The Daily Breakdown looks at Tesla ahead of its shareholder meeting, Apple after its WWDC event and GM after its breakout to new highs.

Tuesday’s TLDR

- GM hits 52-week highs; unveils new buyback plan.

- Apple’s WWDC event brings AI to the forefront.

- Tesla’s shareholder meeting is this week.

What’s happening?

Markets continue to churn in anticipation of Wednesday’s big economic day, although the S&P 500 and Nasdaq 100 did post record closing highs on Monday.

The session ended up being somewhat quiet, despite a number of investors keeping a close eye on the second- and third-largest US companies. That’s as Nvidia began trading after its 10-for-1 stock split and as Apple held its WWDC event.

For Apple’s part, the company is looking to integrate new features into its devices, as well as lean more into AI to help generate excitement. At least for the stock price, it didn’t work. Shares fell 1.9% yesterday — but an optimist will remind you that shares are still up 17.7% from the April low.

Today’s expected to be a relatively quiet session, with Oracle reporting earnings after the close and a 10-year Treasury note auction this afternoon.

Given the impact that yields have had on markets this year — and in particular, the 10-year yield — that auction is worth paying attention to for active investors. Otherwise, all eyes remain on Wednesday’s CPI report and update from the Fed.

Want to receive these insights straight to your inbox?

The setup — GM

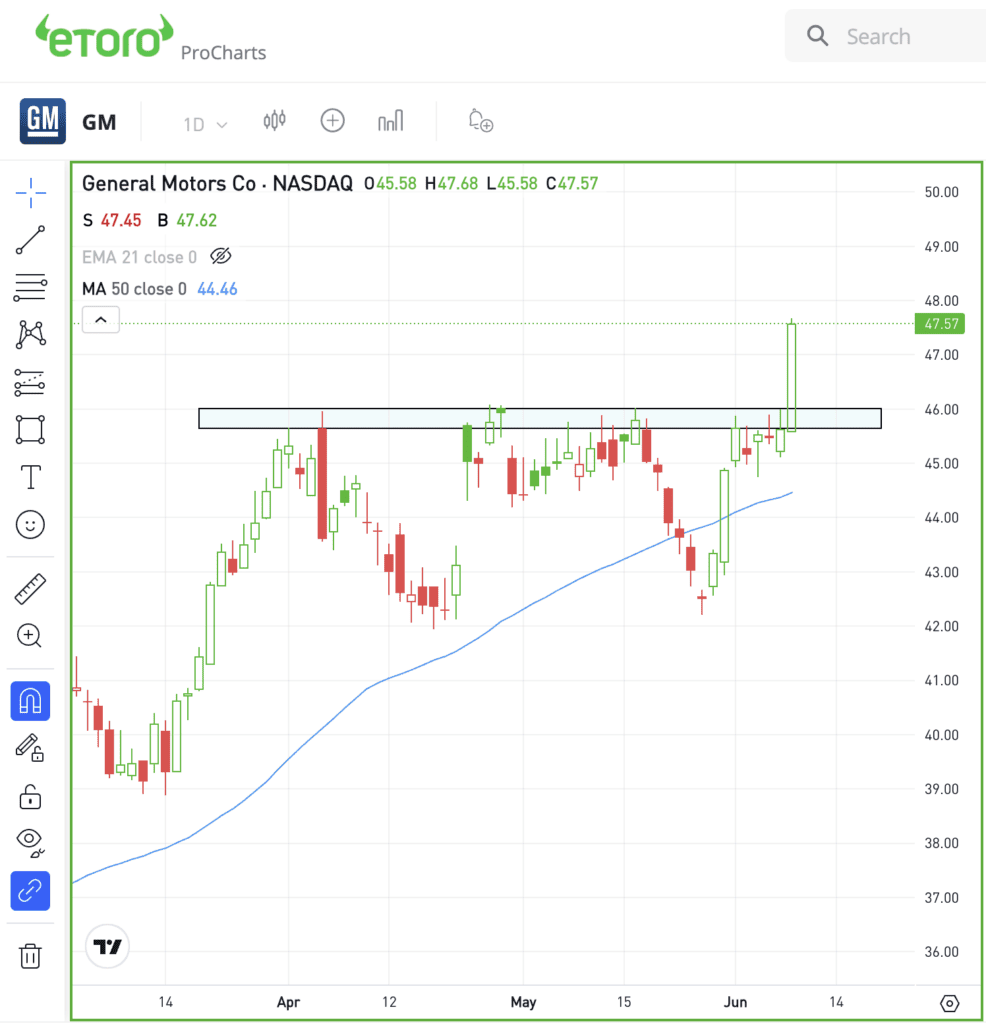

Shares of General Motors led the S&P 100 yesterday with a 4% gain. That rally sent the automaker to fresh 52-week highs.

Now shares are rallying this morning on news of a new $6 billion buyback program.

The rally came after a clean breakout over resistance near $46. So long as shares of GM stay above that level, bulls can maintain momentum. However, a break back below this level would hurt the bulls’ thesis, while giving momentum back to the bears.

On the fundamental front, expectations call for low-single-digit revenue growth this year, but for earnings growth of more than 28%. Further, shares trade at about 5 times this year’s earnings expectations.

Options

For some investors, options could be one alternative to speculate on GM. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and GM rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

AAPL — Apple’s annual Worldwide Developers Conference (WWDC) kicked off in Cupertino on Monday. At the event, Apple introduced “Apple Intelligence,” integrating AI into Siri for personal tasks, and announced a partnership with OpenAI to bring ChatGPT to iPhones.

TSLA — Tesla’s shareholder meeting is coming up on Thursday and the stock remains a big focus among active investors. It’s the worst-performing Magnificent 7 holding so far this year, down 30%. While shares are up nicely from this year’s low, investors are looking for another catalyst to take the stock higher.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.