The Daily Breakdown takes a step back and looks at the mental side of trading and investing as the S&P 500 pulls back.

Friday’s TLDR

- The mental side of investing can be tough.

- But knowing your risk tolerance can help.

- Looking for potential support in TJX Companies.

What’s happening?

The S&P 500 continues to look for short-term support. So is Bitcoin and the Nasdaq 100. But that’s not the point of today’s Daily Breakdown. Instead, it’s the mental side of investing.

How are you feeling during this pullback?

Is it causing widespread pain to your portfolio? How is your mental state — is the market action causing you some depression or anxiety?

Unfortunately, I’m not a psychologist. However, I am someone who’s been around the investing block a few times (and taken my bumps and bruises in the market).

Whenever the market pulls back, it can always be hard to keep perspective. Remember, the S&P 500 rallied more than 28% off its October low — rallying in five straight months and generating 10%+ returns in both Q4 and Q1.

Now we’ve dipped about 5%.

Yet despite US stocks being up considerably over the past few quarters — the S&P 500 is up 20.5% over the past year — and only down marginally from the all-time highs, we’re seeing sentiment take a nosedive as investors’ spirits sink.

There’s no other way to put this: There is no reward without taking the risk. The question you need to ask yourself is, “How much risk can I handle?”

We think we can handle a lot of risk on the way up, but we really answer that question during the pullbacks.

On average since 1974, the S&P 500 has about three pullbacks a year of 5% or more. In other words, dips like this are common (and they’re actually good for bull markets). Unfortunately, they just don’t feel very good when they’re happening.

Drawdowns like this give us clues on our investing pain tolerance, too.

The S&P 500 is down about 5%, but if your portfolio is down 20% it may be a sign that you have too much risk — and if those losses are keeping you up at night or making you squeamish, it’s a sign that that risk is too much for you.

There’s no shame in it, but acknowledge it and apply it to your approach going forward.

Some solutions?

Maybe that’s using less leverage. Perhaps it means smaller position sizes or less volatile stocks. It might mean utilizing stop-loss orders to limit losses when investments go the wrong way — or it could be a combination of all of these factors.

Investing is as much mental as it is analysis, but the mental aspects of it become much easier if we remember to ask ourselves, “How much risk can I handle?”

You can try to answer that question by looking at a prospective investment and determining at what price you would want to exit your position if it’s a loss. When you know the per-share loss you have in mind, you can equate your position size and determine a total loss that you would be comfortable with.

It doesn’t always play out like that, but it serves as a good way to balance risk and reward and construct a portfolio.

The Bottom Line: If you find yourself down in the dumps, remember this: You’re not alone! There are plenty of other investors in your shoes and things will get better. This is just one step — but an important step — in the investing journey. Remember to focus on your “mental capital” and do your best to learn your risk tolerances.

Want to receive these insights straight to your inbox?

The setup — TJX

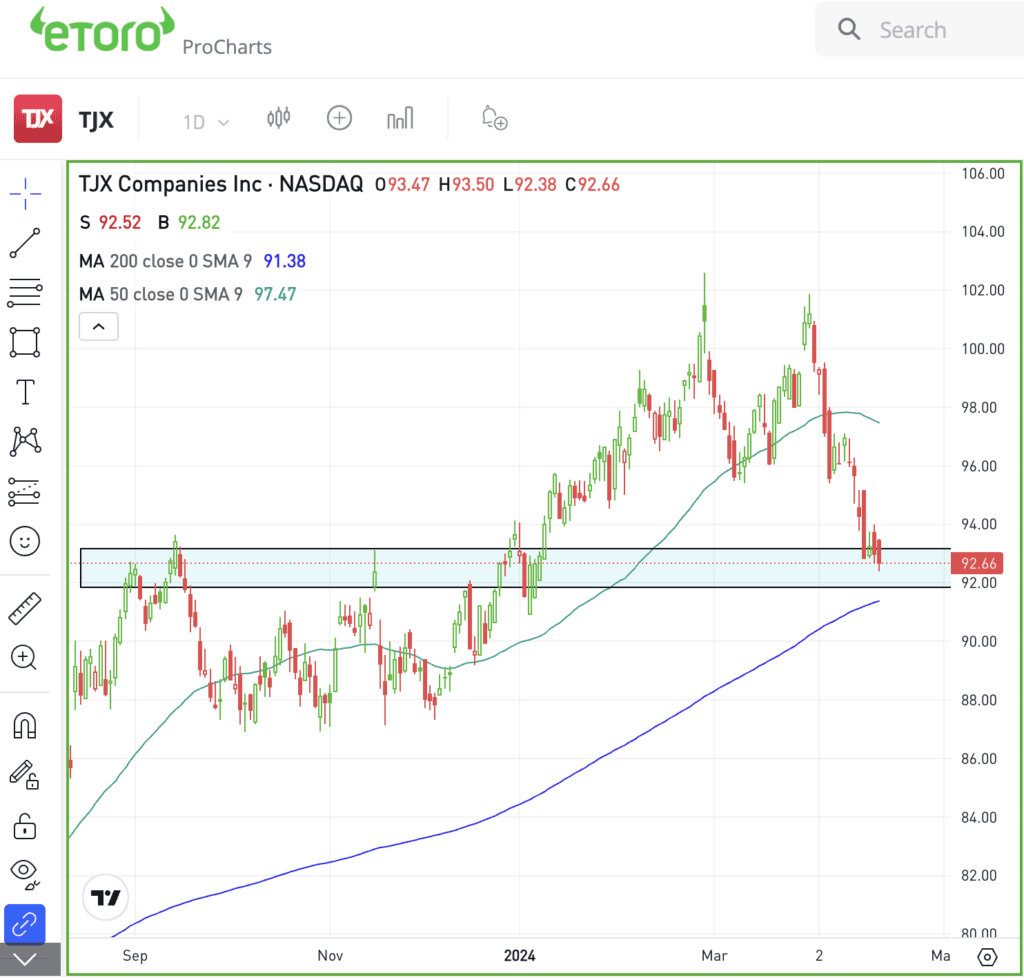

TJX Companies spiked to all-time highs after it reported earnings in late February, but the stock has since pulled back about 10%.

The dip slightly outpaces the pullback in the consumer discretionary sector, but the pattern is largely the same — which can be seen with the XLY ETF.

Notice how TJX stock is pulling back to an area that was prior resistance, with the 200-day moving average just below current levels.

We don’t know that TJX stock will find its footing in this area. But this company is often considered a high-quality name by investors and the fact that shares were just at all-time highs last month speaks to that sentiment.

If support firms up, calls or call spreads may be one way for options investors to take advantage of a potential bounce. If support fails, we will know relatively quickly and can adjust accordingly.

Further, investors who think the selling pressure will continue can consider puts or put spreads to speculate on more downside.

For those looking to learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.