The Daily Breakdown looks at stocks after a higher-than-expected inflation report. Meanwhile, a top energy stock hits all-time highs.

Thursday’s TLDR

- The CPI report was higher than expected.

- A top energy stock enjoys a breakout.

- Costco raises its dividend.

What’s happening?

Bulls were hoping for a lower-than-expected inflation report for the month of March. Instead, the CPI print came in hot — topping economists’ expectations as inflation persists.

That sent rate-cut odds for June spiraling lower, as the market starts to price in a “higher for longer” interest rate environment.

It’s not the worst thing in the world, though.

Many would argue — I would argue — that it would be better to have inflation persisting in the 3% range amid a strong labor market and solid economic backdrop.

I say that because the alternatives are much worse. Think of a recession or stagflation — where inflation persists even in the face of slowing economic growth and rising unemployment.

For now, the S&P 500 ETF — the SPY — is holding that key level we talked about yesterday. If it fails, we could see a bit more downside pressure, but at this point, that would be healthy and allow us to look for better opportunities.

Want to receive these insights straight to your inbox?

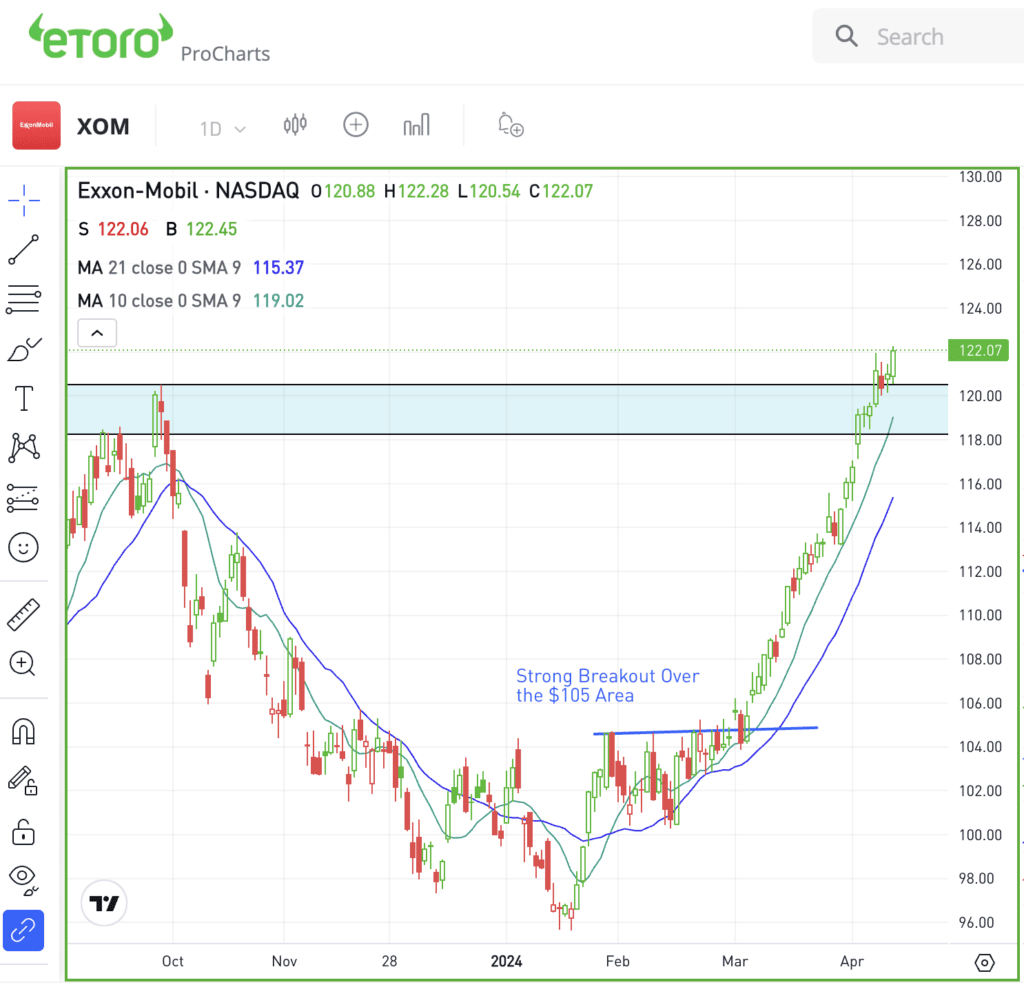

The setup — XOM

BODY: 10 out of the 11 S&P 500 sectors finished lower on Wednesday. Care to guess which one finished higher?

Yep, it was energy — the sector that has been crushing it over the past few months.

The sector ETF XLE has rallied in eight straight weeks and recently broke out over resistance. So it makes sense that the largest component within that ETF has broken out, too.

That component is Exxon Mobil, which sports a market cap of roughly $485 billion. Shares are up an impressive 22.2% so far in 2024, and while the market was selling off after the CPI print, Exxon was busy hitting all-time highs.

With the recent rally, Exxon stock has broken out over the key $118 to $120 resistance level. This is hard to illustrate on the daily chart, but pull up a weekly chart and you’ll see that this resistance level has been in play since February 2023.

It would be bullish to see a dip back into this zone and see it hold as support. It would be even better if the stock tested and held the 10-day moving average as support.

If that happens and Exxon stock rebounds, more new highs could be possible.

For options traders, calls or bull call spreads could be one way to speculate on support holding on a pullback. In this scenario, buyers of calls or call spreads limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

COST — Costco reported monthly net sales of $23.5 billion for March, an increase of 9.4% from $21.5 billion last year. Net sales for the first 31 weeks (from the start of Costco’s fiscal year starting in September) were $146.6 billion, up 6.4% from $137.8 billion. The retailer also increased its quarterly dividend by 13.7% from $1.02 a share to $1.16 a share.

NVDA — Nvidia stock dropped into correction territory earlier this week, down 10% from its all-time highs. However, it outperformed on Wednesday amid a volatile day in the overall market. Still, the dip comes after the stock’s enormous rally to start the year and amid intensifying competition in the AI chip market.

DAL — Delta Air Lines reported robust Q1 earnings of 45 cents a share, beating analysts’ expectations of 37 cents a share. Revenue of $13.8 billion easily beat estimates of $12.9 billion. Guidance was strong too, as Delta highlighted strong leisure and business bookings.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.