Amazon, AMD and SMCI weren’t able to give the markets a lift. The Daily Breakdown takes a look at stocks and crypto ahead of the Fed.

Wednesday’s TLDR

- Earnings fail to inspire a rally.

- The Fed’s interest rate decision is now in focus.

- Marijuana stocks rip higher.

What’s happening?

Investors were hoping that earnings from Amazon, Advanced Micro Devices, and Super Micro Computer would be enough to help stocks, but that wasn’t the case.

Despite beating on earnings, AMD and Super Micro Computer both spilled lower in after-hours trading. Amazon beat on earnings too, but guidance was a bit short of expectations and shares only climbed slightly after the results (more on these companies below).

The S&P 500 fell 1.6% and the Nasdaq 100 fell 1.9%, while tech earnings did little to help give an after-hours boost. Remember a few weeks ago when we said things might be a little bumpy? Well, this is the kind of action that I was talking about.

It’s no longer a near straight line higher at a 45-degree angle with all 1% to 2% dips being bought. That doesn’t mean the bull market is dead, but there’s no doubt that the environment we slogged through in April was more difficult than the prior five months.

Now we turn our attention to the Fed.

At 2 p.m. ET, the Fed will announce its latest decision on interest rates. It’s expected that they will hold rates at current levels, but investors will be keying in on Chair Powell’s press conference at 2:30 p.m. ET for clues on how the Fed is viewing inflation and the economy — and what they’re thinking about interest rates.

Want to receive these insights straight to your inbox?

The setup — ETH

Bitcoin and Ethereum have been struggling, with both names down 16.7% over the past month.

Despite some positive developments — like the Bitcoin halving and new ETFs in China — these names continue to stumble after a powerful rally over the last several quarters.

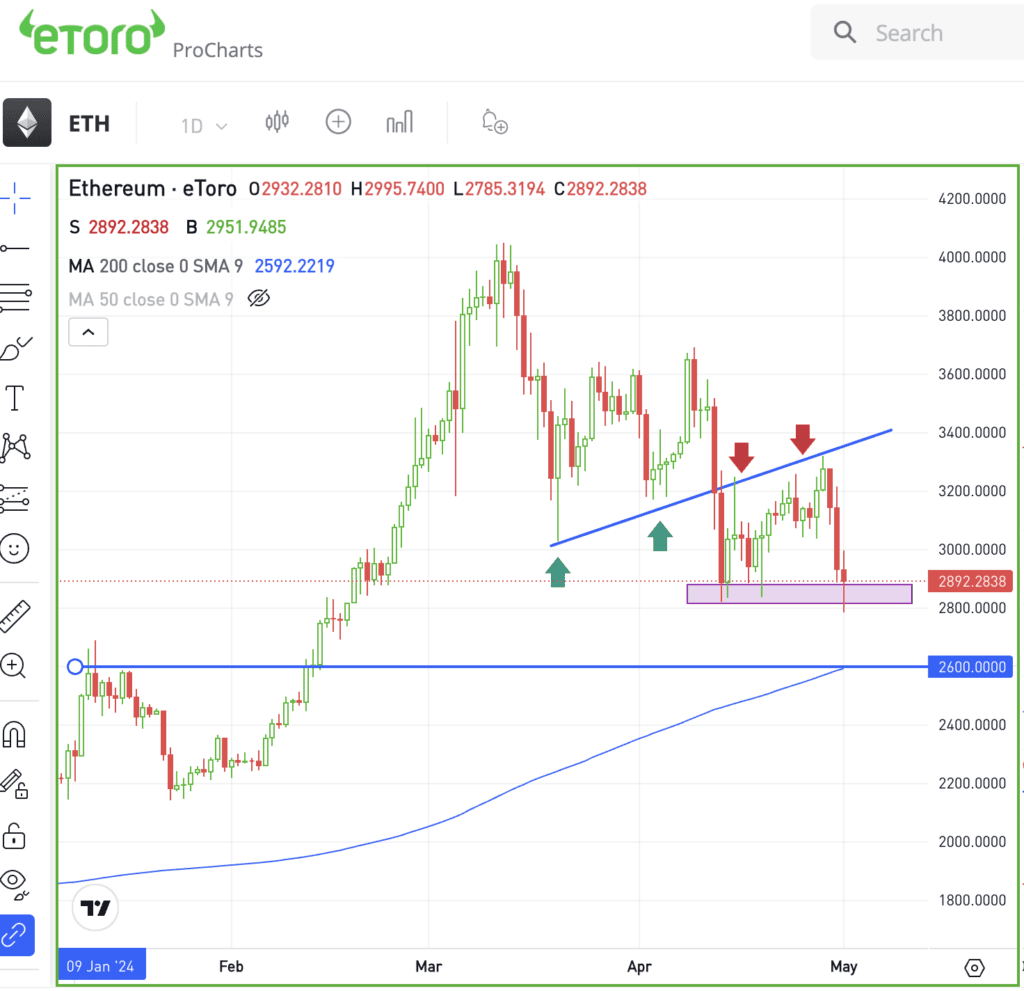

Notice the daily chart here of Ethereum, which is clinging to support in the $2,800 to $2,900 area. ETH had been riding uptrend support higher in early April (green arrows) but by the end of April, this trendline had turned into resistance (red lines).

From here, I want to see if this $2,800 to $2,900 area can continue to act as support. If so, will a move over $3,000 put recent resistance back in play, this time near $3,300 to $3,400?

If we can find a positive to the volatility and recent weakness, it’s that we could see a dip to the key area highlighted above, near $2,500 to $2,600.

That’s where we find the 200-day moving average and a very key breakout area from January. A pullback to this zone could give bulls a buying opportunity — provided that this area acts as support.

What Wall Street is watching

AMD — Advanced Micro Devices beat Q1 earnings and revenue forecasts, but modest guidance is causing shares to dip. The firm expects Q2 revenue between $5.4 billion and $6 billion vs. Wall Street’s expectation of $5.72 billion. Remember the potential support level we are keeping a focus on from a few weeks ago.

SMCI — Despite a big earnings beat, Super Micro Computer missed Q3 revenue estimates. However, the company expects steady demand, providing a strong Q4 revenue forecast and raising its annual sales outlook. Despite this, shares are down in premarket trading.

MJ — The Biden Administration plans to reclassify marijuana as a Schedule III substance, boosting cannabis stocks significantly. This change could lessen federal restrictions and spur growth in medical research and investment in the cannabis industry.

AMZN — Amazon’s Q1 earnings surpassed Wall Street predictions for both revenue and earnings, propelled by a 16% surge in Amazon Web Services (AWS) revenue. Despite a strong quarter, Amazon’s guidance for Q2 indicates potential softness in consumer spending, with projected sales slightly below analysts’ expectations.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.