The Daily Breakdown looks at the week ahead, as well as Alphabet stock. Shares are testing into a key area on the charts now.

Monday’s TLDR

- It’s a big week for the consumer…

- And for the Fed.

- Worries grow over Apple’s new iPhone.

Weekly Outlook

It’s been a crazy couple of weeks to start September. The S&P 500 ended the month of August within 1% of its all-time high, then traded lower in the first four sessions of September, falling 4.1% in the process.

It looked like the spooky September seasonality was back to bite the markets, but now that conclusion isn’t quite so certain. That’s as the S&P 500 had a so-called “perfect week,” rallying in each session last week and is again back within 1% of its all-time high.

So where does that leave us this week? Now that The Daily Breakdown is back to regular-scheduled programming, let’s have a look at the week ahead.

From an earnings perspective, it’s a quiet week. General Mills will report on Wednesday, while FedEx, Lennar, and Darden Restaurants will report on Thursday. Those four could provide some interesting perspectives on the consumer — ranging from grocery store pricing pressure to housing demand and dining spend.

Sticking with the consumer, we’ll also get the monthly retail sales report on Tuesday morning. Bulls will want to see that consumer spending remains alive and well.

But the real fireworks are set for Wednesday afternoon, with the Fed expected to cut interest rates for the first time since 2020. It will be very interesting to see how stocks and crypto trade into that event — and in the weeks following it.

Want to receive these insights straight to your inbox?

The setup — GOOGL

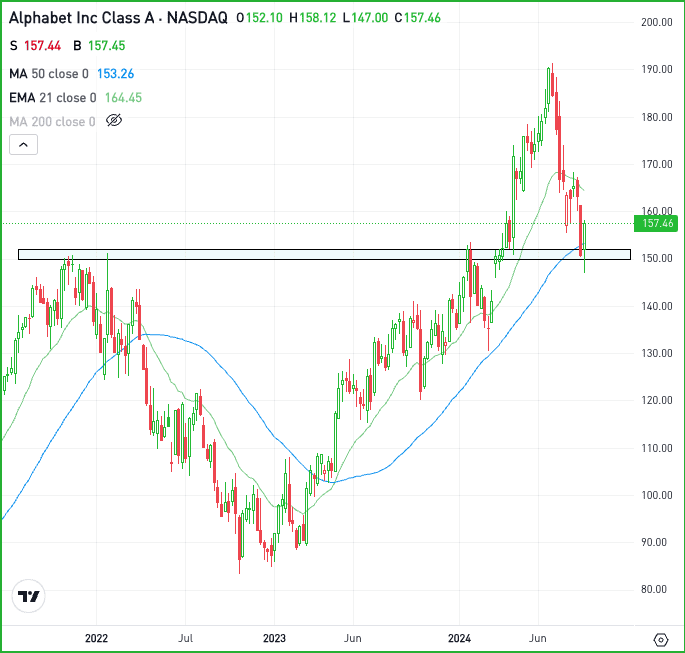

It’s been a little while since we’ve looked at an individual setup, so let’s zoom out with a weekly view of Alphabet.

While Alphabet has done fine this year — up 12.7% — it’s struggled lately, down 17.9% from this year’s high. Further, it’s the second-worst performing Magnificent 7 holding this year, only outperforming Tesla.

However, the recent price action is interesting as the stock held the key $150 area and the 50-week moving average amid its recent pullback.

Active investors who like GOOGL might consider owning the stock so long as it can stay above its recent low near $147. A close below this level could usher in more selling pressure. However, as long as shares stay above this level, a larger rebound could ensue.

Options

For some investors, options may be one way to take advantage of the recent pullback.

For bullish traders, calls or call spreads are one way to speculate on a further rebound. It may be advantageous to make sure they have adequate time until the option’s expiration.

For those that aren’t feeling quite so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

CRM – Salesforce will host its Dreamforce conference this week, featuring product updates like its new AI Agentforce platform. The event will include keynote speeches from CEO Marc Benioff and Nvidia’s Jensen Huang.

AMD – Shares of Advanced Micro Devices rallied more than 13% last week. While a broader market rally helped bolster sentiment, the company’s recently announced AI event scheduled for October 10th also helped rejuvenate the stock price.

AAPL – Apple stock is moving lower this morning over demand worries for its new iPhone 16. Analysts are citing tepid demand and shorter delivery times for the new iPhone, which is weighing on the share price in early Monday trading.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.