The US election, two Fed meetings, earnings season and a number of economic reports dot Q4. The Daily Breakdown digs in deeper.

Friday’s TLDR

- Q4 is off to a mixed start

- There’s plenty to watch this quarter

- Meta’s chart highlights breakout

The Bottom Line + Daily Breakdown

We’ve officially entered Q4 this week and stocks have been off to a bumpy start. Bulls are looking for tech to catch up and for stocks and crypto as a whole to continue higher, while bears are looking for another pullback.

This morning’s jobs report is a major focus because of the implications it may have on the US economy and how the Fed will navigate future rate cuts this year. Remember, good results should send a reassuring signal to investors that the economy can continue humming along. Disappointing results could reignite worries that the jobs market continues to weaken and will weigh on the US economy.

The jobs report is the first major event of Q4, but there will be plenty of other things to watch in the weeks and months ahead.

Looking at the calendar

While this Friday’s focus is jobs, that focus will shift to earnings next Friday when JPMorgan, Wells Fargo and other banks kick off earnings. Earnings will run for several weeks, including through early November.

In the first full week of November, we’ll have the US elections on Tuesday November 5th. Two days later on Thursday November 7th we’ll have the Fed’s next meeting, press conference, and interest rate decision. Roughly six weeks later on December 18th, the Fed will have its final meeting and interest rate update of 2024.

And don’t forget, we’ll still have multiple jobs, inflation, retail sales, and other economic reports between now and year-end.

The bottom line

Investors crave certainty and tend to feel more skittish when uncertainty is on the rise. While some events — like the election — are quite polarizing, it’s important to remember two things.

First, it’s less taxing to come up with a plan while stocks are near the highs and the markets are calm vs. trying to come up with new ideas on the fly. Making new decisions when volatility is rising can be difficult as our emotions are often fluctuating with the markets!

Second, it’s easy to get lost in the day-to-day and even the hour-to-hour action. When we approach stretches like this, consider zooming out. Remember that stocks have been doing well this year as estimates call for solid earnings growth and as market breadth remains strong as the rally has been spreading to more industries and sectors.

While things can turn south, it will be hard to have a sustained breakdown until earnings or the economy deteriorate considerably.

Want to receive these insights straight to your inbox?

The setup — META

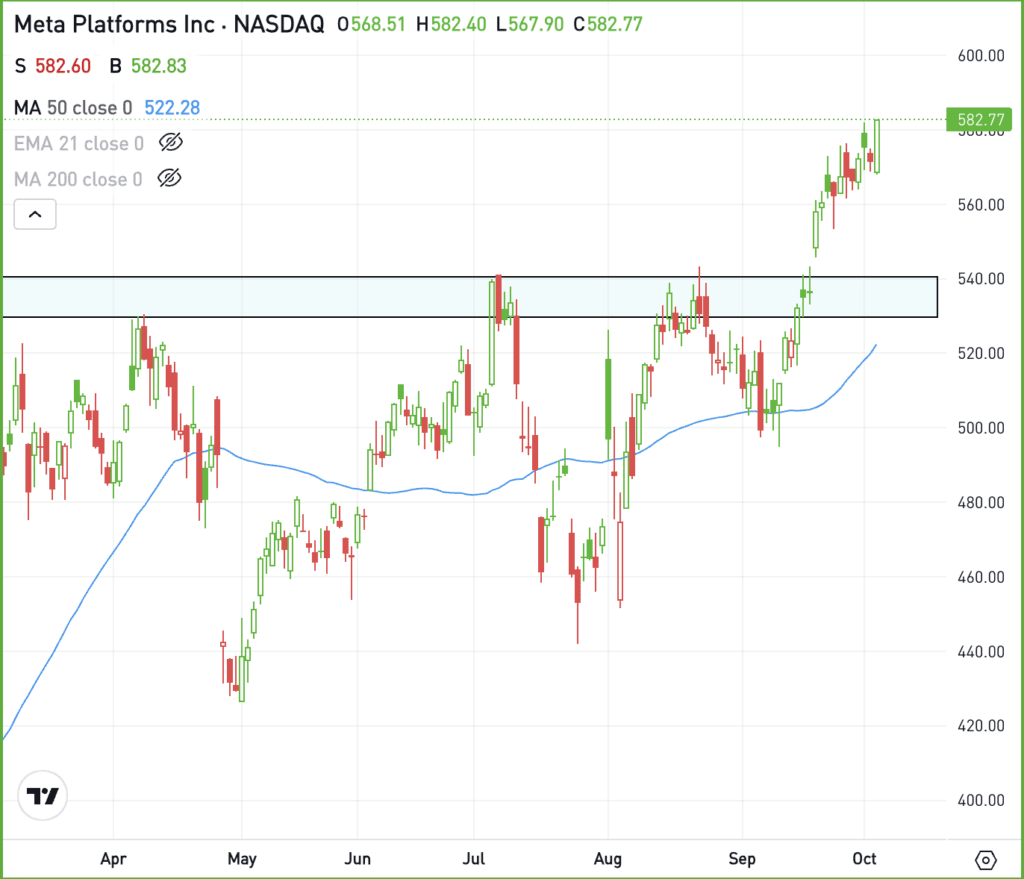

Tech has been a laggard over the last several months and was the second-worst performing sector in Q3, only outperforming energy. The Nasdaq hasn’t made a new all-time high since mid-July and only one Magnificent 7 holding has been able to do so.

The one Mag 7 holding that did? Meta.

Meta has made an impressive push to all-time highs after a big breakout last month. Should the name pull back, bulls will be on the lookout.

If the $530 to $540 area sounds familiar, it’s because we recently talked about this key breakout area for the stock. Since rallying to new highs, investors will likely be watching to see if this zone acts as support on a pullback.

Options

If META is going to remain in an uptrend, bulls will want to see these measures hold as support.

For options traders, calls or bull call spreads could be one way to speculate on support holding on a pullback. In this scenario, buyers of calls or call spreads limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.