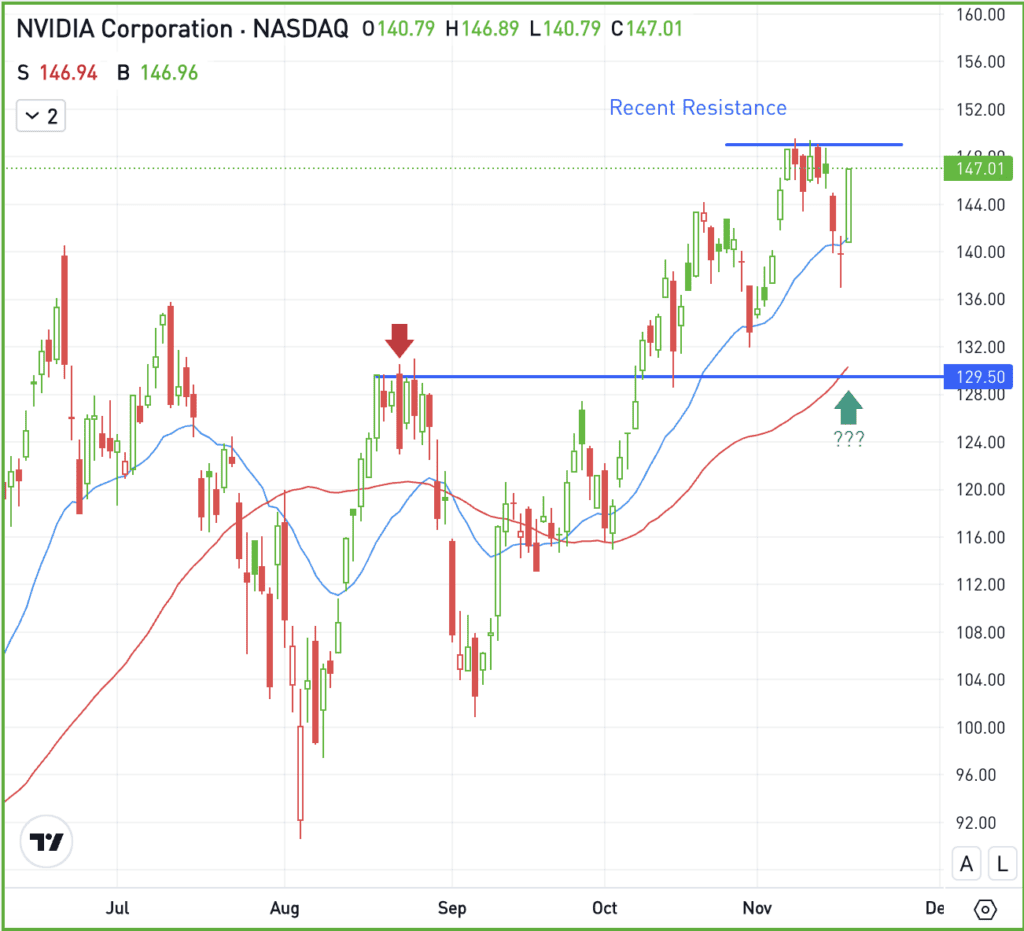

The breakout from early October has played out nicely. Now, earnings will be the key focus in the short term.

For Nvidia’s earnings event, the options market is currently pricing in an “implied move” of about 7% through Friday’s close. However, it doesn’t imply which direction the move will occur. Second, there’s no guarantee we will see a 7% move — NVDA could rise or fall by a small amount or it could be a large amount.

Just because this is what the options market is currently expecting doesn’t mean it will happen. Implied moves are not helpful for all investors, but it’s helpful for those focused on the stock’s trading range and volatility.

For what it’s worth, a 7% decline from Tuesday’s close would send NVDA all the way back down to…the low on Monday.

Recently, resistance has come into play around $150. While only a short distance from current levels, bulls will want to see NVDA clear this level and stay above it should shares rally after earnings.

If NVDA reacts poorly to earnings, it could put the $130 area in play. This was a notable resistance area in August, but was recently support in October. Further, it’s where the 50-day moving average comes into play. If shares pull back in the coming days or weeks, bulls will want to see this area hold.

Options

For options traders, calls or call spreads are one way for investors to speculate on more upside, while puts or put spreads allow them to speculate on further downside or allow bulls to hedge their long positions.

Using options around big events — like earnings — tend to be more expensive. However, one advantage is that the total risk of the trade is tied to the premium paid when buying options or option spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

TGT – A day after Walmart hit all-time highs following solid earnings, Target reported a very disappointing quarter. Shares are tumbling this morning after the retailer missed on both earnings and revenue expectations. Worse yet — and a reminder on the importance of guidance — management trimmed the company’s full-year outlook.

BTC – Bitcoin continues to hold onto its recent gains, with the cryptocurrency notching a new record high on Tuesday and doing so again this morning. The new highs come as Bitcoin pushes through the $94,000 level, the latest milestone on its quest for $100K. Check out the chart.

IBIT – The iShares Bitcoin Trust ETF — IBIT — is the largest Bitcoin ETF by assets, weighing in at more than $40 billion. Alongside Bitcoin, it too hit a record high on Tuesday. Options trading on IBIT began yesterday and it has attracted record-breaking volumes. Check out IBIT for more information.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.