The Daily Breakdown looks at the market’s busy week, as well as the interesting chart development we’re seeing in Apple stock.

Monday’s TLDR

- The S&P 500 is riding a five-week win streak.

- Apple is one of two Magnificent Seven stocks down in 2024.

- Bitcoin looks to extend its winning streak.

What’s happening?

The S&P 500 closed above 5,000 on Friday, the first time it’s ever done so. The strong finish to last week — where it gained 1.4% — comes amid another multi-week winning streak.

The index has now closed higher in five straight weeks, while it has closed higher in 14 of the last 15 weeks. Can it end the week higher again?

If it does, it won’t be easy.

We’re about a month into earnings season, with a lot of the big names having already reported. However, this week we’ll start to hear from some of the more well-known growth stocks from the prior bull-market cycle.

Companies like DraftKings, Coinbase, Roku, Twilio, Robinhood, and plenty of others will report their latest quarterly results this week.

On the economic front, there’s a lot to focus on too. The big one — the monthly CPI report — is due on Tuesday morning. That will give us the latest update on inflation and could have an impact on rate-cutting bets over the next few months.

Retail sales and the PPI report will round out the week on Thursday and Friday, respectively.

Want to receive these insights straight to your inbox?

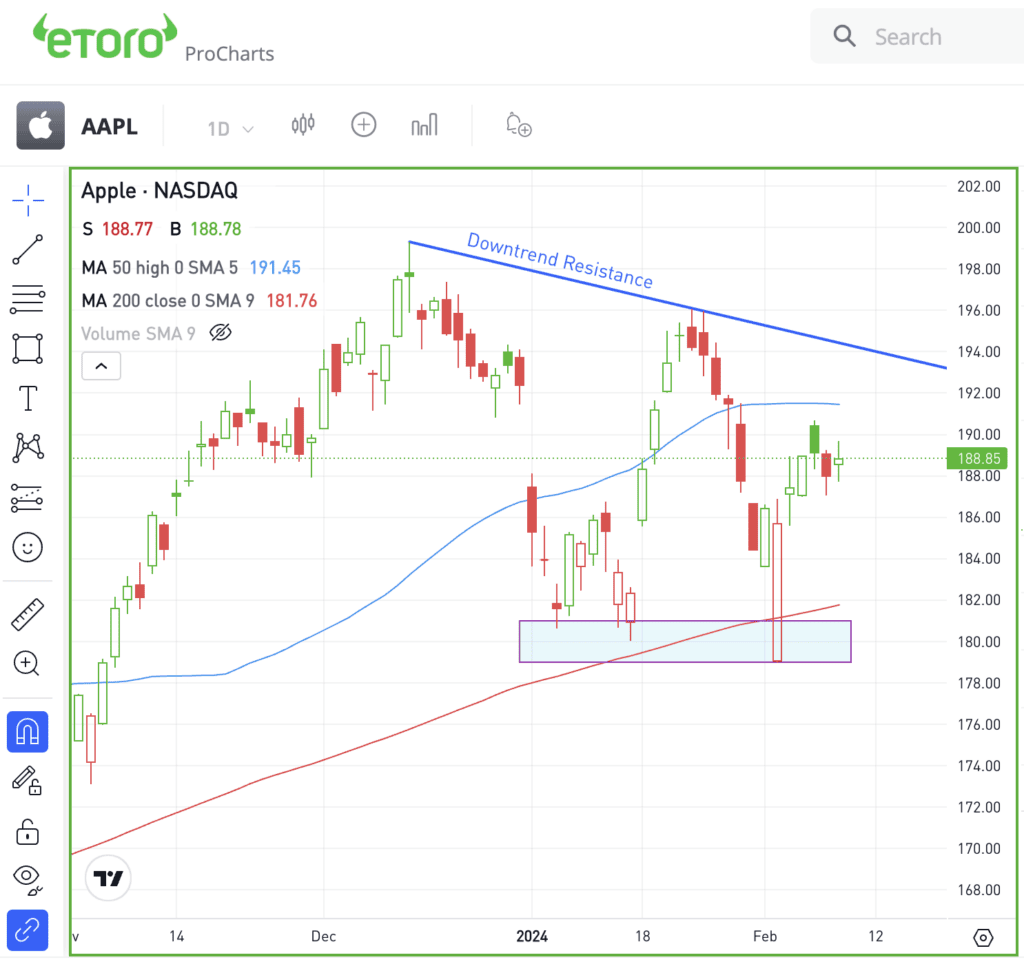

The setup: AAPL

Many of the Magnificent Seven stocks are performing well, but two notable laggards continue to struggle: Apple and Tesla.

These are the only two stocks of the group that are down so far in 2024, although Apple’s 1.9% dip is mild compared to the 22% decline in Tesla stock so far this year.

Is Apple just biding its time?

Notice how the stock continues to find support around $180 as it consolidates in a wide (but tightening) range, with $200 acting as resistance.

If Apple can break out over downtrend resistance, it could gain upside momentum. A move over $200 could fuel even more bullish activity. On the downside, a close below support near $180 wouldn’t bode well for investors.

Apple may have lost its market cap crown to Microsoft, but it’s still the second-largest US company. How it performs has a big impact on the indices and on investor sentiment.

That’s why even if investors don’t plan on trading Apple, it’s still one to keep an eye on.

What Wall Street is watching

AMZN: Jeff Bezos has sold approximately $2 billion worth of Amazon shares following the company’s announcement of his plan to sell up to 50 million shares by January 2025.

CSCO: Gearing up for its earnings report on Wednesday, Cisco is rumored to be planning a significant restructuring — including potential layoffs — to focus on high-growth areas. With nearly 85,000 employees, the extent of the layoffs remains uncertain.

BTC: Bitcoin is on the brink of its longest winning streak since January 2023, fueled by the successful launch of US-based Bitcoin ETFs. Earlier today, the cryptocurrency saw gains in Asian markets as it looks for a seventh consecutive day of increases.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.