The Daily Breakdown looks at the week ahead, including the CPI and retail sales reports. We also look at the pullback in shares of Oracle.

Monday’s TLDR

- After a volatile start, markets have calmed down.

- The CPI and retail sales reports are major focuses this week.

- Meta was the best-performing Magnificent 7 name last week.

Weekly Outlook

Despite last week’s volatile start, markets ended the week on a calmer note.

Bitcoin, which was down about 15% at one point, ended higher last week by 1%. The S&P 500 was down 4.3% at Monday’s low, but ended flat on the week, while the Nasdaq 100 ended higher by 0.4%.

The VIX is back down to 20, but investors are hoping the markets continue to quiet down from here. Perhaps that will be the case today, as Monday lacks any major data points to focus on.

On Tuesday, earnings pick up the pace, as companies like Home Depot and On Holding report earnings, giving investors some clues on the consumer.

On Wednesday morning, the monthly CPI report comes out, giving investors an update on inflation. Cisco Systems and UBS will also report earnings.

Thursday should be an interesting session. That’s as the retail sales report will be released before the market opens, giving investors an update on the consumer — the lifeblood of the US economy.

A number of companies will also report earnings on Thursday, including: Alibaba, Walmart, JD.com, Deere & Co, and Applied Materials, among others.

With any luck, Friday will be another calm finish, just like last week.

Want to receive these insights straight to your inbox?

The setup — ORCL

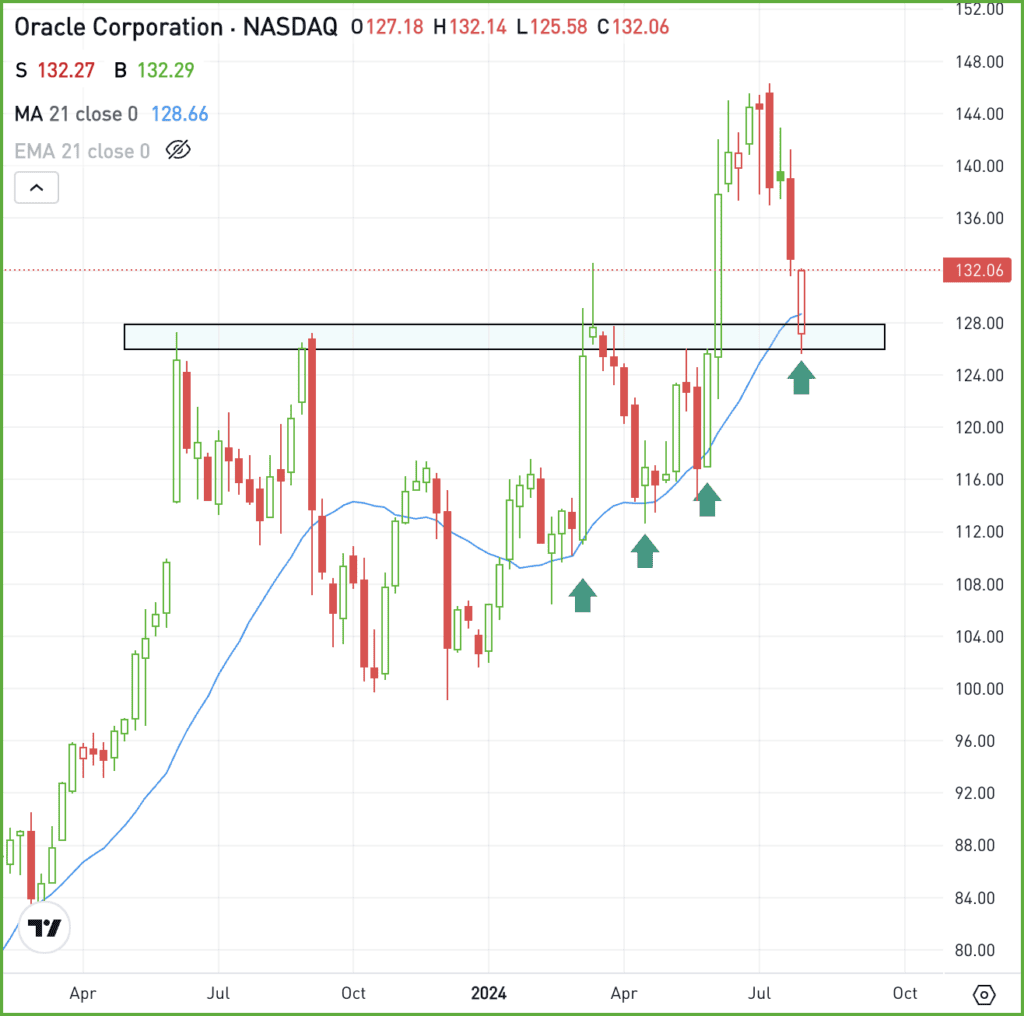

Oracle is one of the old-tech names that has quietly climbed to all-time highs in 2024. However, it has declined in four of the last five weeks, as profit-taking and recent volatility have weighed on the share price.

On the dip, ORCL stock found support near $125. Notably, that mark was resistance for more than a year, until shares broke out in June after the firm reported earnings.

From a valuation perspective, Oracle trades at 21 times forward earnings. However, the firm is expected to generate double-digit earnings for the next several years, alongside revenue estimates calling for 9.4% growth this year and 11.2% next year.

As long as the stock can stay above the $125 mark, bullish momentum may continue. If shares break below $125 though, more selling pressure could ensue.

Options

Buying calls or call spreads may be one way to take advantage of the pullback. For call buyers, it may be advantageous to make sure they have adequate time until the option’s expiration.

For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

TLT — As the S&P 500 Index dropped about 6% in early August, Treasury bonds gained nearly 2%, benefiting investors with a portfolio mix. While bonds later lost some of those gains, they still served as an effective hedge during market volatility.

META — Meta was the best-performing Magnificent 7 holding last week, gaining 6.1%. In fact, it was one of just two Mag 7 components — the other being Netflix — that finished in positive territory last week.

ETH — Like Bitcoin, Ethereum was hit hard last week. However, it has not recovered with the same vigor as its larger peer, falling over 4% last week. On Monday though, ETH is trying to make a comeback, up more than 4% so far on the day.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.