The Daily Breakdown looks at the recent rally in Bitcoin and Ethereum, as well as the potential for a rally in Uber stock.

Tuesday’s TLDR

- Bitcoin posts a big rebound from the recent lows.

- Apple hits record highs…again.

- Uber stock consolidates after the breakout.

What’s happening?

Bitcoin and Ethereum have been frustrating the bulls. Both topped out in mid-March and have been consolidating for months now by trading in a chopping, sideways manner.

There’s nothing really wrong with this, though. In fact, many investors will tell you that it’s healthy price action after a big rally (and they’re right). But that doesn’t mean it isn’t frustrating, especially when the assets are volatile.

For instance, it looked like Bitcoin was going to break out and run to new highs in late May…only for it to roll over and fall 25% back into the mid-$50,000 range.

Now Bitcoin has some momentum, up about 9% last week and already up almost 5% this week. Ethereum is in a similar spot, up 10.8% last week and over 5% this week.

The recent rally has given a boost to crypto-related stocks, too. Marathon Digital jumped almost 20% yesterday, while MicroStrategy and Riot Platforms rallied over 15% and 17%, respectively.

Crypto may still need more time to consolidate, and if that’s the case, that’s okay. Consolidation can be frustrating, but remember that it’s healthy so long as support continues to keep these names afloat. So far, that’s been the case.

Want to receive these insights straight to your inbox?

The setup — UBER

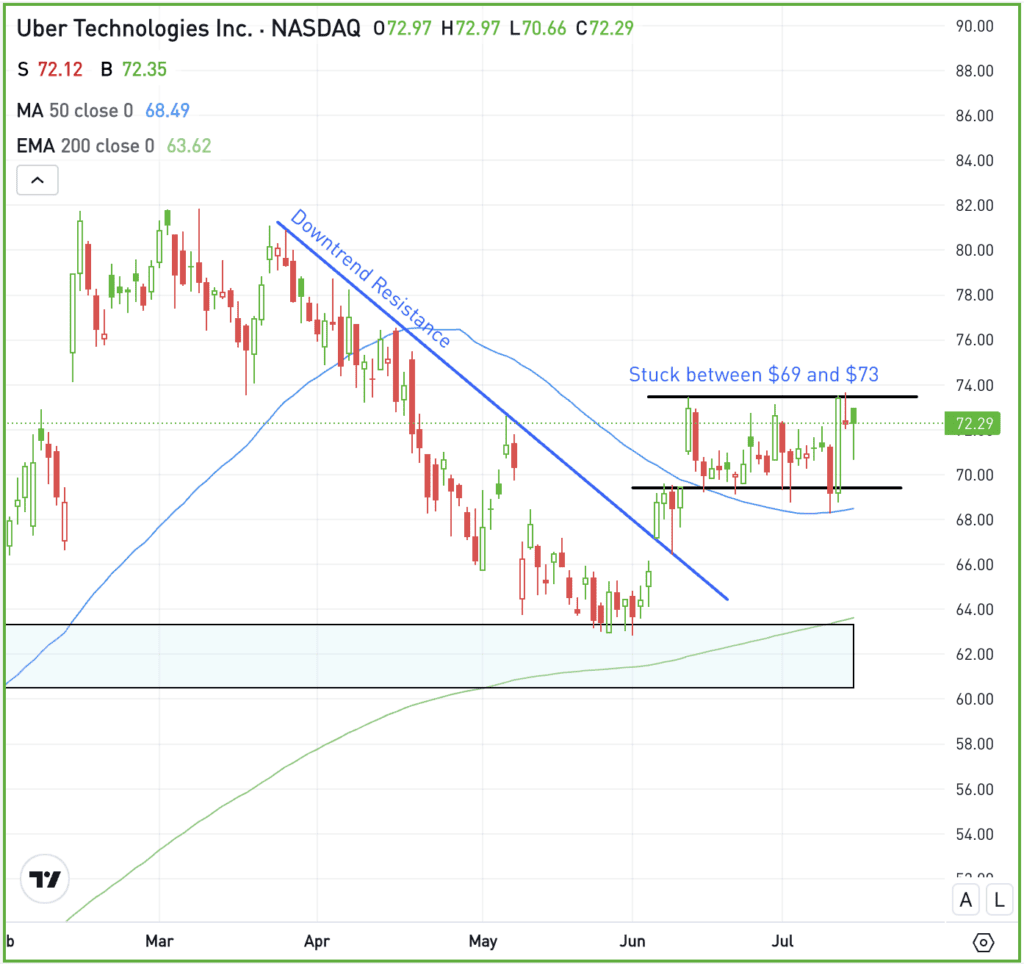

In late May, we noted Uber’s pullback to a key support area in the low-$60s. This level ended up holding and the stock bounced.

However, the action since then has been sluggish, with the stock consolidating between $69 and $73.

But like Bitcoin, bulls shouldn’t fault sideways price action. It generally gives the stock a period of rest before the next move higher — provided it can clear resistance.

If Uber can clear recent resistance, it could open the door for a potential return back to the recent highs near $82. If support fails though, it could put the recent lows back in play in the mid-$60s.

The firm is expected to report earnings on August 6, so anyone wishing to avoid or capture that event should be aware of the date.

Options

This is one area where options can come into play, as the risk is tied to the premium paid when buying options or option spreads.

Bulls can utilize calls or call spreads to speculate on a move higher, while bears can use puts or puts spread to speculate on downside should support break.

For those looking to learn more about options, consider visiting the eToro Academy.

That being said, investors can be neutral on Uber and choose to do nothing with the stock. Remember, you don’t have to be involved with every stock all the time.

What Wall Street is watching

AMZN — Today and tomorrow will feature Amazon Prime Day, marking the 10th year of this popular summer sales event. Last year, Amazon recorded its largest single-day sales performance ever on Prime Day’s opening day, although Prime Day sales historically have little impact on Amazon’s stock price.

AAPL — Apple stock reached another record high Monday, climbing 1.7% after analysts raised their price targets based on AI optimism. Analysts expect new AI-powered iPhones to solidify the phone giant as a leader in generative AI, driving future growth and sales.

M — Macy’s shares plunged after the retailer announced the termination of buyout talks with Arkhouse and Brigade. The company cited “lack of financing certainty and inadequate value” for ending the discussions. Macy’s shares are now down about 16% year to date.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.