The Daily Breakdown looks into the stats behind the Santa Claus Rally, when it typically happens, and what it means for investors.

Friday’s TLDR

- When the Santa Claus Rally takes place

- And what it means for markets

- Abercrombie consolidates

The Bottom Line + Daily Breakdown

A lot of investors have heard of the Santa Claus Rally — known by many on Wall Street as the “SCR” — but they don’t really know what the specifics are.

Some investors believe all of December to be the SCR, while some think it’s the stretch from Black Friday to year-end.

However, it’s not any of those periods of time.

The official period of the Santa Claus Rally is the last five trading days of December and the first two sessions of January. These seven trading sessions make up the seasonally strong SCR period.

So what do the stats look like?

When it comes to seasonality, no one’s better than The Trader’s Almanac. Prior to last year’s SCR stretch, The Trader’s Almanac notes that the average S&P 500 gain over this seven day trade range is a respectable 1.3% since 1950. Since that time, it’s also been positive about 80% of the time.

Jeff Hirsch, who is the editor in chief at The Trader’s Almanac, had this to say as well:

“It is not a trading strategy; it is an indicator. Failure to have a Santa Claus Rally tends to precede bear markets or times when stocks could be purchased at lower prices later in the year. Down SCRs were followed by flat years in 1994, 2005 and 2015, two nasty bear markets in 2000 and 2008 and a mild bear that ended in February 2016.”

The Bottom Line

The Santa Claus Rally has an impressive win ratio and averages an impressive return for such a short period of time. That said, it doesn’t guarantee that bulls will be rewarded just because the seasonality trends are favorable.

I think that’s important to remember, not just for the SCR, but for seasonality in general.

There is no secret sauce on Wall Street — not that I know of, anyway. Every long-term strategy seeking out various rewards comes with some sort of risk attached to it. It’s just the way the markets work.

There’s a time and place for seasonality, especially when it’s consistent. However, it doesn’t guarantee that a specific outcome is certain. Keep that in mind when considering the SCR — or any other stat for that matter — for your investment approach.

The historical odds may be in your favor, but remember, these are probabilities…not certainties.

Want to receive these insights straight to your inbox?

The setup — ANF

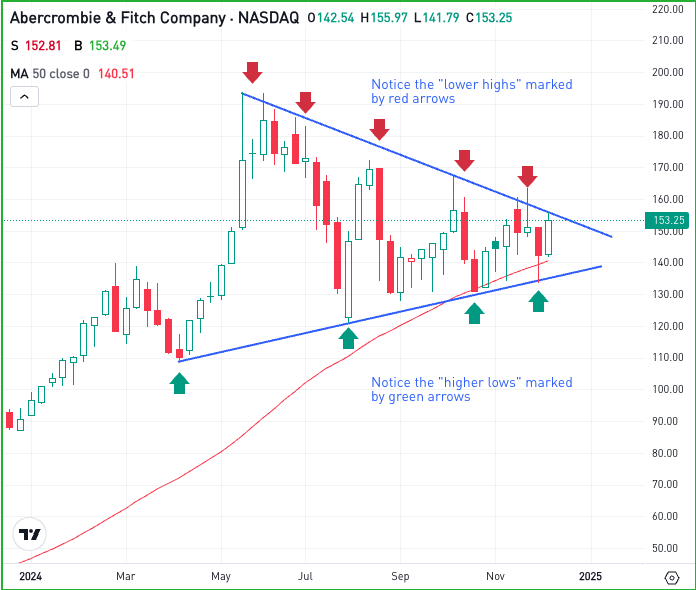

You might remember Abercrombie & Fitch as the stock that rallied over 700% from May 2023 to May 2024. Since then, the stock has been consolidating with a series of “higher lows” and “lower highs.”

This type of digestive price action is considered healthy by traders — provided that the stock can continue in the direction that it was going.

Ideally, bulls want to see ANF clear downtrend resistance, breaking out of the wedge pattern you see above and continue to rally to higher. At the very least though, they want to see support continue to come from the $130 level and the 50-week moving average.

Aggressive traders might buy the stock before the potential breakout and use a stop-loss at or near $130. Conservative buyers might wait for a potential breakout to happen, first.

Fundamentally, earnings exploded higher in 2024, but analysts remain pretty constructive on the stock in 2025 too, with estimates calling for roughly 70% earnings growth. Despite the strong growth, shares trade at just 14.5 times next year’s earnings.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.