The Daily Breakdown previews the trading week and looks at the gold ETF, GLD, as it looks for a potential breakout in 2024.

Monday’s TLDR

- Gold is running into multi-year resistance.

- Crypto continues to make new highs.

- Super Micro Computer will be added to the S&P 500.

What’s happening?

Stocks ended the week with another gain, with the S&P 500 and Nasdaq now up 16 of the last 18 weeks. The Dow dipped 44 points last week — or 0.1% — but has still risen an impressive 15 of the last 18 weeks.

As impressive as the stock market has been, it’s being overshadowed by the move we’re seeing in crypto.

Bitcoin, Ethereum, Solana, and plenty of others are making new 52-week highs.

In fact, many crypto holdings are making new annual highs to start the week. Will bulls get a chance to buy the dip? Probably at some point. Like the stock market, we can expect a dip — we just don’t know when it will come.

As for this week, we’ll get earnings from plenty of retailers, including Target, Costco, Ross, Foot Locker, and many others. That should give some good insights on how the consumer is doing.

Further, investors will get an update on the labor market with Wednesday’s JOLTs report and Friday’s monthly jobs report.

Want to receive these insights straight to your inbox?

The setup — GLD

There are a lot of ways to invest in gold — there’s physical gold, futures contracts, gold-mining stocks, and ETFs.

For simplicity, we’ll stick with the ETF and focus on GLD.

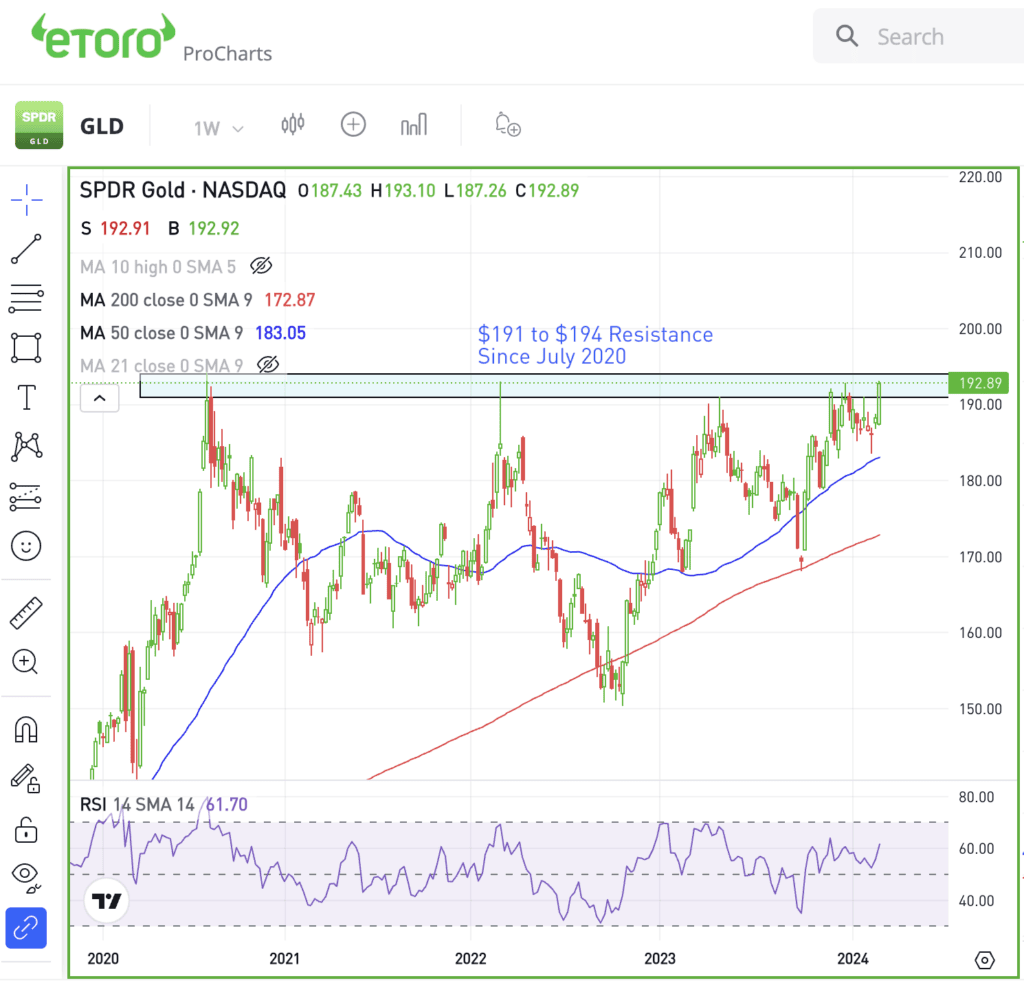

Notice how GLD is trading in the low $190s, a zone that has been resistance for almost four years now dating back to July 2020.

While GLD has done a great job putting in a series of higher lows — a bullish technical development — it’s also failed to break out over the $191 to $194 zone. That may have some investors expecting yet another rejection.

However, a breakout over this zone would have active investors looking for more upside.

Specifically, short-term investors would likely be looking at the $200 to $205 zone, while long-term investors would likely look even higher, potentially into the $220s, should gold find its bullish groove this year.

One thing to keep in mind: Gold prices tend to benefit from a weaker dollar and lower yields — two things we could see from lower rates. When the Fed does cut rates, this could benefit gold too.

What Wall Street is watching

USO: In an effort to prevent a global surplus and bolster oil prices, OPEC+ extended its supply cuts until mid-year. These measures amount to around 2 million barrels a day and are endorsed by key members like Saudi Arabia and Russia.

NVDA: Nvidia’s market cap eclipsed $2 trillion for the first time on Friday. Helping to give it a boost was Dell, which shared a strong outlook on Friday and said it expects more people to buy its servers that use Nvidia’s technology for AI. Nvidia is the third-largest company in the US by market cap.

SMCI: Shares of Super Micro Computer are bursting higher on Monday and are nearing all-time highs in pre-market trading. On Friday evening, it was announced that Super Micro Computer would join the S&P 500, effective March 18.

EWJ: An optimistic start to the day in Asia propelled the Nikkei 225 above the 40,000 mark for the first time ever. Asian equities surged, driven by the Nikkei 225’s new milestone and following another historic close for Wall Street on Friday.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.