The Daily Breakdown looks at Monday’s selloff in stocks and crypto, as Bitcoin searched for — and found — support on the dip.

Tuesday’s TLDR

- Bitcoin gets hit, but rebounds off key support.

- UBER, PLTR earnings come in strong.

- Alphabet loses a key court decision.

What’s happening?

All things considered, the markets closed a lot better than they opened.

At one point, the VIX — also known as Wall Street’s “fear gauge” — was up 180% to 65.73. Going back to 1990, we only cleared 65 during Covid and the financial crisis.

While the VIX faded after the open, it still finished higher by almost 65% — the second-largest one-day gain over the last 34 years. The S&P 500 had just 22 components finish in positive territory, or less than 5%. More than 93% of NYSE securities finished in the red, too.

Most of yesterday’s selloff was due to market mechanics, not some worrisome breakdown in the economy. We’ll dig into that a bit more tomorrow.

Days like yesterday are never easy. Don’t let social media trick you into thinking yesterday was “easy pickings” because of the selloff. When sessions like yesterday come along, investors have to remember that staying the course is an option — and panicking is almost never a good idea.

That said, there’s absolutely nothing wrong with taking a few measured opportunities amidst the chaos. But for long-term investors in particular, they want to avoid being panicked and rattled out of the market during unexpected volatility spikes, only to come back when the waters have calmed and markets are much higher.

Want to receive these insights straight to your inbox?

The setup — BTC

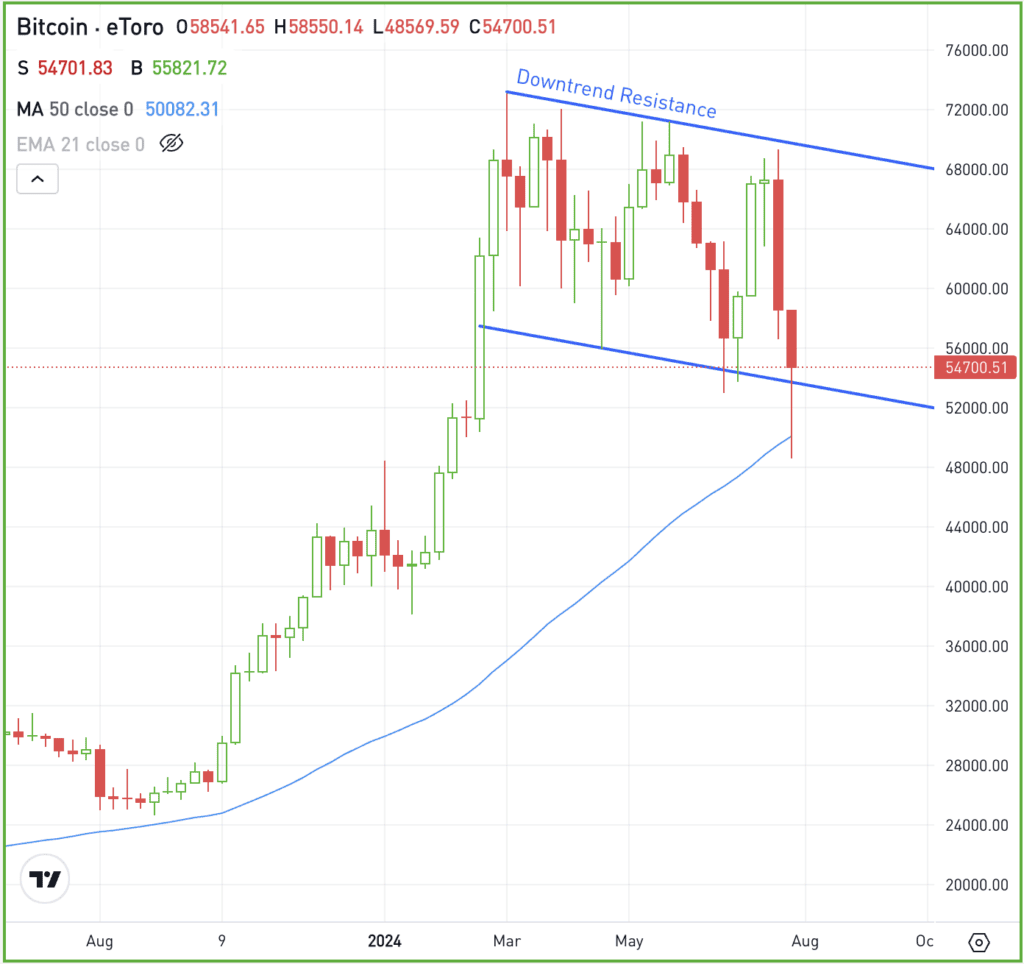

It hasn’t been an easy run for Bitcoin and yesterday’s action highlights that reality. At one point, Bitcoin was down almost 15% on Monday, although by the close those losses had been halved.

From the recent high in late July to yesterday’s low, Bitcoin has tumbled a painful 29.2%. On the plus side, it largely remains in a giant consolidation pattern known as a “bull flag pattern.”

Yesterday’s dip sent BTC down to the 50-week moving average, where it promptly found support and rebounded back into the mid-$50,000 range.

If the selling pressure continues, watch the recent low near $50,000 and the 50-week moving average to see if it again acts as support. If it fails, it could open the door to lower prices, potentially putting the $40,000 to $44,000 zone in play.

On the upside and in the short term, watch this week’s high near $58,000. Above that level and a potentially larger rebound could take place.

In an ideal world, Bitcoin will remain within this bull flag pattern (the blue lines on the chart) until it’s ready to resume the move higher and break out over the $72,000 highs.

Despite the recent volatility, remember that Bitcoin continues to perform quite well, up 30% this year and 90% over the past 12 months.

What Wall Street is watching

PLTR — Palantir Technologies raised its annual revenue and profit forecast, driven by strong AI demand. Management now expects full-year revenue between $2.74 billion and $2.75 billion and adjusted income from operations between $966 million and $974 million — well above analysts’ expectations for $882.9 million.

UBER — Shares of Uber are rallying this morning after the firm delivered a top- and bottom-line beat for its Q2 results. Earnings of 47 cents a share topped expectations of 31 cents a share on revenue of $10.7 billion, which grew 15.9% year over year and beat expectations by $120 million. Trips grew 21% to 2.8 billion.

GOOG — As if yesterday wasn’t hectic enough, a judge ruled that Google has engaged in anti-competitive practices by securing exclusive deals with Apple and others to make its search engine the default option on popular devices. While it was not ruled that Google has a monopoly on search ads, the ruling is considered a notable defeat.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.