The Daily Breakdown looks at what a 5% pullback would look like in the S&P 500 and examines how often dips like this occur.

Wednesday’s TLDR

- We’re pulling back — but that’s normal.

- A 5% dip in the S&P 500 puts it back at 5,000.

- ASML falls on earnings.

What’s happening?

Tuesday was a mixed day in markets. The S&P 500 fell 0.2%, the Russell 2000 dropped 0.4%, and the Dow squeaked out a gain 0.2% largely thanks to the post-earnings rally in UnitedHealth Group.

Isn’t it funny how price can change sentiment so quickly?

What I mean by that is, notice how negative so many investors have become amid this pullback. Despite the fact that we rode a five-month win streak into April and hit all-time highs just a few weeks ago, a small dip from the highs has many investors changing their tune.

We see the same thing after an extended drawdown is followed by a strong rally — everyone who was seemingly bearish just a few days ago is suddenly bullish. Price changes sentiment and right now, sentiment is diving lower with stocks.

But remember, mild corrections are common; they are a feature within bull markets, not a bug. As eToro’s Global Markets Strategist Ben Laidler recently noted, the S&P 500 has averaged more than three pullbacks of 5% or more per year going back to 1974.

It’s possible we’re entering a larger correction. But it’s also possible that this is simply one of several dips within the larger overall trend.

Want to receive these insights straight to your inbox?

The setup — S&P 500

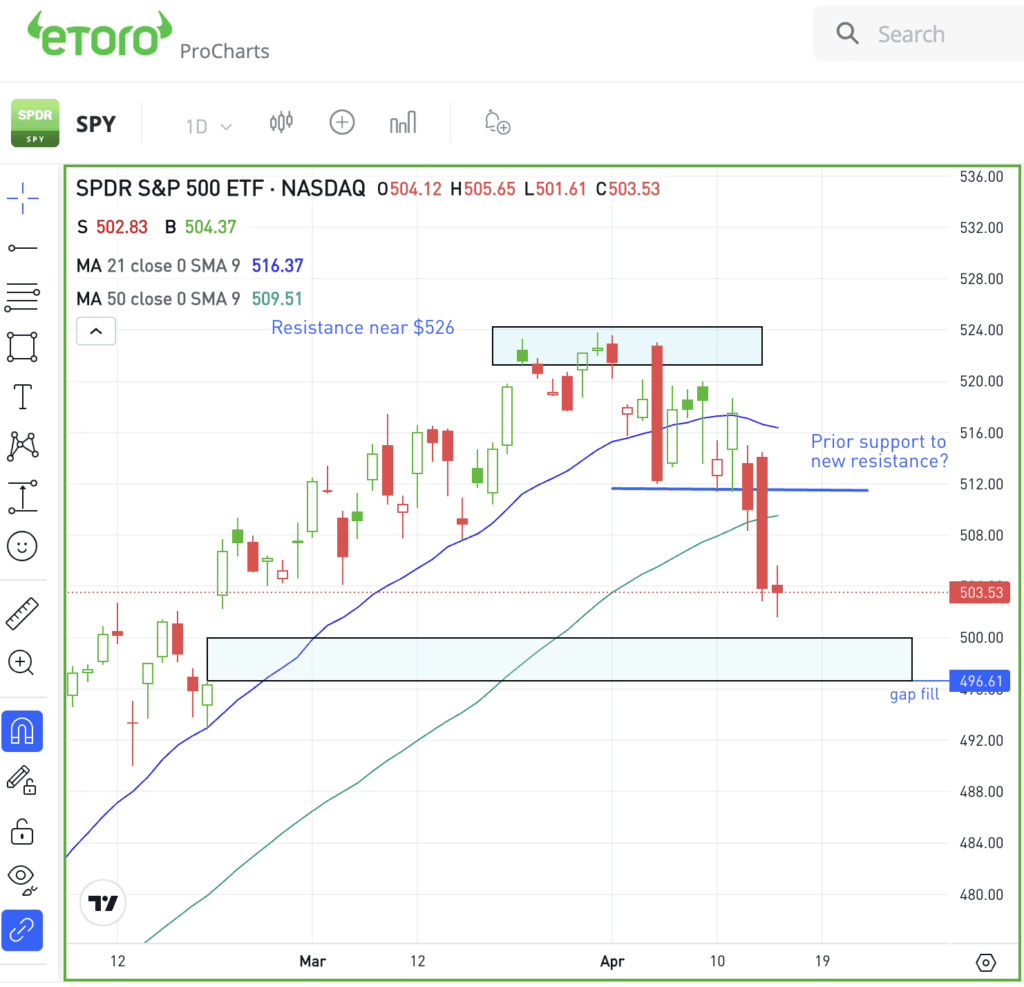

For the S&P 500, I’m wondering if we’ll get a pullback into the key 5,000 level — which, conveniently, would represent a decline of about 5% from the all-time high.

On the SPY ETF, that comes into play around $500. Notice there’s also a gap-fill level down at $496.61. Is it possible that the SPY pulls back to this area — $497 to $500?

The SPY doesn’t necessarily need to dip into the $497 to $500 area, but it will be a great test if it does.

It would be a logical area for bears to cover their short positions and for bulls to step up and buy. 5,000 is also a key level in the S&P 500 options market, which could help support the index on a dip to this zone.

Remember, we may not see this scenario play out. The index may not dip this far — or if it does, this area may not hold as support. Regardless, we want to see how the S&P 500 responds to this zone if and when we dip there.

For options traders, calls or bull call spreads could be one way to speculate on support holding. In this scenario, buyers of calls or call spreads limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

ASML — ASML reported lower-than-expected Q1 earnings of 1.22 billion euros ($1.3 billion). New bookings also fell short at 3.6 billion euros, well below the anticipated 5.4 billion euros. The report reflects certain challenges in the semiconductor industry, particularly in securing new orders.

BAC — Bank of America’s shares dropped after quarterly profit fell 18% to $6.67 billion or 76 cents per share. Excluding a $700 million FDIC charge, earnings were 83 cents per share. Revenue decreased 1.6% to $25.98 billion but beat consensus expectations despite lower net interest income from the previous year.

ARKK — Cathie Wood’s leading fund — ARKK — dipped to a five-month low, driven by a decline in Tesla. The automaker is the largest holding in ARKK and nearly hit one-year lows after the company announced job cuts and amid heightening investor concerns about its future growth.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.