The Daily Breakdown looks at the US consumer by analyzing how the five largest credit cards companies in the US are doing.

Tuesday’s TLDR

- Credit card companies are doing well

- Palantir sniffs for all-time highs

- Boeing ends labor strike

What’s happening?

We’ve talked enough about the election and you’ll see it reach a fever pitch over the next 48 hours. If you want a reminder on how elections impact your portfolio, here it is. Now let’s talk about the consumer.

Roughly 70% of the US economy is driven by consumer spending. Americans love to spend — and they’re pretty good at it, too. Look no further than our major credit card companies: Visa, Mastercard, American Express, CapitalOne, and Discover.

All of the companies above beat on earnings estimates in the most recent quarter, while three of the five generated double-digit year-over-year revenue growth. The average increase in revenue was 9.9% for the quarter.

All five stocks have hit a 52-week high within the last month and four of them registered all-time highs on their recent rallies.

None of these observations screams “recession” to me.

Further, consider this line from CapitalOne CEO Richard Fairbank: “I think the US consumer remains a source of relative strength in the overall economy…The labor market remains strong…We saw signs of softening in the first half of 2024 and the unemployment rate ticked up a bit, but the most recent data points on unemployment and job creation have actually shown renewed strength.”

Or Mastercard CEO Michael Miebach, who said this after the firm beat earnings and revenue expectations: “These results reflect healthy consumer spending and ongoing solid demand for our value-added services.”

I don’t have the room in this daily note to go into a full-on deep dive for these stocks. But even as things aren’t necessarily perfect for all consumers — they never are — as a whole, they’re doing better than many investors may realize.

Want to receive these insights straight to your inbox?

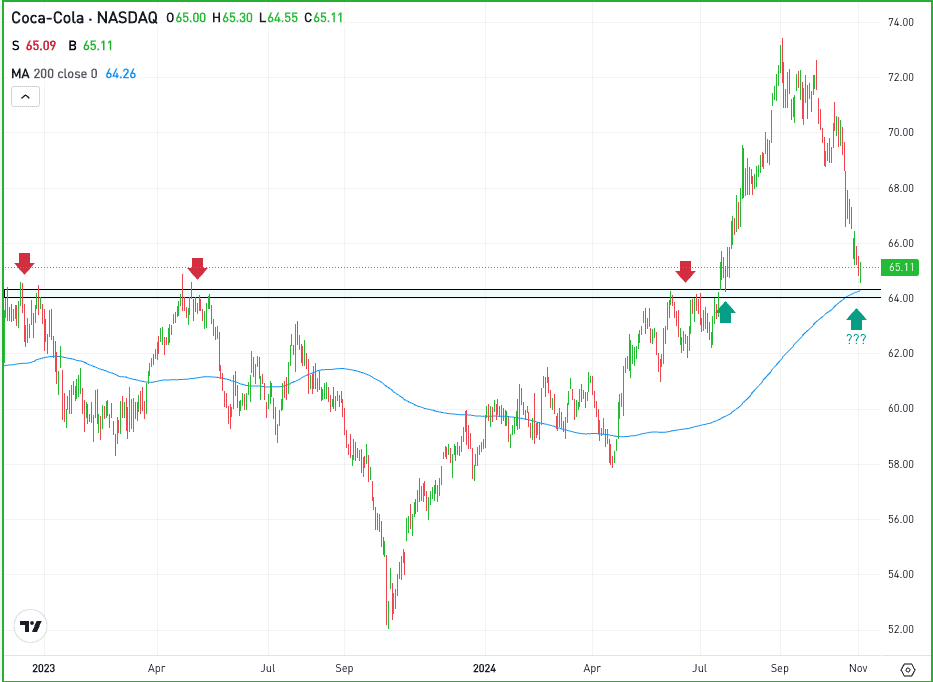

The setup — Coca-Cola

Coca-Cola has done well this year, up about 13%. That’s despite shares sliding roughly 12% from its high two months ago, while KO is still outperforming PepsiCo — which is flat on the year, no pun intended.

Admittedly, the daily chart below is pretty zoomed out, so I encourage you to click on it and zoom in if it helps. That’s as shares pull back to the 200-day moving average and an area of prior support and resistance near $64.

While that doesn’t mean this area will surely hold as support, we’re coming into a zone where bulls may become interested in buying the dip. If the $64 area holds, we could see a rebound, potentially back toward $70 or higher. However, if $64 fails as support, investors will know quickly and can try to keep their losses limited.

Despite this year’s rally, shares still pay a dividend yield of about 3%, which may be a consideration for income-oriented investors.

Options

Buying calls or call spreads may be one way to take advantage of a pullback. For call buyers, it may be advantageous to have adequate time until the option’s expiration.

For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

PLTR – Palantir stock will try for all-time highs as shares trade higher on better-than-expected quarterly results. The firm beat earnings and revenue expectations, while management spoke positively on the earnings call, sending shares higher in after-hours trading. Will it take out the prior highs? Check PLTR here.

SMCI – Supermicro Computers will report earnings tonight in what’s expected to be a high-tension situation. The firm has recently faced accusations over its accounting practices — accusations of which seemingly gained more credibility after its auditor Ernst & Young resigned. Shares fell over 40% last week in response, putting a lot of focus on today’s report.

BA – Shares of Boeing are ticking higher in pre-market trading on news that the current labor strike will come to an end. 59% of union members voted in favor of the recent terms, which include a 38% pay increase over four years, as well as enhanced retirement contributions. Check out the chart.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.